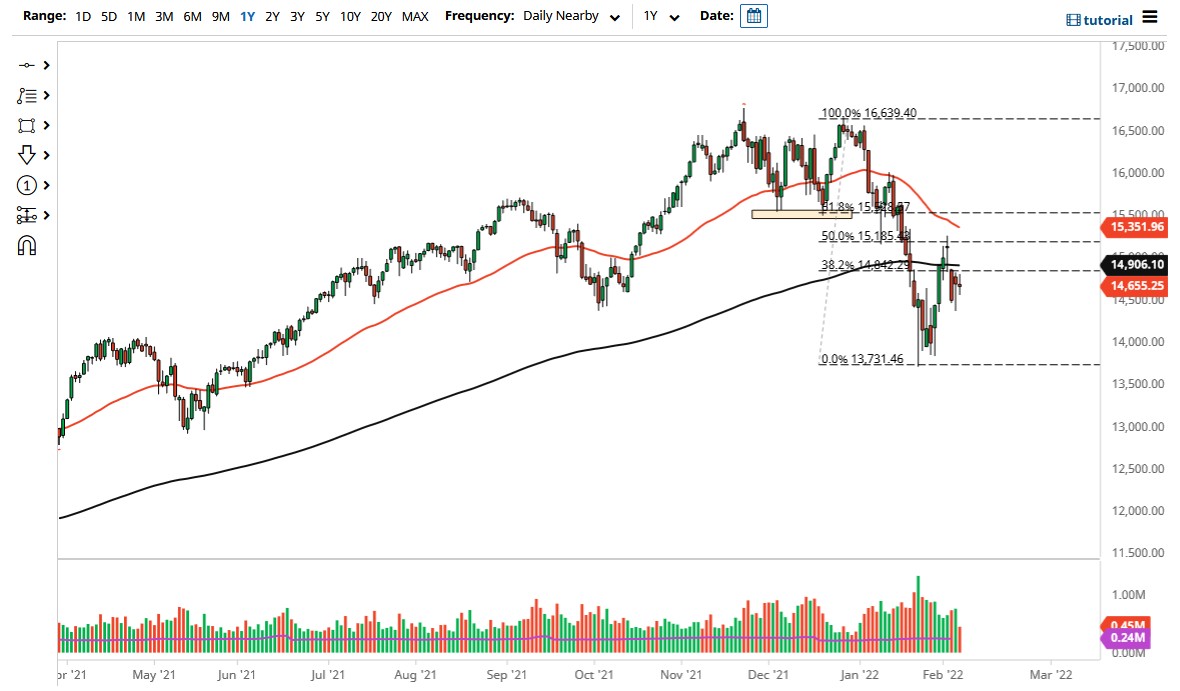

The NASDAQ 100 went back and forth on Monday, which is exactly what the buyers want to see due to the fact that the volatility scares people. At this point, if the NASDAQ 100 can find a bit of stability, that might be the first step in order to turn things around. The 200 day EMA sits above at the 14,905 level. That would be a little bit of a barrier, but if we can break above there, then we will make a serious attempt to make a new high. As things stand right now, I think you are probably better off simply waiting for some type of certainty to get going.

Ultimately, this is a market that needs a growth environment to get momentum to the upside, and I think the NASDAQ 100 is probably not where you want to go right away. If we break down below the bottom of the hammer from the Friday session, then I think it opens up a move down to the 13,750 level. Breaking down below there could very well open up a massive amount of selling pressure and perhaps a move down to the 13,000 level.

Keep in mind that interest rates will be something that we need to pay close attention to, and it is worth noting that the 10 year yield was rather sluggish during the day. If it suddenly takes off to the upside, meaning yields and not the price of the 10-year note, then that will more than likely work against the NASDAQ 100. Not only is it about higher interest rates, but it is also about the rate of change, meaning that you need to see exactly how quickly the yield rises or falls. Obviously, it can work both ways.

Facebook has been getting absolutely terrorized, so it is worth noting that the stock is a major player in this index, as it is so heavily weighted to just about seven or eight companies. That being said, some of the other ones such as Amazon have done quite well, so we will continue to see a lot of noisy behavior, as the market continues to see a lot of questions asked, and as a result I think that the market is likely to see the S&P 500 outperform in the short term.