The price of gold rose to its highest level in more than eight months as fears of heightened geopolitical tensions fueled demand for safe haven assets. Accordingly, the price of gold moved towards the resistance level of $1914 an ounce before settling around the level of $1908 an ounce at the time of writing the analysis. Bullion just capped three straight weeks of gains, driven by the potential for conflict in Europe. And in the latest development, the United States has told allies that any Russian invasion of Ukraine would likely target several cities outside the capital, Kiev, according to three people familiar with the matter.

President Joe Biden said Friday he is now convinced that Russian President Vladimir Putin has decided to act against Ukraine and that an invasion - including a strike on Kiev - could come within days. Moscow continues to deny plans to invade its smaller neighbour, and says it is already withdrawing its forces from areas near the border.

Geopolitical concerns overshadowed the downside from a possible rate hike, which could dampen demand for the non-interest bearing precious metal.

On the other hand, statements made last week by Governor Lyle Brainard and President of the Federal Reserve Bank of New York John Williams, as well as the President of the Federal Reserve Bank of Chicago Charles Evans, showed that officials are keen to tighten the Fed's policy, without seeking a significant increase in rates. Interest or move before the next scheduled date.

Oil and gold temporarily gave up their gains before bouncing back after the US statement, even with no response yet from the Kremlin. News of a possible summit came after Russia and Belarus said joint military exercises scheduled to end last week had been extended. Russia has repeatedly denied its plans to invade Ukraine, calling the allegations propaganda and "hysteria".

For his part, a French official said that the so-called tripartite contact group - Russia, Ukraine and the Organization for Security and Cooperation in Europe - will hold talks to work to restore the ceasefire in the regions of eastern Ukraine controlled by Russian-backed separatists. This comes after mounting reports of ceasefire violations, with allegations being exchanged between the separatists and Kiev. The foreign ministers of Russia and France are expected to speak by phone on Monday, while the foreign ministers of the European Union are meeting.

Overall, global commodity markets have been affected by the protracted standoff over Ukraine, which comes at a time of already strong demand, rising prices and concerns about rapidly depleting stocks. Raw materials are trading near a record low, boosting inflation and complicating the task of global central banks as they seek to tame the pace of price gains without impeding the recovery.

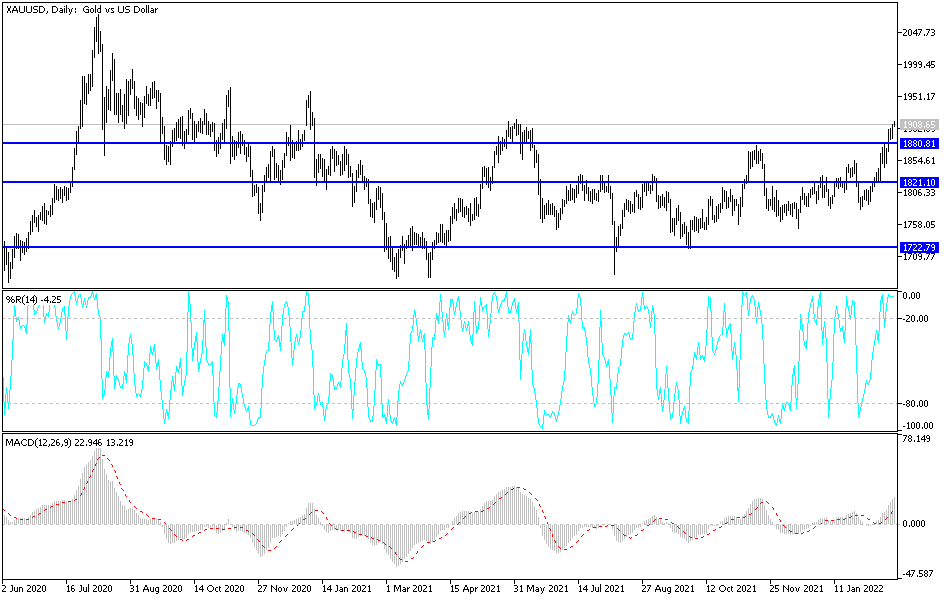

According to gold technical analysis: There is no change in my technical view of the gold market. The general trend of the gold price will remain bullish and stability above the psychological resistance of $1900 is a confirmation of the bulls’ dominance over the trend. In general, the closest targets for the bulls are currently $1919 and $1945, and on the downside there will be no change in direction without a breach of the support of $1825 per ounce.

The price of gold today will be affected by the level of the US dollar and the extent to which investors take risks or not.