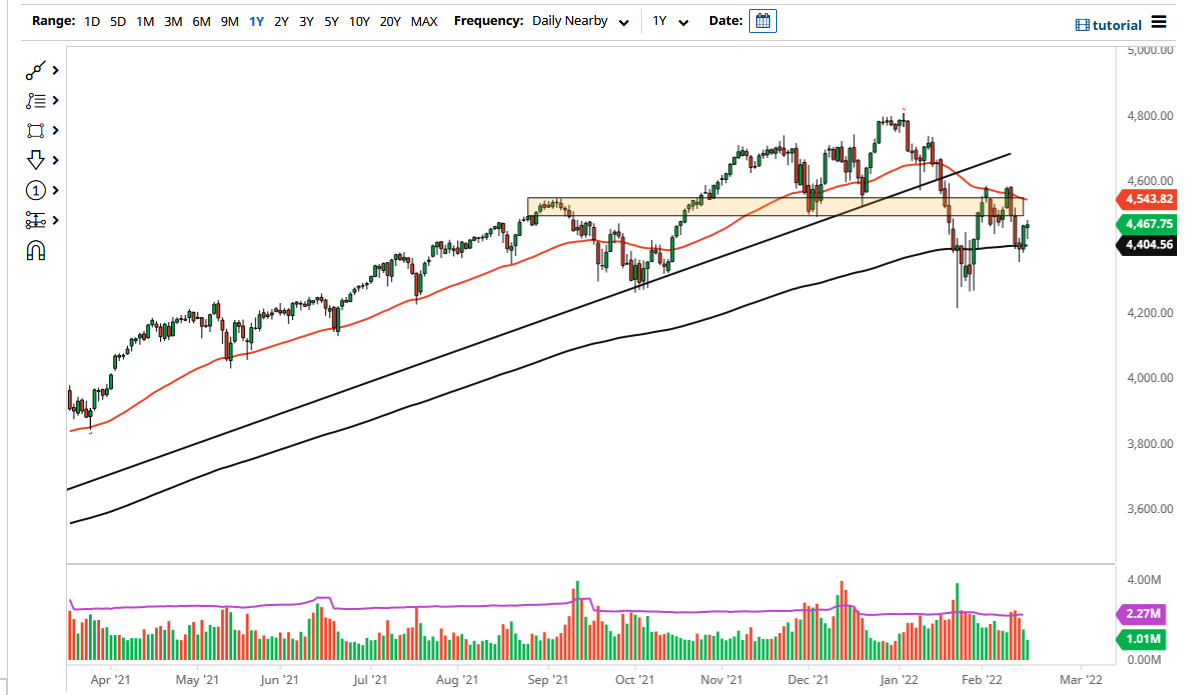

The S&P 500 has gone back and forth on Wednesday as we hover around the 4450 handle. That being said, the market looks as if it is running out of momentum, which is not a huge surprise considering just how many things it has working against it. At the very least, we have the 50 day EMA above falling and offering resistance, but at this point it is likely that the 200 day EMA is near the 4400 level and could offer a little bit of support. That being said, the market is likely to see a lot of choppy behavior as we are squeezing between the 50 day EMA and the 200 day EMA.

Take a look at the Monday candlestick, it is a hammer, and that is something that you need to pay close attention to. If we break down below the hammer, then it is likely that the market could go much lower, perhaps reaching towards the 4250 handle. If we break down below there, then it could open up the trapdoor to much lower pricing.

Keep in mind that inflation is something that a lot of traders are concerned about, right along with the tightening of monetary policy by the Federal Reserve. That being said, the market is likely to continue to see a lot of volatility, and I think we are nowhere near the end of volatility. With that being the case, you need to be very cautious because one bad move could do serious damage to your account. Keep your position size very small regardless of what you decide to do, but I think at this point we have more sideways action ahead of us more than anything else. If we can get a move above the 4600 level, the market would finally have enough clarity to go higher, but right now I do not think it is going to happen anytime in the next couple of weeks. Keep in mind that everything points to tighter monetary policy. Furthermore, there are reports coming out that perhaps the Russians are still sending troops towards the Ukrainian border, and that tensions have not loosened as much as people had hoped during the previous 24 hours or so.