In the same course as last week, the price of the USD/JPY currency pair moved downwards, with losses to the 114.50 support level in the morning trading today, before settling around the 114.75 level at the time of writing the analysis. Investors have increased their appetite for buying safe havens, with the Japanese yen being one of the most important ones, in light of the growing concern and indications that Russia is only serious about military action in Ukraine, despite recent international calm attempts.

On the other hand, strongly affecting the sentiment of the markets and investors, the future of the tightening policy of the US Federal Reserve. In this regard, Federal Reserve Governor Michael Bowman said Monday that she is open to raising US interest rates by more than a quarter point of the traditional rate at the next central bank meeting in March.

Bowman's comments came after several officials on Friday rejected the idea of a half-point increase in the Federal Reserve's benchmark short-term interest rate. The Federal Reserve is looking to raise interest rates as inflation climbed to 7.5% in January from a year earlier, the largest increase in four decades.

Financial markets are watching the debate over the speed of US interest rate hikes closely and it could have an impact on the broader economy. Many economists said the Fed has moved too slowly in response to a persistent, unexpected rise in prices, raising the risk that inflation will continue to rise. But if it raises rates too quickly, the Fed risks halting growth and employment.

The US central bank is almost certain to start raising interest rates at its March 15-16 meeting, with most officials who have expressed their views backing a quarter-point increase. However, James Bullard, president of the St. Louis Fed, has expressed support for a half-point hike sometime at the next three Fed meetings.

Any increase next month would be the first since 2018.

Bowman added in prepared remarks to the American Bankers Association conference in Palm Desert, California, that she supported raising interest rates next month, and that "if the economy develops as I expect, additional rate increases will be appropriate in the coming months." She added, "I will monitor the data closely to judge the appropriate size of the increase at the March meeting," noting that it is open to a half-point hike. An increase in the federal interest rate usually raises borrowing costs for consumers and businesses, which slows the growth of the economy. Average mortgage rates have already risen to nearly 4%, the highest level since 2019, as markets have moved in anticipation of an interest rate hike from the Federal Reserve.

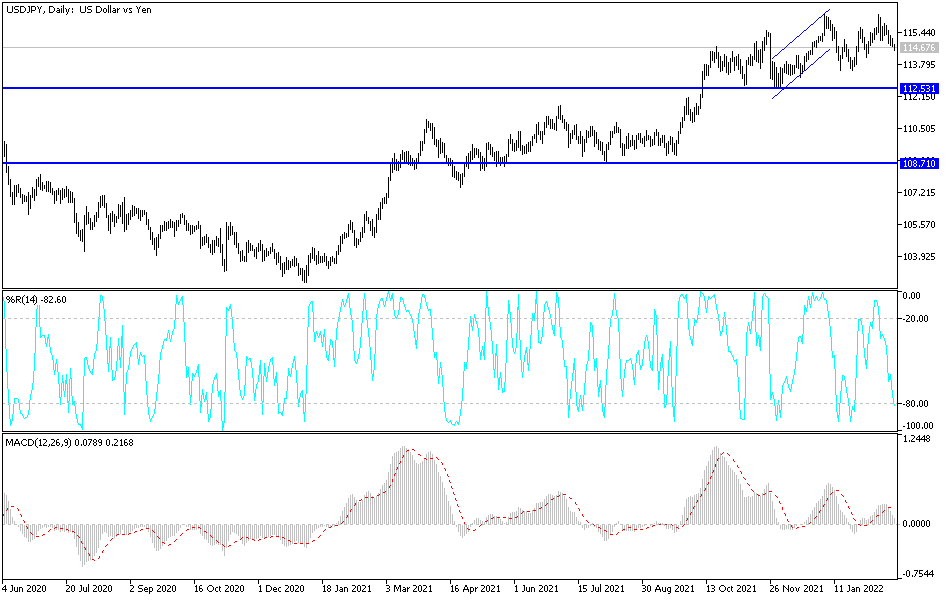

According to the technical analysis of the pair: According to the performance on the daily chart below, the movement will remain below the 115.00 level, which is important to push the bears of the USD/JPY currency pair towards stronger bearish levels. The closest levels for them are currently 114.30, 113.75 and 112.90, respectively. These are important areas for changing the general trend bearish. The bulls are trying to hold on, but if the risk is too high, they may be shot down quickly. On the other hand, the bulls should move to breach the resistance levels 115.45 and 116.30 to confirm the strength of control.

The currency pair will be affected today by the risk appetite of investors, as well as the reaction to the announcement of the US consumer confidence reading.