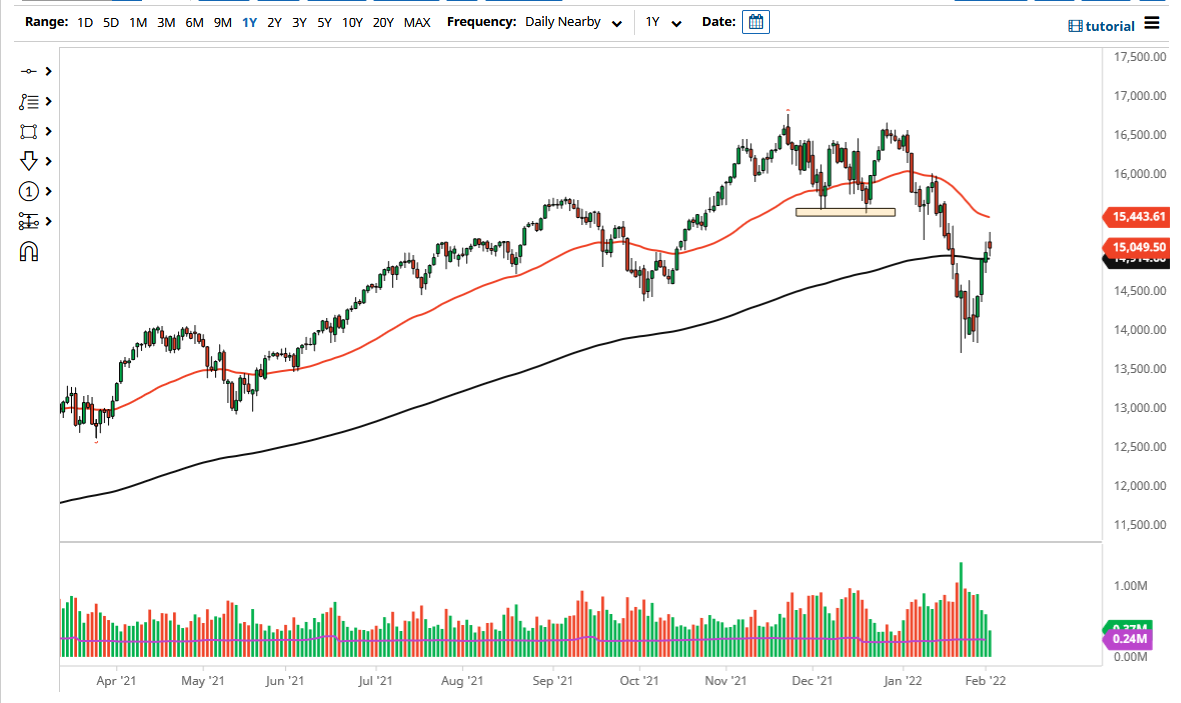

The NASDAQ 100 went back and forth on Wednesday as we are starting to finally recognize that gravity is a thing. The neutral candlestick is something that will catch the attention of certain traders, as we have gotten far too ahead of ourselves. With that being the case, I think that if we break back down below the 200 day EMA, we could see a huge move lower in the short term. Keep in mind that the jobs number comes out on Friday and a lot of people might be a bit concerned at that point.

The internals of the stock market does not necessarily suggest that there is a lot of faith in the rally, and this just looks more or less like a typical bounce after a major selloff. In fact, it is focused on the 50% Fibonacci retracement level, so it is very likely that we could see even more ugliness. If that is going to be the case, then it would not surprise me at all to see this market head towards the 14,000 level over the next several sessions. After all, we are in the midst of earnings season, and it would probably not take too much to get the markets concerned. I do believe that we are nowhere near getting rid of the volatility, and stock markets do not like volatility at all. Because of this, I anticipate that it is probably only a matter of time before we see some type of shock to the market.

On the other hand, we could rally and break above the top of the candlestick. If we do, then it is more likely than not that we will go to the upside to search for the 50 day EMA. In that general vicinity, which is near the 15,443 level, I would anticipate that you will start to have to worry about the 15,500 resistance barrier, an area that had been significant support previously. In that area, I would expect even more pushback. If we can finally get back above that area, then you may have a confirmation of the longer-term uptrend continuing. That being said, I just think that far too many people were concerned about the Federal Reserve to see an extended bullish run at this point in time.