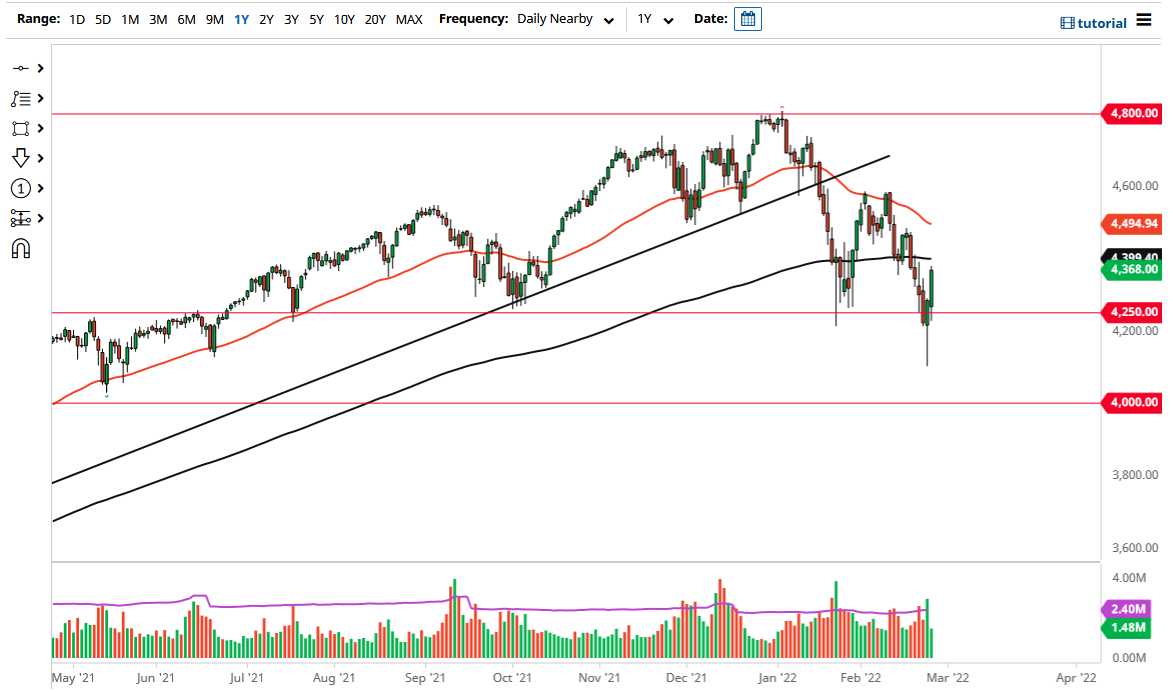

The S&P 500 rallied rather significantly during the course of the trading session on Monday to go reaching towards the 200 day EMA. The 200 day EMA currently sits just below the 4400 level, so it does make a certain amount of sense that the market has stalled in that area. The S&P 500 has seen a lot of short covering heading into the weekend, because Russia has hinted that they are interested in talking to Ukraine, and Ukraine has stated the same. That being said, we have not seen a move towards that actually happening, so it will be interesting to see if this is simply just noise.

The 200 day EMA attracts a lot of attention, so I think that if we were to break above there is likely that the market could go looking towards the 50 day EMA which is currently drifting lower. With that being said, I think it is probably only a matter of time before we see sellers coming back in, but I certainly would not just jump into the market the way it looks. The market needs to form some type of exhaustive candlestick, and furthermore, it is going to be difficult to get overly negative of this market heading into the weekend, so I believe that the Monday session is going to be driven solely by either news, or perhaps even the lack of it over the weekend.

If we can break above the 4500 level, then we could start to look towards the upside. We are still hundred 50 points away from there, so it is interesting to see that the next day or two will be crucial. Looking forward, I do believe that we will have to make some type of decision for a bigger move but reading too much into the Friday candlestick could cause you issues. I still believe that the market is going to be focusing on the slowing down the economy that is also going to be exacerbated by the Federal Reserve tightening at the same time, so therefore I am skeptical of rallies until proven otherwise. Yes, it has been a nice relief rally after the Ukraine war has not crossed borders, but that of course could produce headlines that cause major issues at any time as well.