Obviously, the biggest event during the month of February was going to be the Russians invading Ukraine, and that had people very concerned, sending stock indices around the world plunging. All things being equal, we have turned around for the very fact that the battle in Ukraine does not seem to be spreading.

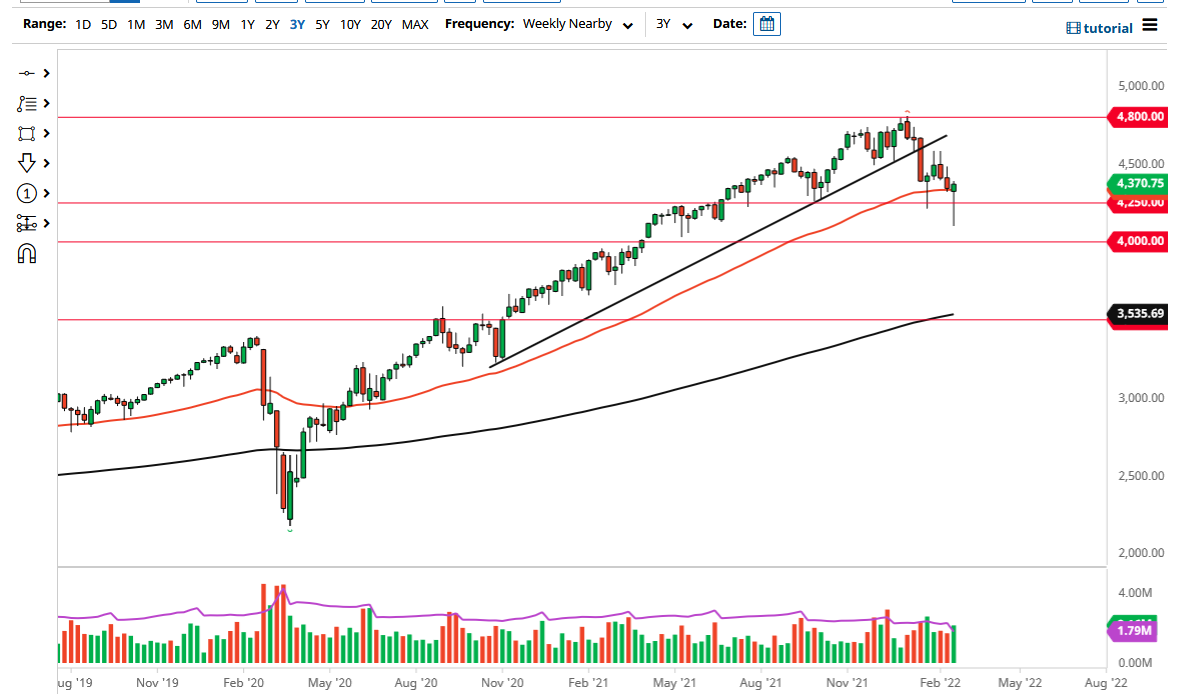

The month of March is going to be a bit difficult, because it is going to be heavily influenced by external factors. The first one of course will be the situation in Ukraine. If that gets worse, and perhaps more importantly expands beyond Ukrainian borders, then the S&P 500 will almost certainly sell off quite drastically. The 4000 level would be a major large, round, psychologically significant figure that could offer a little bit of support, but in the event of an expanded war, the S&P 500 will blow through it like it is not even there.

Another concern is going to be Federal Reserve monetary policy tightening, which some people are starting to suggest that the Federal Reserve will not be able to tighten monetary policy like they have been stating. Because of this, it is going to be a situation where traders parse every word of every speech between now and the meeting this month. If the Federal Reserve sounds overly hawkish and we continue to see really hot inflationary numbers coming out the United States, that has people thinking that we could be looking at a 50 bps hike. That is bearish for stocks. On the other hand, if we see a little bit of rolling back of the aggression by federal Reserve speakers, then that might be bullish for stocks because it is “less bad.”

A break above the 4500 level on a daily close would be a sign that we more than likely than not would go looking towards the 4800 level again. On the other hand, if we break down below the bottom of the weekly candlestick for the last week of February, we almost certainly will continue to plunge. In the meantime, expect a lot of choppy and sideways action, and therefore keep your position size relatively small.