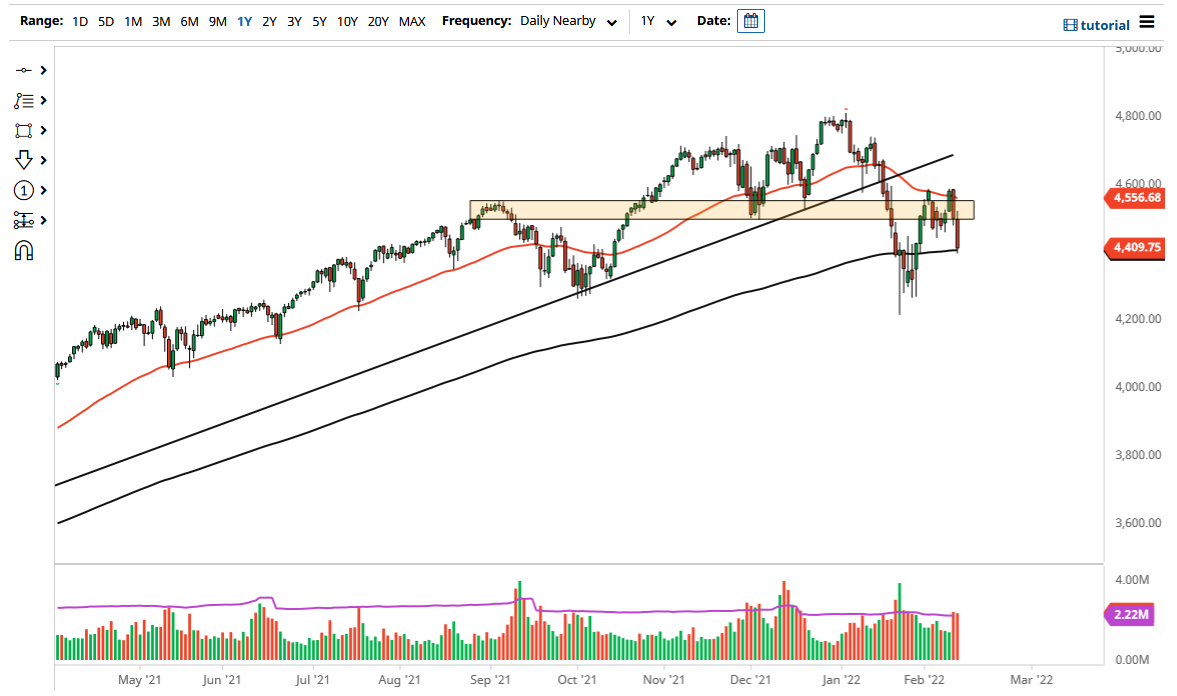

The S&P 500 had a rough trading session on Friday, as we continue to see a lot of concerns around the world. Now that we are starting to worry about the idea of war in Ukraine, that only adds more fuel to the fire. The Federal Reserve wants to tighten into a slowing economy, which is almost always an extraordinarily negative thing. Granted, the Federal Reserve will eventually try to save Wall Street, but it is not happening right now.

If we do continue to go lower on the open for the Monday session, we could very easily go looking towards the recent lows. The 200 day EMA should offer a certain amount of support, but any bounce at this point will be a selling opportunity at the first signs of exhaustion. Overall, I believe that the S&P 500 has further to go to the downside and it is worth noting that the Federal Reserve has an emergency meeting today. This typically means that we are going to do a bit of tightening, and that works against the markets. A lot will be read into the statement, because if we see the Federal Reserve tightening rather quickly, it will more than likely work against the stock market overall. I think that with the momentum we were picking up late in the day on Friday, the only thing that saved the market with the fact that it closed.

I do not have a bullish scenario at this point, unless today is about the Federal Reserve changing its attitude completely. I do not see that happening with inflation roaring the way it is, and now I would also need to see the market overtake the 4600 level to get bullish. Do not get me wrong, I think there will eventually be a bottom, and it will end up being a nice buying opportunity. However, we are nowhere near there, and I think it is going to be difficult to tell when that is going to happen in the short term. The markets will continue to be very skittish as we are basically hanging on to every word of Federal Reserve governors, Vladimir Putin, and the US State Department. Keep your position size small, it is the only thing that you can do.