The S&P 500 went nowhere over the last four days, but it certainly has wrecked a lot of short-term traders. When you get in these little choppy tantrums, it is very difficult to make money for anything more than a quick scalp. With the CPI numbers coming out on Thursday, it is very likely that we will continue to see this type of nonsensical trading, as we just do not know where to be.

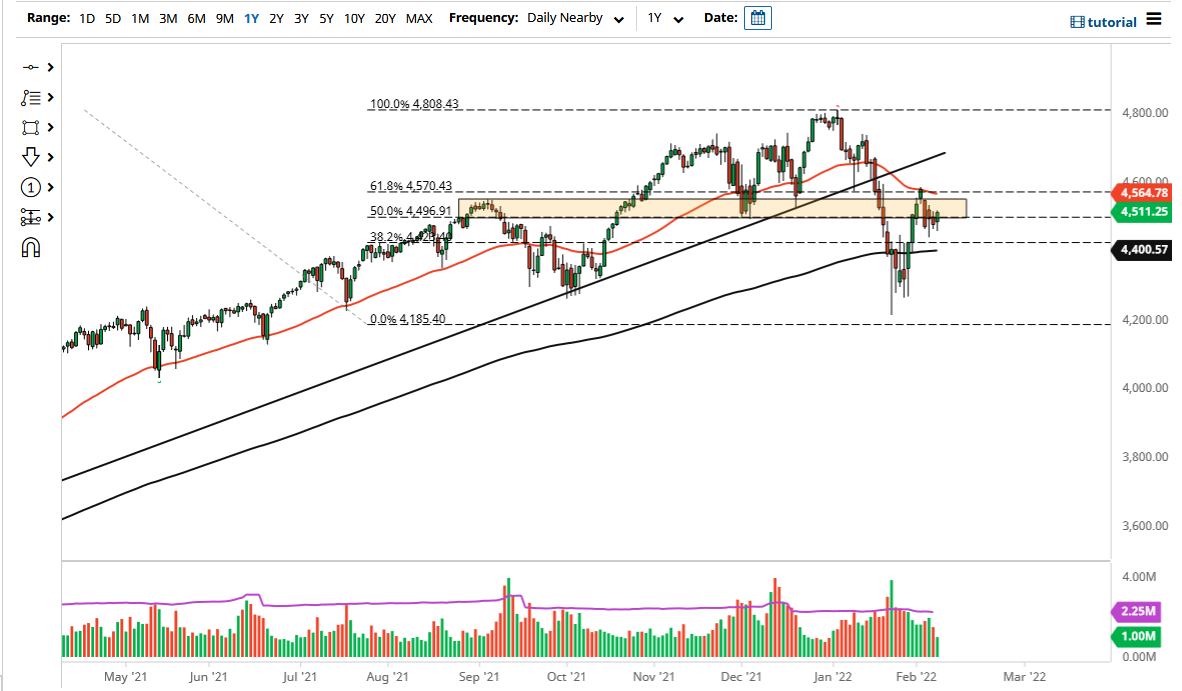

We are currently stuck between the 50 day EMA above and the 200 day EMA below. That normally means that you are squeezing, and longer-term traders are starting to come to grips with the idea of having a trend either fizzle out, or return. I do not like shorting US indices as you know, because if this thing crashes hard enough, the Federal Reserve will bend its knee to Wall Street, because at the end of the day that's who they serve.

However, as midterms approach in November, there is a lot of pressure to do something about inflation. Interest rate hikes should in theory knock inflation down, but that also will throw the economy into recession. Given enough time, the Federal Reserve will have to make a decision one way or the other, whether they are going to do something for Wall Street or Main Street. Regardless of what they have to do, or for that matter what they decide to do, there are no good outcomes in the long term. That does not mean that the stock market cannot go up; we have seen 13 years of the stock market making its biggest gains when there is bad news. It is all about liquidity and has nothing to do with the underlying companies in the index, so you can forget about P/E ratios, valuation metrics, and everything else. It is about how much cheap and free money is coming into the picture. Wall Street loves that cheap money, so if we get the Federal Reserve freaking out and not able to raise interest rates, that would shoot this market through the roof. This is why the CPI numbers on Thursday will be so important, because of inflation is in fact starting to slow down a bit, it will limit the amount of interest rate hikes that the Fed needs to do.