The price of gold moved strongly upwards, reaching the resistance level of 1865 dollars an ounce, starting from the level of 1821 dollars an ounce on Friday, and closed trading stable around the level of 1858 dollars. This is despite the results of the US inflation data that is stronger than all expectations and supports the expectations of raising US interest rates. As we mentioned many times before that the price of gold, despite the trend of global central banks towards tightening this year, the gold market has the opportunity to rise with the support of other factors, the most important of which are global geopolitical tensions.

The price of gold remained above the psychologically critical $1800. With inflation now showing no signs of slowing, investors stuck to the traditional inflation hedge, preventing the precious metal from falling off a cliff. Gold prices posted a weekly gain of more than 1.55%, which lifted the price of the yellow metal into positive territory over the course of the year.

In the same way, silver, the sister commodity to gold, continues to stay above the $23 threshold. Silver futures fell to $23.29 an ounce. Accordingly, the white metal will register a massive weekly support of 3.4%, erasing most of its loss in 2022. Gold is trying to avoid ending a five-session winning streak. Gold saw a spike in US inflation which jumped to a 40-year high of 7.5% in January. The specter of higher interest rates still hangs over gold. Gold is a hedge against inflation but the Fed will raise US interest rates to curb inflation and make non-yielding bullion less attractive.

However, investors continue to maintain their confidence in gold, says Carlo Alberto de Casa, offshore market analyst at Kinesis Money, in a note, “We should note that rising inflation and the return of positive returns could be a challenge ... for the precious metals." But investors so far still have faith in gold, which could be an interesting hedge in case of market turmoil.

Meanwhile, the University of Michigan's preliminary estimates for February show a downward trend for the consumer. The US Consumer Confidence Index fell to 61.7, consumer expectations fell to 57.4, and expectations for near-term inflation rose to 5%.

The US Treasury market was mixed, with the 10-year bond yield dropping to 2.021%. One-year yields rose 0.01% to 1.096%, while 30-year yields advanced to 2.318%. In general, strengthening returns is a downside trend for commodities because it raises the opportunity cost of owning an asset without a return.

The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 95.71, from an opening at 95.55. In general, a stronger profit is bad for dollar-priced commodities because it makes them more expensive to buy for foreign investors.

In other metals markets, copper futures fell to $4,506 a pound. Platinum futures fell to $1015.20 an ounce. Palladium futures breached up to $2,213.50 an ounce.

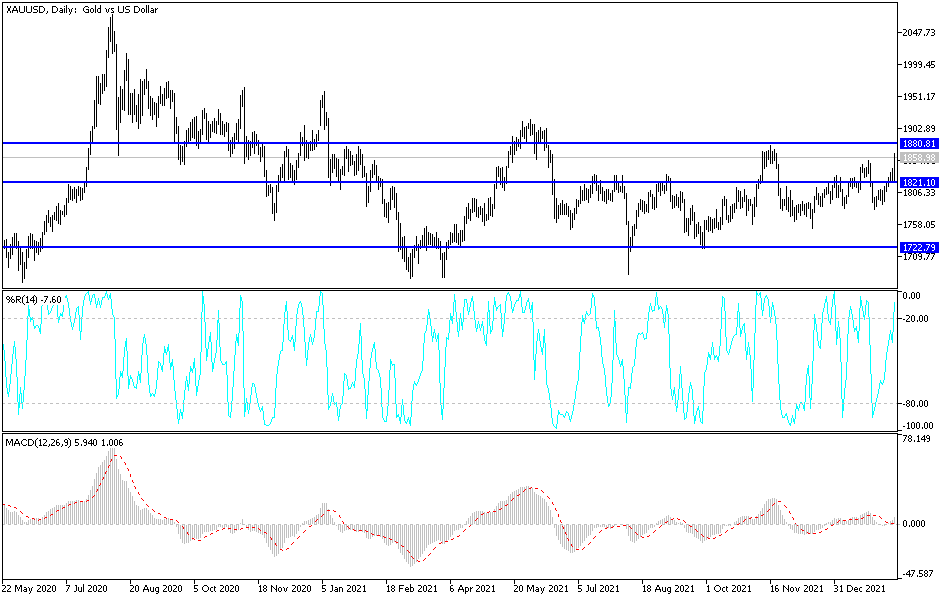

According to the technical analysis of gold prices: In the near term and according to the performance on the hourly chart, it appears that the price of gold is trading within the formation of a sharply ascending channel. This indicates a strong short-term bullish momentum in the market sentiment. As a result, the price of XAU/USD rose to the overbought levels of the 14-hour RSI. Therefore, the bears will target potential technical pullbacks in the short term around $1,841 or lower at $1,827. On the other hand, the bulls will look to extend the current rally towards $1,873 or higher to $1,888 an ounce.

In the long term, and according to the performance on the daily time frame, the price of the yellow metal appears to be trading within the formation of a sharp bullish channel. This indicates a slight long-term bullish momentum in the market sentiment. Therefore, the bulls will target long-term profits at around $1,902 or higher at $1,946 an ounce. On the other hand, the bears will target potential pullback profits at around $1,810 or lower at $1,766 an ounce.