In the midst of profit-taking, the price of an ounce of gold fell to the level of $1891 before settling around the psychological resistance level of $1900 an ounce, waiting for any news. The selling came after the yellow metal's gains reached the resistance level of $1914 an ounce this week, its highest in eight months. The yellow metal fell as demand for safe haven assets stalled before the United States and Europe imposed new sanctions on Russia.

Earlier, the metal rose to an eight-month high after Russian President Vladimir Putin announced that he would recognize two self-proclaimed separatist republics in eastern Ukraine. The move generated condemnation from the United States, the European Union and nearly all representatives of the United Nations Security Council who spoke on Monday night.

Markets and investors are waiting for a new set of sanctions against Russia to be announced to see how much the West is ready to respond. It is not clear what the US and its allies will define as an invasion of Ukraine - something Putin denies he intends to do - what might lead to tougher sanctions and whether they will isolate Russia from global financial markets.

Overall, the price of gold rose this month as investors seek a safe haven against rising geopolitical tensions in Europe. Both Comex ETFs and hedge funds have added to bullion bets in recent weeks, helping to support the rally. This was despite expectations that the Federal Reserve will raise US interest rates at its meeting next month, a move that will put pressure on the non-interest bearing asset - gold.

Commenting on the performance of the gold market. “Gold’s rally is paused before a heavy layer of resistance in the $1917/23 region with momentum not strong enough to take it through this stage,” said Ole Hansen, commodities analyst at Saxo Bank A/S. A fair amount of risk premium is priced which doesn't usually tend to stay for a long period of time.”

The crisis in Ukraine is another concern for investors who are starting 2022 trying to determine how the economy will perform amid rising inflation and looming interest rates. Firms face supply chain problems and rising raw material costs as demand for goods outstrips supply. The Federal Reserve plans to raise interest rates to combat inflation, but Wall Street isn't sure how the number and frequency of rate hikes will affect the market and the economy in general.

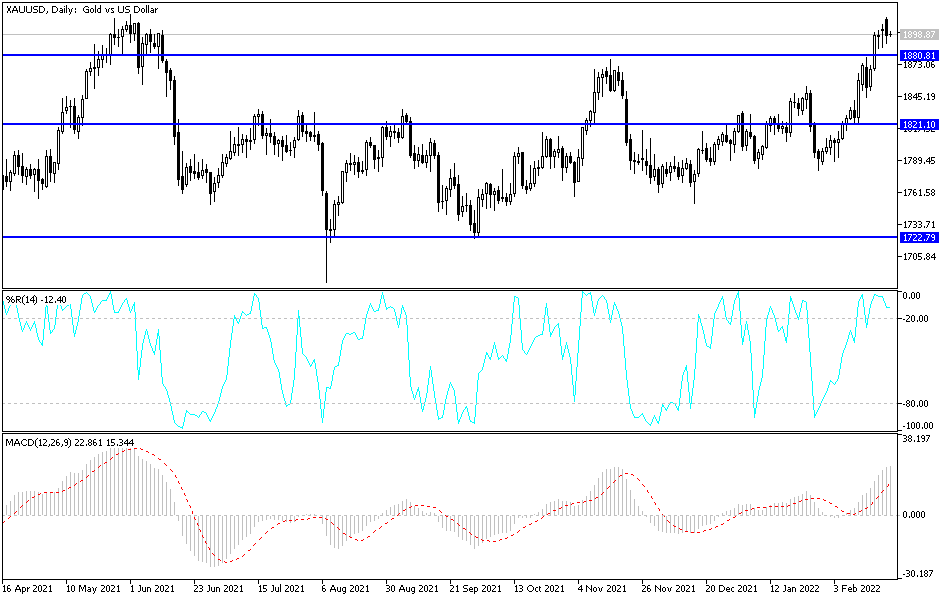

According to gold technical analysis: So far, the psychological resistance of $1900 is still confirming the extent to which the bulls control the general trend. As I mentioned before, it is necessary to be careful, as the technical indicators have reached overbought levels. The gold market, as is the case with all global markets, is cautiously waiting to see if there will be a Russian invasion or noth. If yes, a new record rise will happen to the price of gold and the closest level for the bulls is currently $1919 and $1945, which may pave the way for the historic high of $2000.

If there is a negotiation and a military exit for Russia, we may witness strong sales to take profits for the price of gold. This is excluded at the present time until Putin gets what he wants from the latest move. Accordingly, the selling levels for gold will remain a target for buying again, with the closest support levels currently $1885 and $1860.