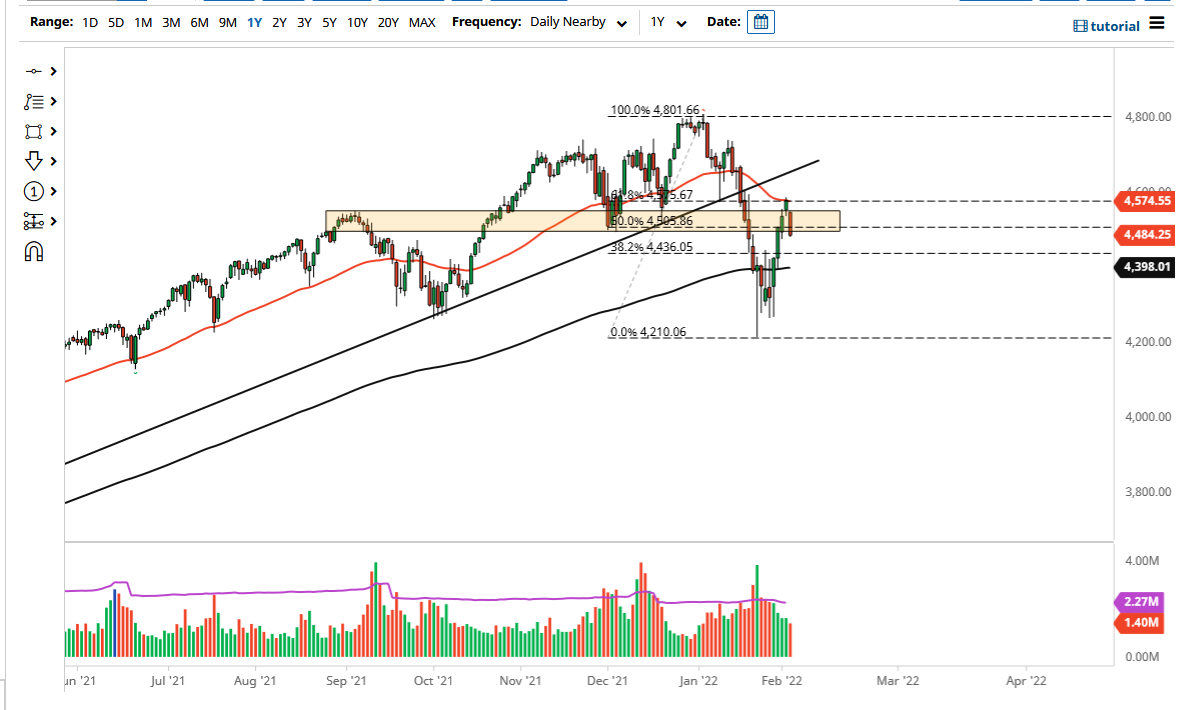

The S&P 500 has fallen apart during the trading session on Thursday as it has become obvious that central banks around the world have entered a tightening cycle. If that is going to be the case, the market is more than likely going to be struggling going forward. After all, the market had pulled back from the 61.8% Fibonacci retracement level and the 50 day EMA. Because of this, it is likely that we are going to continue to see a bit of downward pressure and the fact that we have the jobs number coming out on Friday suggests that we should see a lot of volatility.

Looking at this chart, it is very possible that we could see further downside as we had closed at the very bottom of the range and of course we will have a lot of volatility around that jobs number coming out. With this, we could go looking towards the 200 day EMA, and I think that the market is still going to look at earnings season with a bit of trepidation due to the fact that the bigger picture looks very tough. At this point in time, it is more likely than not that we will see a bit of a drop, followed by an attempt to stabilize things.

We had recently broken down through a major trendline, and now we have come back to get close to that trendline, only to fail again. At this point, market participants will continue to look at this through the prism of trouble, and therefore I think we will see a bit of follow-through. That being said, if we were to turn around a break above the 50 day EMA, that could be a very bullish sign and therefore send a bit of a “panic bid” into the market. I think the one thing you can probably count on is a lot of noisy behavior during the day on Friday, and therefore I think you need to be cautious with your position sizing. Position sizing will be crucial, as we have a lot of noise out there and you can lose a lot of money very quickly if you are not careful. That being said, I do like the idea of a short position at least until we get to the 200 day EMA, where we could see things stabilize a bit.