Amid increasing appetite for safe havens, as well as the temporary abandonment of the US dollar, and the recent FOMC minutes, the USD/JPY was sold off. As a result, it retreated towards the level of 114.78 before closing the week's trading, stable around the level of 115.03. Markets have been turbulent all week as investors monitor recent developments in Ukraine, where Russia is massing troops on the border.

Tensions are another concern for investors as they try to determine how the economy will respond to rising inflation and looming interest rate hikes. Then there is the uncertainty about what could happen in Ukraine this weekend, as US markets are scheduled to be closed Monday in observance of President's Day.

Tensions over Russia and Ukraine have been escalating throughout the past week, throwing a curveball to markets that have been more focused on inflation, monetary policy of global central banks and economic growth. For its part, the United States has issued some of its clearest and most detailed warnings yet about how a Russian invasion of Ukraine might take place, and its Western allies have gone on high alert for any attempts by the Kremlin to create a false pretext for a new war in Europe. Russia is a major energy producer, and a military conflict can disrupt energy supplies and make energy prices highly volatile.

Inflation remains a major concern on Wall Street as companies continue to grapple with supply chain problems and rising costs, leading to warnings that operations will suffer through some or all of 2022. Shares of General Electric plunged 5.9% after it warned that pressures caused by inflation and supply chain problems it has damaged many of its businesses including healthcare, renewable energy and aviation. It expects the problems to continue through at least the first half of the year.

Nevertheless, the US housing market remains strong. US previously owned home sales unexpectedly rose to a one-year high as buyers rushed in ahead of higher mortgage rates, draining tight inventories to a record low. Figures from the National Association of Realtors on Friday showed closings rose 6.7% in January from the previous month to 6.5 million annually. The four regions saw gains on a monthly basis. The median forecast in a Bloomberg survey of economists called for an annual rate of 6.1 million in January.

With US demand for homes still outstripping supply, the current pace of sales is largely dependent on real estate availability. The increase in sales in January came almost entirely from homes over $500,000, and the recent rise in mortgage rates may dampen demand going forward.

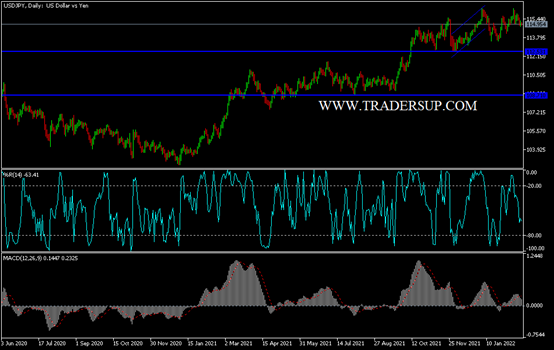

According to the technical analysis of the pair: the bulls are trying to hold on to the upward trend of the USD/JPY currency pair, and as I mentioned before, the 115.00 level will be a good opportunity for the bulls. Confidence in the bullish trend may be shaken if the currency pair declines towards the support levels 114.40 and 113.30, respectively, which are highlighted on the daily chart below. I still prefer selling the currency pair from every bullish level.