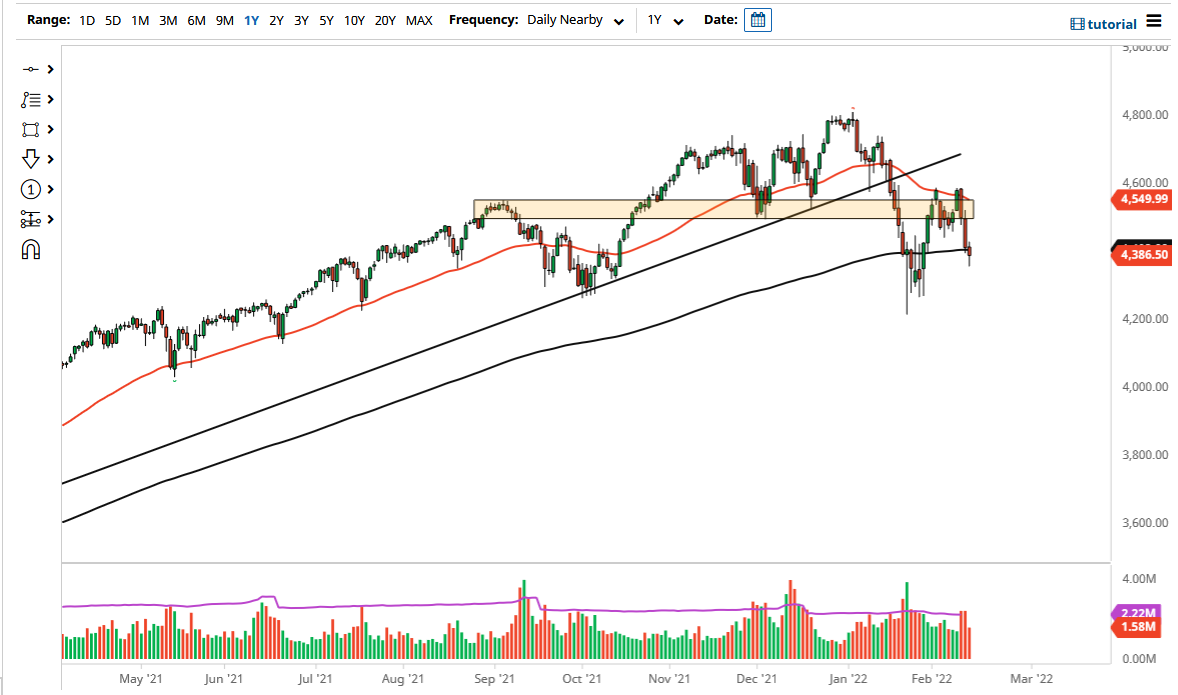

The S&P 500 fell a bit on Monday in the futures market but turned around to form a bit of a hammer. We are sitting at the 200 day EMA, so it does suggest that perhaps we may have a bit of a bounce ahead of us. This does not necessarily mean that the markets will turn around and start rallying with any great significance, just that it is likely that we are going to continue to see a lot of back and forth. This is a very dangerous market at this point, because people are trading on speculation as to what the Russians are going to do next more than anything else.

Long before the Russia/Ukraine border situation, the markets were struggling. However, as the market likes to move on the latest narrative, that is the one that we are dealing with. We have already seen a bit of shenanigans in the markets during the day as Twitter followers have thrown things around, based upon whatever the latest rumor is. I do believe that ultimately this is a market that needs to figure out what in the hell it wants to do, but right now I think selling rallies will continue to be the easiest way to make any sense of the situation. Being a short seller is quite a bit different than simply buying and holding, so you need to be quite a bit nimbler.

When you look at the chart, the 50 day EMA currently sits at the 4550 level and is drifting lower. I think that the technical traders out there will be paying close attention to this, especially as it is near a significant resistance barrier where we have previously formed a bit of a double top. To the downside, if we break down below the candlestick for the trading session on Monday, we could very well go lower and perhaps look towards the 4300 level.

Unfortunately, this is all based upon the latest headline or rumor, so it is going to be very difficult to trade this market. I have been trading very small positions at best, because it is just not worth the stress when the markets get this confused and concerned.