Despite the importance of announcing the results of US economic data today, the markets are reacting strongly to the developments in Europe. It is clear that Russia is determined to invade Ukraine, but it will be in stages, and the recent optimism was temporary. In light of the risk aversion, the price of the USD/JPY currency pair fell to the 114.50 support level at the time of writing the analysis.

Amid the continuing anxiety, Asian stock markets fell and oil prices rose after President Vladimir Putin announced Russian military action in Ukraine. Market indices in Tokyo and Seoul fell 2% and Hong Kong and Sydney indices lost more than 3% on Thursday. Oil prices jumped nearly $3 a barrel amid concerns about a possible disruption to Russian supplies. Earlier, Wall Street's benchmark S&P 500 fell 1.8% to an eight-month low after the Kremlin said rebels in eastern Ukraine had requested military assistance.

On the other hand, investors were already uneasy about the potential impact of the Federal Reserve's plans to try to cool inflation by withdrawing ultra-low US interest rates and other stimulus that boosted stock prices.

And in a development, I scared investors. Ukraine's ambassador to the United Nations told the Security Council that Russian President Vladimir Putin had "declared war on Ukraine". He also pressured his Russian counterpart to announce that Russia would not bomb or bomb Ukrainian cities. Ukrainian Ambassador Sergei Kiselitsya said Wednesday night that if Russian Ambassador Vassily Nebenzia was not in a position to give a positive answer, he should give up the presidency of the Security Council, which Russia takes over this month.

Then the Ukrainian requested another emergency meeting of the Security Council, calling on the United Nations to "stop the war because it is too late to talk about de-escalation." Kyslytsya then asked if he should play a video of Putin announcing the start of military operations in Ukraine.

Nebenzia replied: “This is not called war. This is called a special military operation in the Donbass.”

For his part, Russian President Vladimir Putin announced a military operation in eastern Ukraine, claiming it was aimed at protecting civilians. In a televised address early Thursday, Putin said the action was in response to threats from Ukraine. He adds that Russia has no goal of occupying Ukraine. Putin says the responsibility for the bloodshed lies with the Ukrainian "regime". Putin also warns other countries that any attempt to interfere with the Russian measure will lead to "consequences they have not seen before."

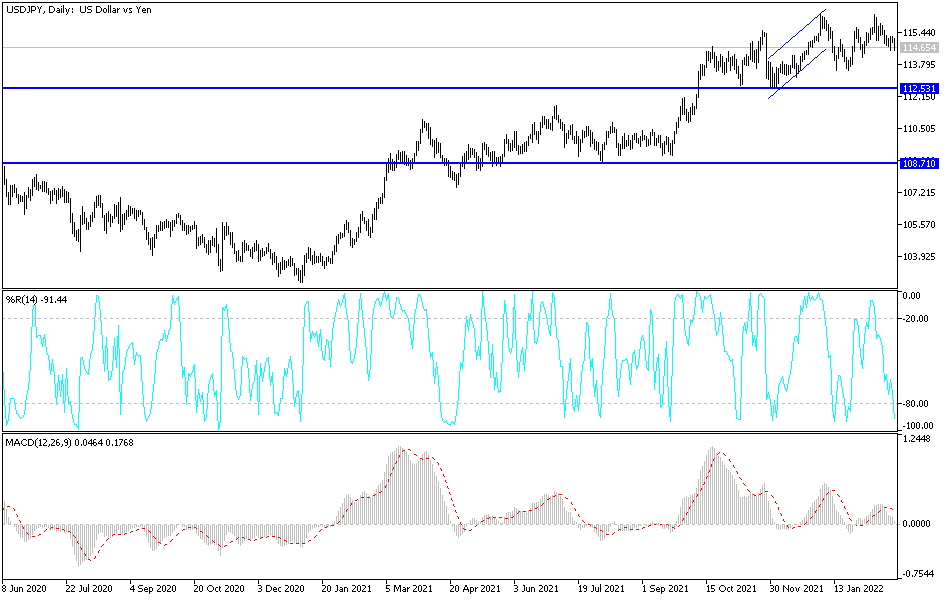

According to the technical analysis of the pair: On the daily chart, if the price of the USD/JPY currency pair moves to the 114.15 support level, the bears may start a strong bearish journey with which the upward hopes of the USD/JPY that have dominated it for a long time will collapse. The support level 113.45 brings the pair back to the vicinity of the descending channel from the middle of last January. I still prefer to sell the currency pair from every bullish level. The closest resistance levels for the pair are currently 115.20 and 116.00, respectively.

The USD/JPY currency pair will be affected by the risk appetite of investors, as well as the reaction to the release of US economic data results, GDP growth rate, jobless claims and US new home sales.