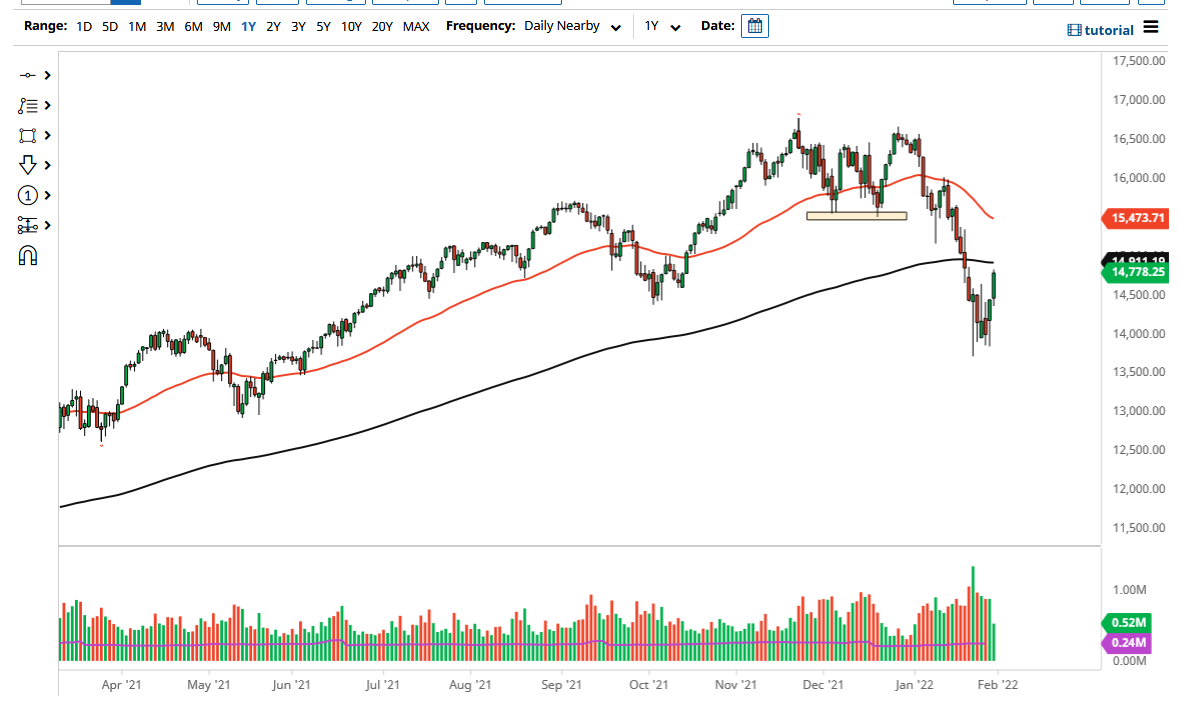

The NASDAQ 100 did rally significantly on Monday to show signs of life again. That being said, we are still below the 200 day EMA, and that might have a little bit of technical relevance. The 200 day EMA is currently at the 14,911 level and starting to tilt lower. If we can break above that, it might have more technical traders starting to buy again.

Keep in mind that there are a lot of technology stocks reporting earnings over the course of this week, so I would anticipate a lot of volatility. That being said, markets are likely to see opportunities in both directions. Which lasts longer will be the question. We have seen a massive selloff, so unless things change completely, traders will still have to worry about the idea of tight monetary policy, which has been the biggest driver of the market lower. Whether or not the bears are done selling is a completely different question, but right now I think the only thing you can count on is a lot of noise, so please keep your position size reasonable.

If we break down below the bottom of the candlestick for the trading session on Monday, then it would probably send this market lower to threaten the 14,000 level. If we get a sustained move below there, the NASDAQ could be in serious trouble. Keep in mind that there are just a handful of stocks that tend to move this index, so pay attention to all the big boys such as Tesla, Microsoft, and Amazon.

Ultimately, there continue to be a lot of questions about where the economy is going, and it is very possible that we are looking at not only inflation, but perhaps stagflation. Stagflation is absolutely toxic for economies, so anything with a high-growth multiple is probably going to be in trouble. While the volatility has been strong, the reality is that eventually it will die down. We are nowhere near that at the moment so do not go crazy with your position sizing. The size of the candlestick was a good start for the NASDAQ 100 on Monday, but we need to see some follow-through. If we do see a turnaround in this market, it is very likely that you have plenty of time to add to a position.