In the last two trading sessions of last week, the price of the USD/JPY currency pair moved higher with gains to the level of 115.43 before closing trading stable around the level of 115.18. In a sudden wave of hiring, the US economy added a total of 467,000 strong jobs last month, a sign of the economy's resilience in the face of a wave of Omicron infections.

The government's report on Friday also radically revised its estimates of job gains for the months of November and December, with a total of 709,000 jobs. He also said the country's unemployment rate rose from 3.9% to 4%, mainly because more people started looking for work and not all of them found jobs immediately. Strong employment growth for January, which defies expectations for only modest gains, has shown many employers are keen on hiring even as the pandemic hits. Companies seem to have considered the Omicron wave to have, at most, a temporary effect on the economy and remain confident in their long-term prospects.

US employment gains in January and sharp upward revisions to previous months mean that the US has 1.1 million more jobs than government data indicated just a month ago. Strong hiring, along with steady wage gains, is boosting consumer spending, which has hit faltering supply chains to accelerate inflation to its highest level in four decades. These trends will give the Fed more room to raise US interest rates, possibly faster than planned, to cool inflation. The Fed has indicated that it will start raising interest rates in March and could do so again at its next meeting in May. Raising interest rates faster could reduce borrowing and spending and potentially weaken the economy.

Recently, US stocks fell on expectations that the Federal Reserve will tighten credit more quickly before stock prices rebound. The yield on 10-year US Treasury bonds jumped nearly a tenth of a percentage point, to 1.91%, a sign that investors expect borrowing costs to rise.

Overall, higher interest rates in the future will eventually affect the outlook for economic growth, something that stocks are discounting now. However, higher rates provide greater returns on US debt instruments that attract international capital inflows and boost the value of the dollar. Some analysts point out that the US dollar tends to rise in the Fed rate-raising cycle, but from this point on the performance could wane. In February it could see more losses for the pound.

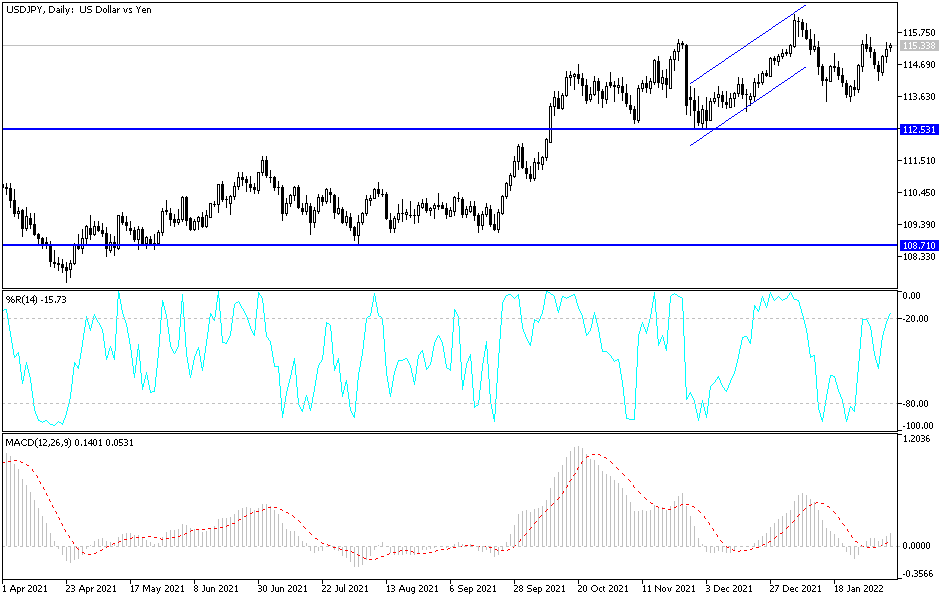

According to the technical analysis of the pair: the recent performance still confirms the extent of the opportunity for the bulls to control the direction of the price of the US dollar against the Japanese yen USD/JPY currency pair. Nevertheless, I still prefer to sell the pair from every bullish level. On the other hand, on the daily chart, the move towards the support level 113.45 will be an end to the pair's bullish expectations and the start of a new, opposite phase. The US dollar pairs are on an important date this week as the US inflation figures will be announced.