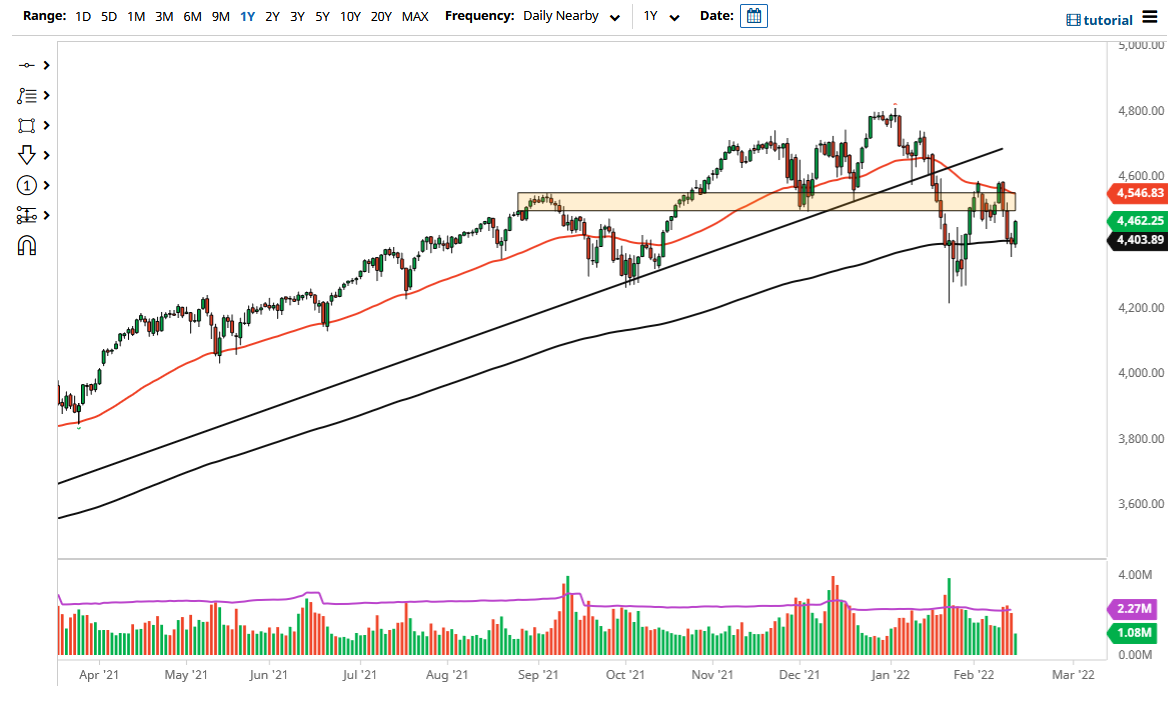

The S&P 500 rallied a bit on Tuesday as the 200 day EMA has come back into the picture. That being said, we still see a lot of noise above and it is likely that it is going to be somewhat difficult to simply take off to the upside. Given enough time, we will probably see sellers come back in, especially as we get closer to the 4500 level. The 4600 level as well is an area of resistance, so I think of this more or less as a “zone of selling”, or perhaps supply.

At this point, part of the relief rally has to do with the fact that the Russians have pulled back from the Ukraine just a bit, but that was just a recent issue. We still have plenty of concerns when it comes to inflation, and this will have done absolutely nothing to change that. We also have concerns about earnings, as the US economy is more likely than not going to slow down due to people being priced out of the market. In general, this is a market that I think will continue to be very noisy, especially as the 50 day EMA is reaching down towards the consolidation area above that I think causes resistance. If we can break above the 4600 level, that would obviously change a lot of things, but I also believe that it would take a significant amount of pressure that we may not be able to drum up.

The overall attitude of the market is one of confusion, and you should keep in mind that even though we are in a rather bearish market, the bounces that we get from time to time are a bit more aggressive. It is likely that we will continue to see a lot of choppiness, as the markets continue to go back and forth and try to figure out what is about to happen next. The market is currently between the 50 day EMA and the 200 day EMA, which typically “squeezes” the market, eventually forcing some type of more impulsive move. That being said, I think that we still have a lot of concerns out there, so I am looking at a market that I think will continue to go lower.