The S&P 500 has gotten hammered during the trading session on Thursday as the CPI numbers came out much hotter than anticipated. While the stock market selling off in that scenario should not be a huge surprise, what did surprise me is that we turn around and spiked right up in the air in a massive recovery. However, James Bullard, the St. Louis Federal Reserve Gov., stated later in the day that he wanted to see at least a 50 basis point hike at the next meeting. Furthermore, he even went to the point of suggesting that 100 basis points are needed between now and July.

This suggests that the Federal Reserve is far behind the curve, something that everybody but the Federal Reserve knew already. However, they will almost certainly “overcorrect” at this point in time, so the market is starting to worry about some type of hard landing when it comes to the economy. Underneath, we have plenty of areas that could offer support, but we are closing at the very bottom of the range of the day, which typically means we need to see some type of continuation. I think at the very least you are looking at a very volatile market just waiting to happen, so I would be cautious.

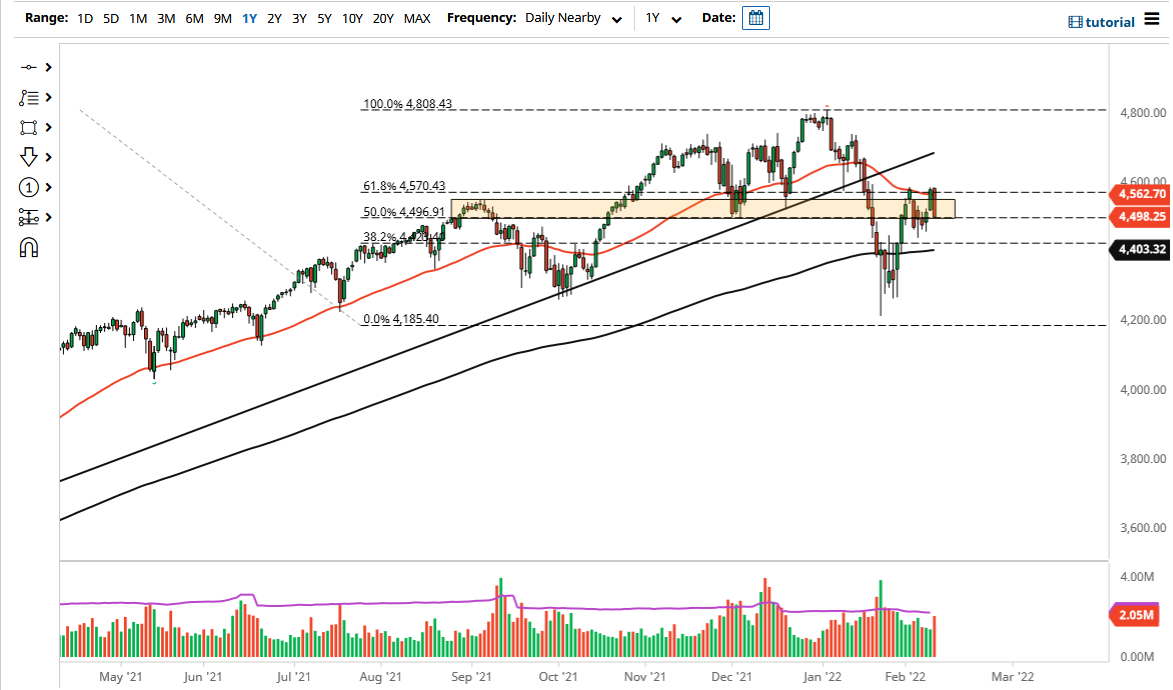

The 200 day EMA currently sits at 4400, and I think that could be a supportive level. If we break down below there, then it is likely that we go much lower, perhaps finding plenty of fear out there that could send this market spiraling. Below there, we could go looking towards the 4250 level, possibly even the 4200 level. At this point in time, the question now is whether or not we just formed a “double top” at the 61.8% Fibonacci retracement level.

It is very likely that the market has further to go to the downside, and therefore I think that you need to be very cautious at the very least and keep your position size small. At this point, I am not interested in trying to “catch a falling knife”, and therefore I think you need to be very cautious as we are then going to be moving based upon the overall words of Federal Reserve officials, and at this point I think it is only a matter of time before we see a big move.