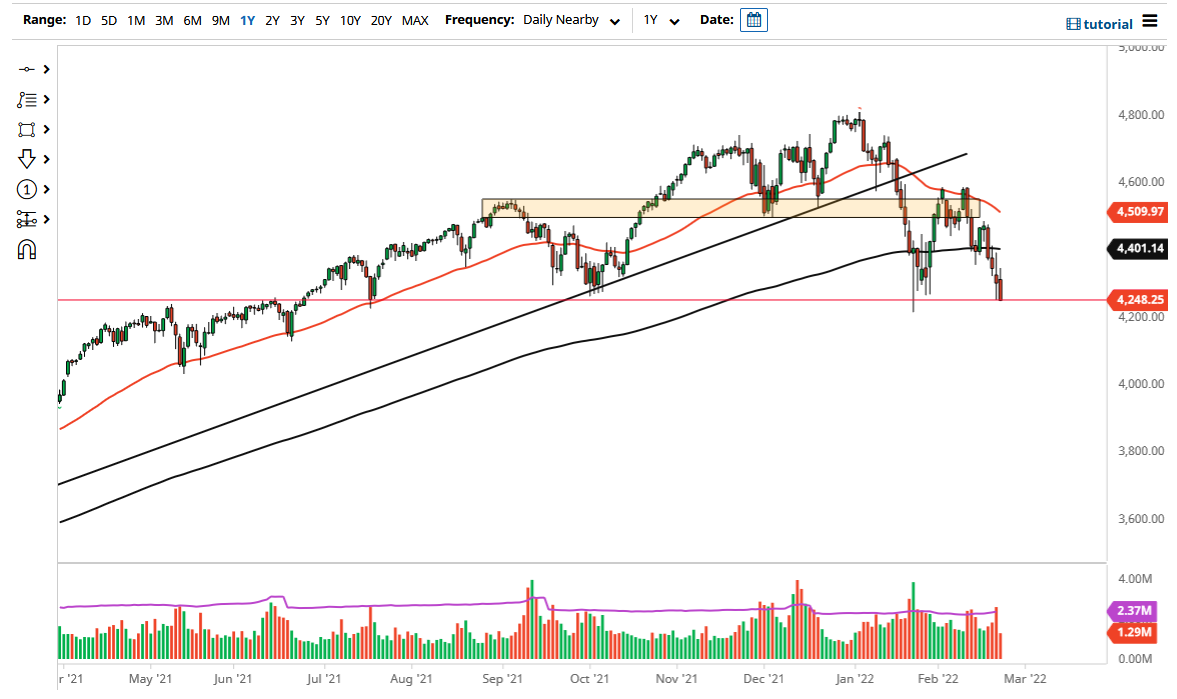

The S&P 500 initially tried to rally on Wednesday but gave back the gains rather quickly. By doing so, the market is suggesting that we have further to go to the downside and it is probably only a matter of time before we see this market break down drastically. The 4200 level probably will cause a little bit of a speedbump on the way lower, as it is only a large, round, psychologically significant figure and not necessarily proven support. If we break down below the 4200 level, then we could be looking at a move towards the 4000 level.

Rallies at this point will have to be looked at with suspicion, because there is no real reason to think that stocks will continue to gain. Tightening monetary policy is something that you need to be very cognizant of, as it takes a lot of the risk off the table as far as appetite is concerned. If that is going to be the case, then I think with any rally that you get, you should look for signs of exhaustion that you can short. It is worth noting that we ended up forming a bit of a massive neutral candlestick during the day on Tuesday and are now currently breaking down below the bottom of it.

At this point, I find it very difficult to think that any rally will be anything more than a bit of a “dead cat bounce”, as we have seen plenty of reasons to think that stocks need to go lower. It is not only a matter of tightening monetary policy, but it is also concerns about inflation. Beyond that, growth is slowing down and comps from a year ago are going to be difficult to match, let alone beat. With that, a lot of the companies in the S&P 500 are going to be falling, so that also puts downward pressure on the market. There is just no real reason to get involved in this market to the upside, but I might be tempted to buy puts if we break down through the massive hammer from January 24. Ultimately, this is a market in which I am either fading rallies, or buying puts through that breakdown.