Gold futures settled on the rise, achieving gains for the fourth consecutive session. The price of an ounce of gold moved to the resistance level of $1835, the highest for the gold price in two weeks, and the gains in the gold market came as the US dollar drifted lower, ahead of US inflation data due to be released today, Thursday. Economists expect inflation may have accelerated to a forty-year high of 7.3% in January.

San Francisco Fed President Mary Daly told CNN that inflation could get worse before it gets better. However, she added, the Fed is unlikely to be too aggressive about raising interest rates. And at the upcoming FOMC meeting, on March 15-16, policy makers are widely expected to start raising US interest rates in an effort to rein in inflation that significantly exceeds their 2% target. The committee is also scheduled to hold further discussions about plans to begin reducing the Fed's bond portfolio later this year.

Bets on the pace of US interest rate hikes have increased since the Federal Reserve's meeting in January, and have shifted to nearly a fifth this year versus the three officials had expected in December. Loretta Meester, president of the Cleveland Federal Reserve, said Wednesday that she expects it would be appropriate for policymakers to raise interest rates at a faster pace, repeating a January comment in which it supported the first hike in March. "Every option is on the table," Atlanta Fed President Rafael Bostic said earlier.

The advance in US stocks gained momentum as the pullback in Treasuries selling gave respite to markets that have been affected in recent weeks by concerns about monetary tightening.

So the S&P 500 extended Tuesday's rally broadly, with technology stocks recovering about half of their losses this year. Megacaps topped the Nasdaq 100, with buying in Facebook's Meta Platforms Inc shares tumbled after a four-day slide that wiped out about a third of its market value. The S&P 500 and Nasdaq 100 both posted their biggest daily gains this month.

The 10-year US Treasury yield fell from levels last seen in 2019 and reached a session low of 1.91 percent after strong auction demand for similar maturities. Prices also fell across Europe after the French central bank governor said markets may be at the forefront of price increases for this year.

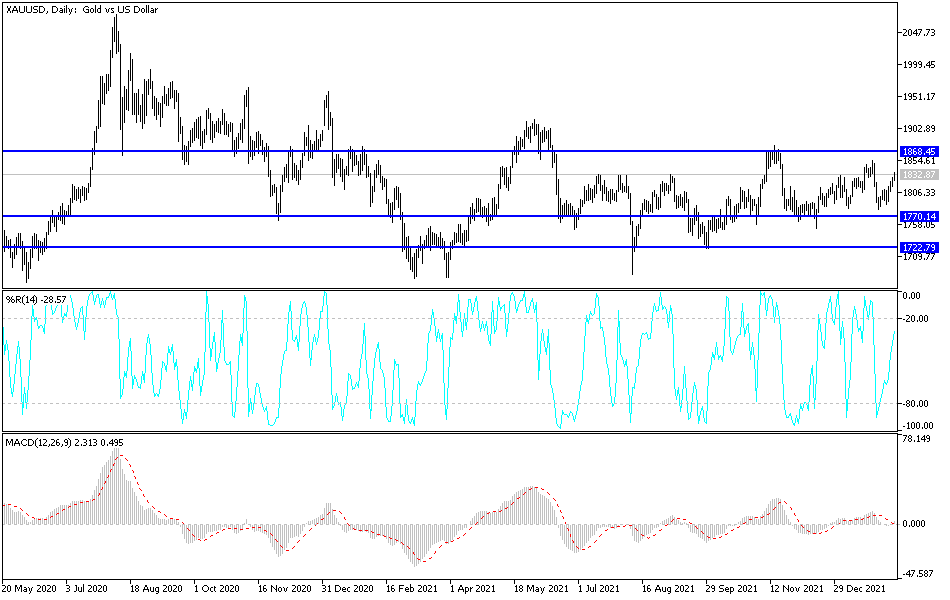

According to the technical analysis of gold: The price of gold is moving steadily towards the rising levels that we expected and mentioned in recent technical analyses of the yellow metal based on the stability of the gold price above the psychological resistance of $1800 an ounce. It has already reached the tops of $1818 and $1827, and now looking towards resistance of $1845 and this may occur in the event that the US inflation numbers come in much less than what was expected because it may shake confidence in raising the US interest rate.

On the downside, as I also mentioned, there will be no real trend reversal without bears moving in the price of gold to the support level of $1,775 an ounce.