All US dollar pairs will carefully monitor the reaction of markets and investors to what will be contained in the minutes of the last meeting of the US Federal Reserve. Expectations so far still indicate the number of US interest rate hikes this year. Yesterday, the price of the USD/JPY currency pair recovered to the resistance level of 115.88, before settling around the level of 115.70 at the time of writing the analysis. Record US inflation figures still support the Federal Reserve's intentions to raise US interest rates.

Prices paid to US producers in January jumped more than expected, in a sign of persistent inflationary pressures as companies struggle with supply chain and employment constraints. Yesterday, Labor Department data showed that the producer price index for final demand in the United States increased by 9.7 percent from January of last year and 1 percent from the previous month. December's gain was the largest in eight months. The median forecast in a Bloomberg survey of economists called for an increase of 9.1 percent year on year and 0.5 percent advance monthly.

The numbers, which reflected broad increases across categories, may strengthen the Federal Reserve's position to be bolder in raising US interest rates and reducing its bond holdings in the coming months. Transportation bottlenecks, strong demand, and labor restrictions through 2021 have carried over into this year and risk keeping price pressures well high. Commenting on this, Maher Rashid and Kathy Bostancik, economists at Oxford Economics, said in a note: "The combination of violent supply disruptions and rising energy prices will prevent producer prices from returning to more normal patterns until later this year."

On the other hand, the S&P 500 Index rose on optimism that tensions between Russia and Ukraine may ease, while Treasury yields rose. The latest monthly progress indicates that inflationary pressures in the production pipeline remain severe, which will continue to filter into the final costs of consumer goods and services.

Data last week showed that consumer prices rose more than expected in January, sending the annual inflation rate to a four-decade high.

The PPI report is expected to give more credence to calls for bolder action by more hawkish policy makers such as St. Louis Fed President James Bullard. But centrists among the Fed's top officials seem skeptical of the half-point hike and have suggested there's little need to start the hiking cycle with half a percentage point.

A separate report on Tuesday showed that prices received by New York state manufacturers jumped to the highest level in data since 2001. Energy cost rebounded in January after falling the previous month, rising 2.5 percent. So far this month, crude oil and other energy prices have continued to rise amid the risks that a Russian attack on Ukraine could trigger severe sanctions by Western governments.

Excluding food and volatile energy components, core PPI rose 0.8 percent from the previous month and rose 8.3 percent from a year ago. Commodity prices accelerated in January from the previous month, rising 1.3 percent, the biggest rise in three months. Similar to the CPI, prices for goods are still running as hot as services.

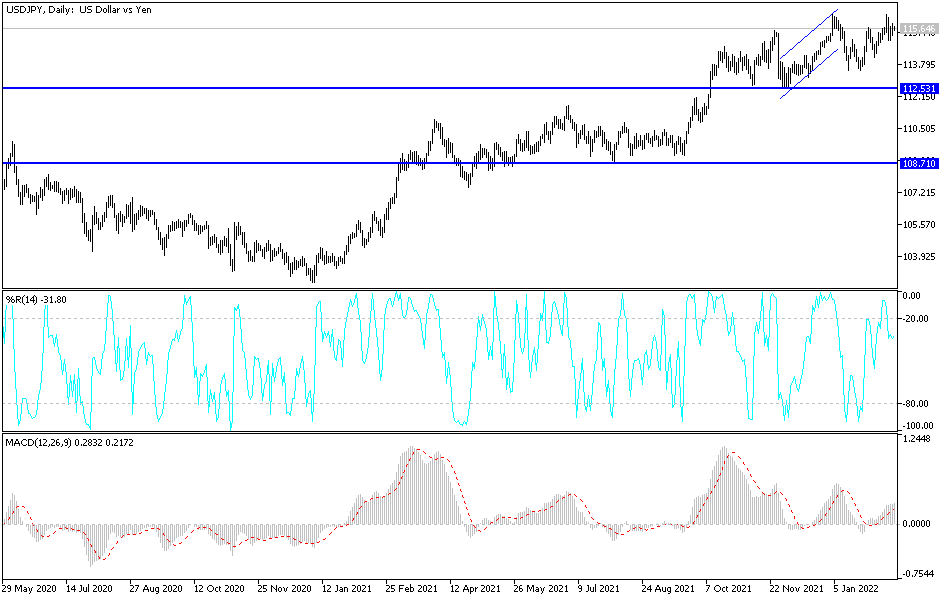

According to the technical analysis of the pair: USD/JPY is still trending higher in its ascending channel on the 4 hour chart, and it appears that a test of support is underway. The Fibonacci retracement tool shows where more buyers might be looking. The price is testing support at the 50% level which aligns with the important middle channel area. A bigger correction might reach 61.8% Fibonacci near the key psychological level of 115.00 and the dynamic support at the moving averages or the bottom of the channel near 114.50.

So far the 100 SMA is still above the 200 SMA to confirm the chance for an upside move. If any of the Fibonacci hold as support, USD/JPY may resume climbing to the swing high of 116.33 or channel top near 116.80.