Investors are back in strong demand for safe havens, amid increasing global geopolitical tensions, led by expectations of a Russian-European war. Accordingly, the USD/JPY currency pair returned to the vicinity of the support 115.00 at the beginning of this week's trading. Besides the situation in Europe, expectations of a US interest rate hike still support the strength of the US dollar in the forex market. More recently, the worsening inflation picture has generated a range of opinions from Federal Reserve policy makers about how quickly they should raise US interest rates starting at their next meeting in March.

On Monday, James Bullard, President of the Federal Reserve Bank of St. Louis, reiterated his call for the Federal Reserve to take the bold step of raising the US short-term interest rate by a full percentage point by July 1. The Kansas City Fed expressed support for a more "gradual" approach. Mary Daley of the San Francisco Fed declined to commit to more than a modest rate hike next month.

Their comments follow a report last week that US inflation jumped 7.5% in January from a year ago, the fastest increase in four decades. Prices also rose 0.6% from December to January, the same month as the previous month, indicating that price gains are still not slowing, as many economists and federal officials had hoped. The Fed usually responds to higher inflation by making borrowing more expensive, which slows spending and increases prices.

Last week's report on consumer price inflation in the US sparked a sharp increase in expectations for a rate hike by the Federal Reserve this year. Some economists now expect up to six or seven quarter-point increases. This is well above the Fed's December forecast of just three interest rate hikes for 2022.

In their notes, Pollard and another policymaker, Thomas Barkin, president of the Federal Reserve Board of Richmond, noted how the price acceleration has expanded beyond automobiles and other industries affected by the pandemic. Even inflation measures that exclude such categories have shown sharp price hikes.

However, the two officials expressed different views on how the US Federal Reserve should respond.

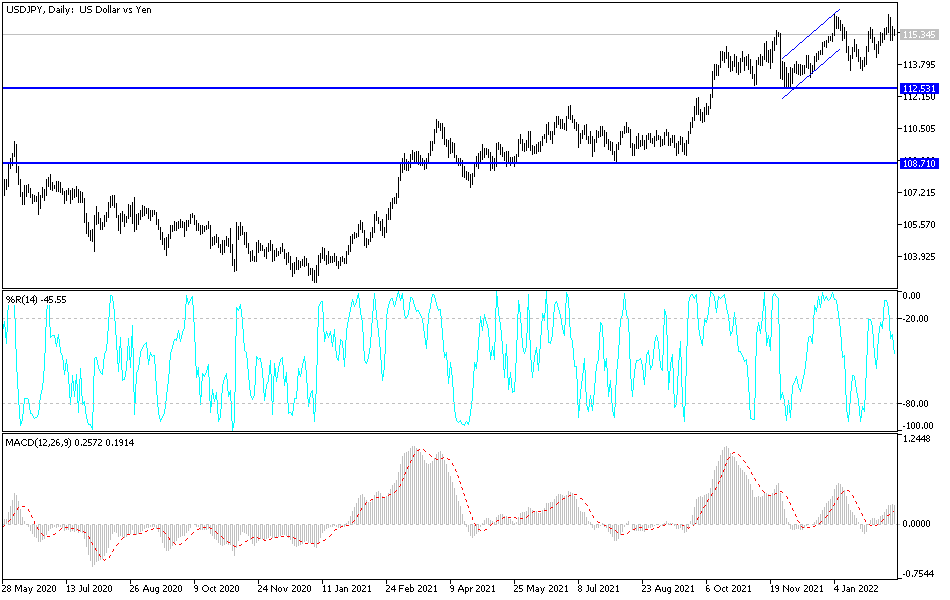

According to the technical analysis of the pair: Despite the performance at the beginning of this week’s trading, the price of the USD/JPY currency pair can rise in the upward direction. This depends if it is stable around and above the psychological resistance 115.00 and on the daily chart below the trend remains bullish, supported by the expectations of raising interest. This may include selling operations if investors are more willing to buy safe havens, especially if Russia takes military action in Ukraine. You must be careful; the situation is not reassuring so far. The closest targets for the bulls are currently 115.85 and 116.65, respectively.

On the other hand, the bears' control of the currency pair will increase if it moves towards the support levels 114.80 and 113.90 over the same period. I still prefer selling the currency pair from every bullish level. The currency pair will be affected in the current period by the extent to which investors take risks or not, more than focusing on economic performance.