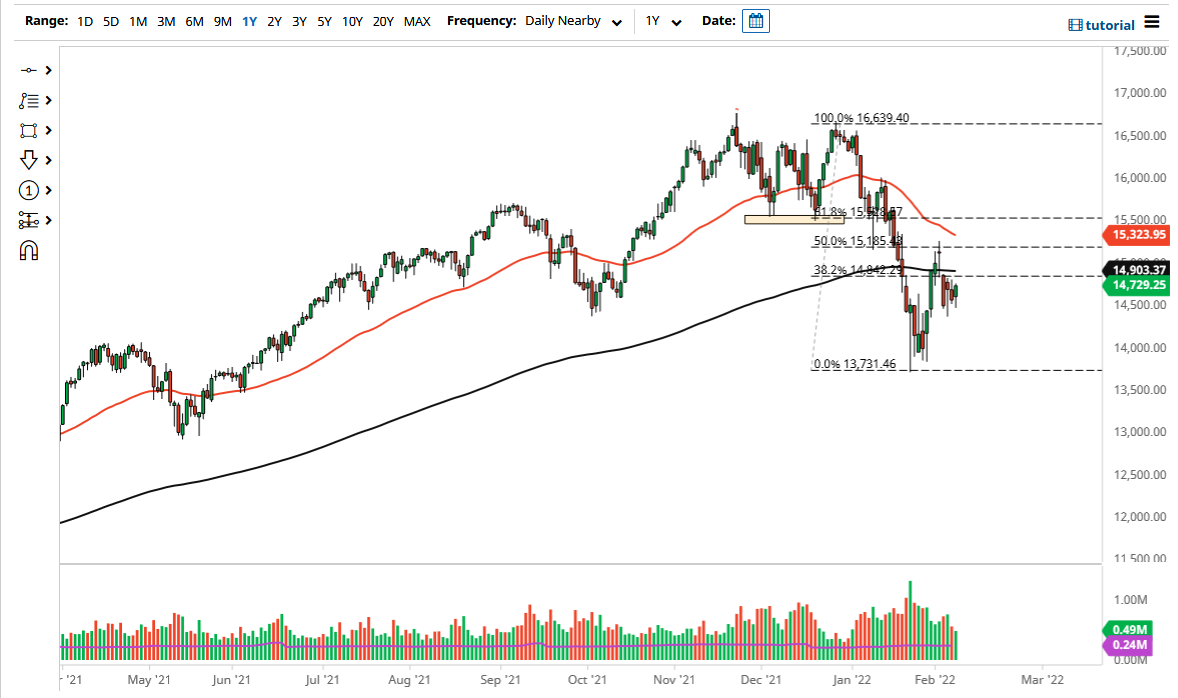

The NASDAQ 100 was essentially a back-and-forth market over the last three days, and Tuesday was never going to be any different. We have the CPI inflation numbers coming out on Thursday, which a lot of people will be paying close attention to. The market simply has no idea what to do with itself right now and it is probably best left alone. Wild swings intraday continue to be the norm, as we are sitting just below the 200 day EMA.

That being said, the 50 day EMA is racing lower, but moving averages are a lagging indicator anyway. Essentially, it is telling you that the market is falling, which might be useful, unless you have not been paying attention to the last couple of months. However, you do know that it has been falling, so it still looks as if it is a “sell the rallies” type of situation, but until we get the inflationary figures out of the United States on Thursday, it is difficult to put a lot of money or faith in this market.

If inflation is higher than the anticipated figures, I think you can probably count on the NASDAQ 100 selling off quite drastically, but if it does end up being relatively weak - this will have people thinking that the Federal Reserve will not be able to raise interest rates as much as is currently priced in. That is the real danger here: that the Federal Reserve has to change its stance relatively soon. Yes, there is a lot of inflation right now, but at the end of the day it is very unlikely that they will ever get anywhere near five interest rate hikes.

If we break down below the 14,500 level on a daily close, that could signal that we are going lower but then again, I think you need to see Thursday first before even make that decision. If we can break above the recent high then we might be able to recover towards the 15,500 level, but it is the same situation as we are essentially waiting CPI numbers. For Thursday, I would stay out of this market and let the algorithm traders chop each other up on short time frames.