Gold futures are trading at their best in three months as investors monitor the border crisis between Ukraine and Russia. The yellow metal, which has held steady in 2022 despite rising expectations of a rate hike, may target the $1,900 resistance this week if there are no signs of an improvement in the situation in Eastern Europe. The gold market gains reached the resistance level of 1880 dollars an ounce at the time of writing the highest analysis for the price of gold in eight months.

Gold posted a weekly gain of about 2%, taking its year-to-date jump to about 1.7%. In the same way the price of silver, the sister commodity to gold, is heading towards $24. As silver futures advanced to $23.925 an ounce. Accordingly, the price of the white metal has increased by nearly 4% over the past week, bringing its rise in 2022 to approximately 2.4%.

On Friday, White House National Security Adviser Jake Sullivan warned that a Russian invasion of Ukraine could happen "any day now." This sent markets flying and crashing: stocks fell, but the prices of commodities, such as gold, crude oil, and natural gas, rose. As a result of this announcement, investors are looking for safe haven assets to protect themselves from the inevitable volatility amid geopolitical tensions abroad.

In the background, inflation fears are rising after the Consumer Price Index rose to a 40-year high of 7.5%. Meanwhile, this has been offset by rising expectations that the Fed will accelerate its push for quantitative tightening, making non-yielding bullion less attractive.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, has oscillated between positive and negative territory in 2022. The US Dollar Index rose 0.17% to 96.24, from the opening of 96.08, with the beginning of this week's trading. The DXY index jumped 1% last week, extending its year-to-date gains to 0.3%. In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

The US Treasury market was mostly in the green, with the benchmark 10-year bond yield rising to 1.974%. One-year bond yields rose to 1.106%, while 30-year bond yields rose to 2.273%.

In other metals markets, copper futures fell to $4.469 a pound. Platinum futures rose to $1037.80 an ounce. Palladium futures rose to $2,278.50 an ounce.

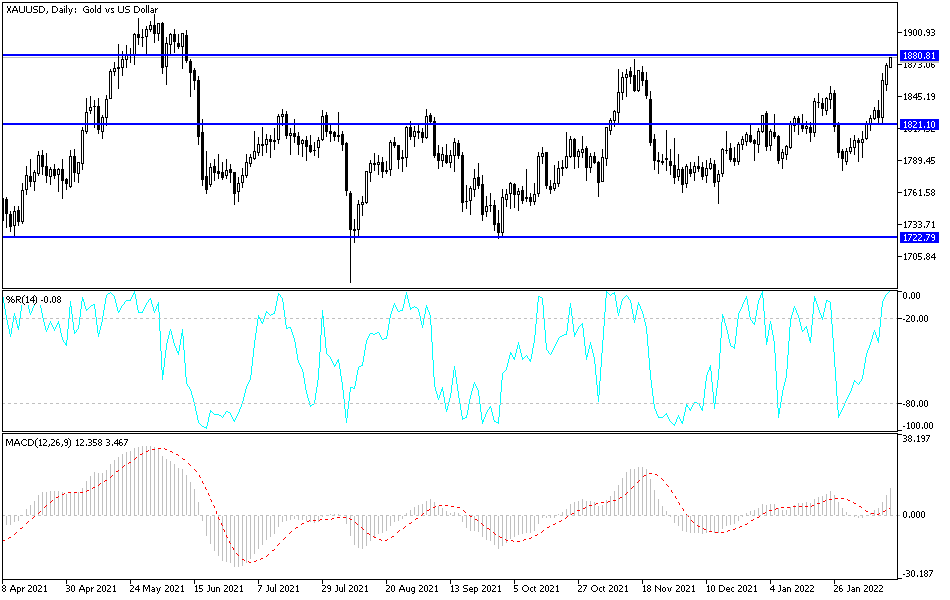

According to the technical analysis of the pair: The price of gold jumped to all the ascending levels that we expected, since the price of gold stabilized above the psychological resistance of 1800 dollars. Amid global geopolitical tensions, gold price gains may increase more strongly. It is currently closest to testing the next psychological resistance, $1900 an ounce. This will support the strength and control of the bulls on the gold market in a crucial week for fears of a Russian invasion. Resistance 1916 dollars per ounce, the highest gold target since June 2021, and expectations may increase to the historic summit of 2000 dollars. This may happen in the event that Russia has already launched a large-scale invasion in Ukraine and increased European and American intervention in the conflict.

In the event that Russia did not take military action and that the matter was tightening the world to the extent of Russia’s strength and influence, the price of gold may be subjected to selling operations to reap profits quickly. The markets will return to focus on the future of tightening monetary policy by global central banks. Currently, the closest support levels for gold are 1865, 1840 and 1825, respectively. I still prefer buying gold from every bearish level.