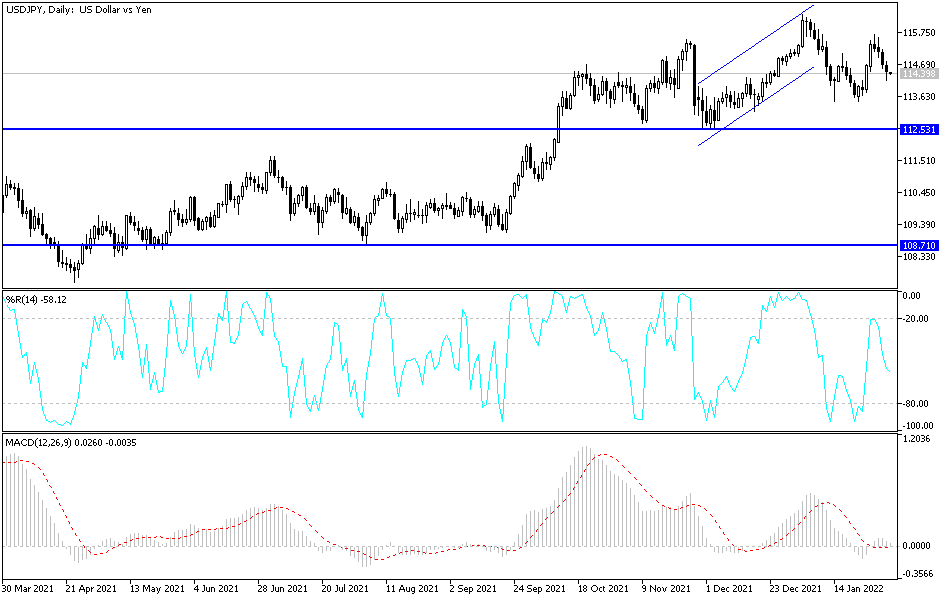

For four consecutive trading sessions, profit-taking continues for the USD/JPY currency pair, which is possible until the US job numbers are announced at the end of the week. This may have a reaction to the expectations of raising US interest rates this year as the Federal Reserve targets the labor market and inflation to determine the paths of its policy. The selling operations this week pushed the dollar yen to the 114.15 support level, especially after the disappointment with the US jobs numbers from the ADP, and it settled around the 114.45 level at the time of writing the analysis.

Despite the last performance, a leading US investment bank is preparing for another broad move higher in the value of the US dollar, with JP Morgan saying the US Federal Reserve is providing the basis for the move with the promise of several rate hikes over the next two years. He told the Federal Reserve in January that the US economy had reached full employment and would need to raise interest rates to tackle inflation.

The US dollar rose in the second half of 2021 as the markets expected a US interest rate hike in 2022; This dynamic was reinforced by the Fed's commitment to more rates and sooner.

This calculation is based on historical price relationships and assumes JPMorgan "some empirical version of sympathetic interest rates in the rest of the world with re-pricing of US yields".

The US dollar index DXY - a broad measure of the value of the US dollar - fell at the beginning of 2021 amid a strong start to the year for stocks and the liquidation of "long" dollar positions. The Fed's subsequent hawkish calls along with plunging global stock markets pushed the US currency to its highest level since July 2020. The US dollar may benefit more if market concerns surrounding geopolitics escalate, while watching the situation deteriorate between the US, Russia, and Ukraine.

Economists at JPMorgan warn of the downsides to global growth from geopolitical oversupply in energy prices linked to Russia and Ukraine. Illustrative calculations by JP Morgan show that a sudden rise in oil prices of up to $150 a barrel could reduce 3% from the current global growth forecast for the first half of 2022. The dollar would be the clear beneficiary as global currencies that are highly sensitive to growth will back off. Therefore, JP Morgan's FX Strategists say they are looking to sell the Euro and Yen against the Dollar, largely in anticipation of higher US interest rates compared to those in the Eurozone and Japan.

According to the technical analysis of the pair: The price of the USD/JPY currency pair may remain under the current pressure until the US job numbers are announced tomorrow. This strongly affects the US dollar and the sentiment of investors and markets towards the future of raising US interest rates. The closest targets for the bears are currently 113.80 and 112.90, and the last level has changed the general trend to the downside. On the other hand, the psychological resistance 115.00 will remain the most important for the bulls to control. The currency pair will be affected today by the risk appetite of investors and the reaction from the US jobless claims announcement, non-farm productivity and ISM services PMI reading.