By the end of last week's trading, gold futures struggled to stay above the critical $1900 resistance level. The price of the yellow metal is off to a hot start in 2022 and is poised for huge weekly gains. There are a whole host of factors driving gold prices higher, but many investors are committed to the events taking place in Eastern Europe. The price of gold rose to the level of 1902 dollars an ounce, the highest for the gold market in eight months. The price of gold recorded weekly gains of more than 2%, bringing its 2022 year-to-date gains to nearly 4%.

In the same way, silver, the sister commodity to gold, topped $24 on Friday. Accordingly, the price of the white metal rose by 1.8% last week, bringing its gains since the start of the year 2022 to date to nearly 3%. Overall, this was the metals market's best weekly performance in nine months, buoyed by the Ukraine-Russia tensions, which seeped into global financial markets.

There have been conflicting reports about Russia's attack on Kiev, but Moscow insists it has reduced the number of troops on the Ukrainian border. Meanwhile, the US administration continues to claim that an invasion is imminent.

Meanwhile, the Federal Reserve released from last month's Federal Open Market Committee (FOMC) meeting. The minutes revealed that some officials are very hawkish and want to end quantitative easing earlier than the scheduled date. But the general message was that the US central bank was ready to raise interest rates next month.

Commenting on the developments, Robert Rowling, market analyst at Kinesis Money, wrote in a daily note: “The escalation of military aggression in Ukraine has seen a flight to gold with the price now challenging $1,900 an ounce and trading at levels not seen since June 2021.” "The fact that these gains came in the week that the Federal Reserve charted the course for a potential interest rate hike highlights that fear is the dominant sentiment among many investors," he added.

Other factors affecting gold. The US bond market was mostly in the red by the end of the week, with the 10-year US Treasury yield dropping to 1.939%. One-year yields fell to 1.001%, while 30-year yields fell 0.05% to 2.263%. Decreasing returns for gold are usually bullish because they reduce the opportunity cost of holding non-yielding bullion.

Another factor affecting the gold market. The US Dollar Index (DXY), which measures the performance of the US currency against a basket of major currencies, rose to 95.87, from an opening at 95.80. Accordingly, the DXY dollar index is on its way to decline by 0.2%, adding to its loss since the start of the year 2022 to date by 0.1%.

Double profit is a good thing for dollar-denominated commodities because it makes them cheaper to buy for foreign investors.

In other metals markets, copper futures rose to $4.55 a pound. Platinum futures fell to $1091.10 an ounce. Palladium futures fell to $2,358.00 an ounce.

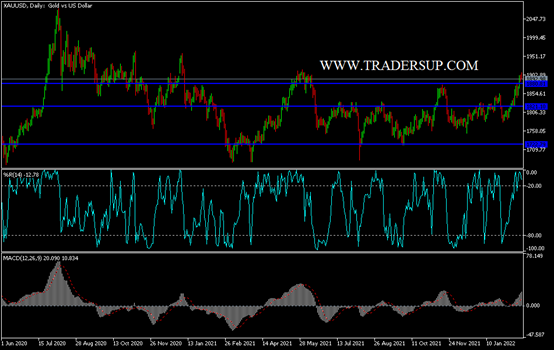

According to the technical analysis of gold: the general trend of the gold price will remain bullish and stability above the psychological resistance of $1900 is a culmination of the bulls’ control of the trend. Today, in light of the American holiday, unless there is a strong shift in the military anxiety in Europe, gold will continue reap the gains.

The closest targets for the bulls are currently $1919 and $1945, and on the bearish side, there will be no change in direction without a breach of the support $1825 per ounce.