The S&P 500 rallied a bit on Monday as traders came back from the weekend. That being said, the market is likely to continue seeing a lot of noise, as the markets have so many different things to worry about. At this point, there are three major central banks meeting during the course of the week, and we are in the midst of earnings season. Technology is on tap, but you should also pay close attention to the fact that the jobs number comes out on Friday.

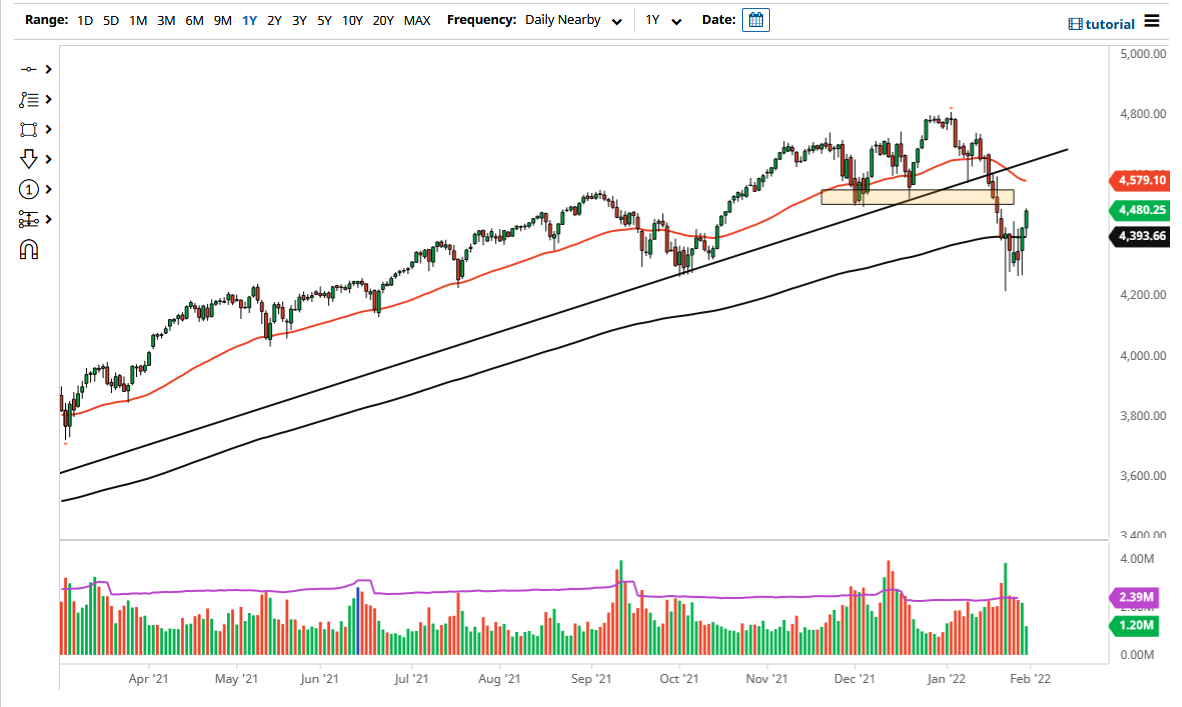

That being said, you can see that we did break out of a little bit of consolidation but lost some of the steam late in the day. It also is worth noting that the 4500 level above could cause major resistance as it was previous support. This would be based upon “market memory”, as it was so important previously. There will more than likely be people willing to gladly get out of bad bullish bets that had been eviscerated over the last couple of weeks if they can get anywhere near “break even.”

Furthermore, there are a lot of concerns out there as to whether or not the economy is going to head into a recession due to Federal Reserve tightening, and traders will also have to keep that in mind. This may be part of what we had seen late in the session in New York, as institutional money moves a lot later in the day. Whether or not we can continue to be seen going higher is a completely different question, but if we were to get above the 4500 level that I think a certain amount of money would come flowing back into the market. Nonetheless, there are a lot of concerns out there and I think that continues to make the market sluggish at best. If we break down below the 200 day EMA again, then we might have more consolidation. I do not think that this is a market we will be comfortable in anytime soon, as there are so many different things out there causing issues. As long as that is going to be the case, I think that nobody is going to be completely comfortable hanging on to a position and that continues to be a major problem.