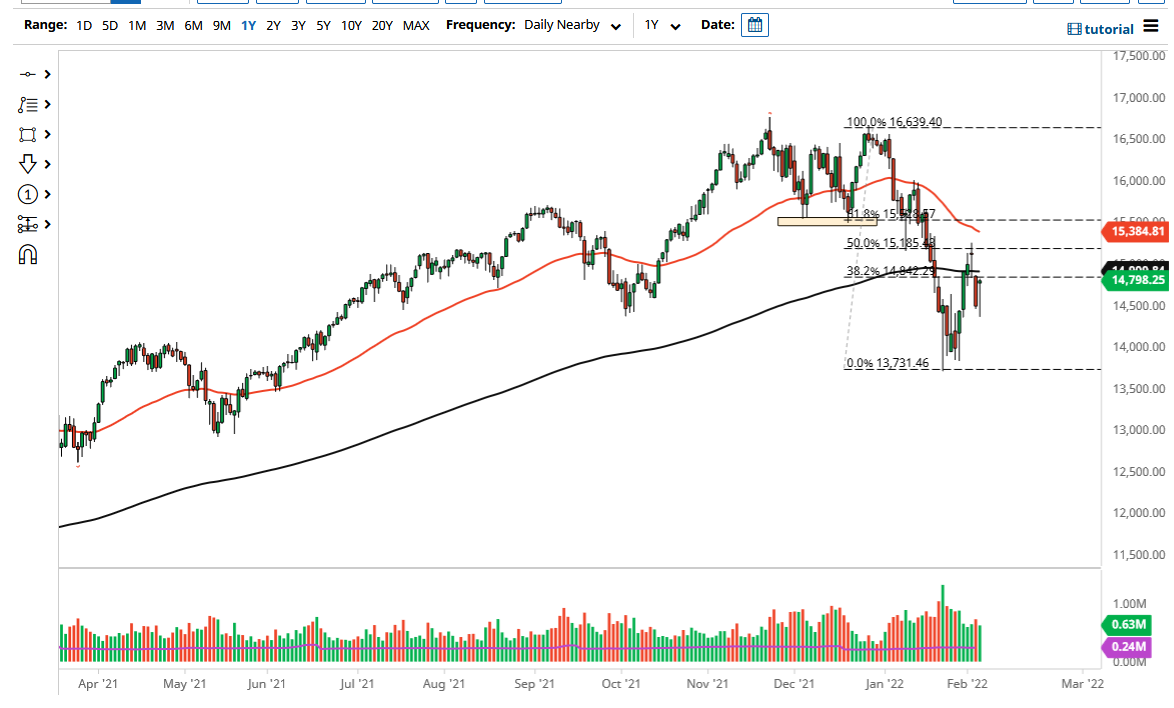

The NASDAQ 100 initially was shocked by the jobs number, and perhaps more importantly, the spike in interest rates that came out the United States. Because of this, the NASDAQ 100 sold off due to the fact that there are so many highflying technology stocks that push this thing around, so it should not be a huge surprise to see that we have broken down. However, it looks as if somewhere near the 14,400 level we started to find value hunters.

Keep in mind that Amazon itself gained as much as 14% one point, so that was a big driver of where this index went. The hammer sitting just below the 200 day EMA is a good sign, but we still have to look at this through the prism of a market that had pulled back 50% and then broke down. A lot of this is going to come down to interest rates and whether or not they are moving rather quickly. If they are, that will almost certainly cause some major problems. The idea of the NASDAQ 100 taking off to the upside also assumes that there is a certain amount of stability economically.

If we break down below the bottom of the candlestick, then we will more than likely enter consolidation underneath, which extends down to roughly 13,700 or so. It could be very noisy in that area but breaking down below that level would be catastrophic. It is a little early to call what is going to happen next, but we have a couple of major areas to pay close attention to. I anticipate that more than anything else we are likely to see a lot of choppy behavior in the short term, allowing the market to grind away as we try to figure out what happens next. The shape of the candlestick is encouraging, but we are sitting just below a gap and the 200 day EMA, which could work against the value of the market from a technical analysis standpoint. While the NASDAQ 100 has been a consistent winner over the last 13 years, the Federal Reserve stance changing will have a definitive effect on this market and things will have changed as a result. Earnings and future outlook will have more to do with what happens to these companies going forward instead of simple liquidity.