Today's recommendation on the lira against the dollar

- Risk 0.50%.

- None of the buy or sell orders were activated on Thursday's recommendations

Best entry points buy

- Entering a long position with a pending order from 13.29 levels.

- Place your stop-loss point below the 13.10 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best selling entry points

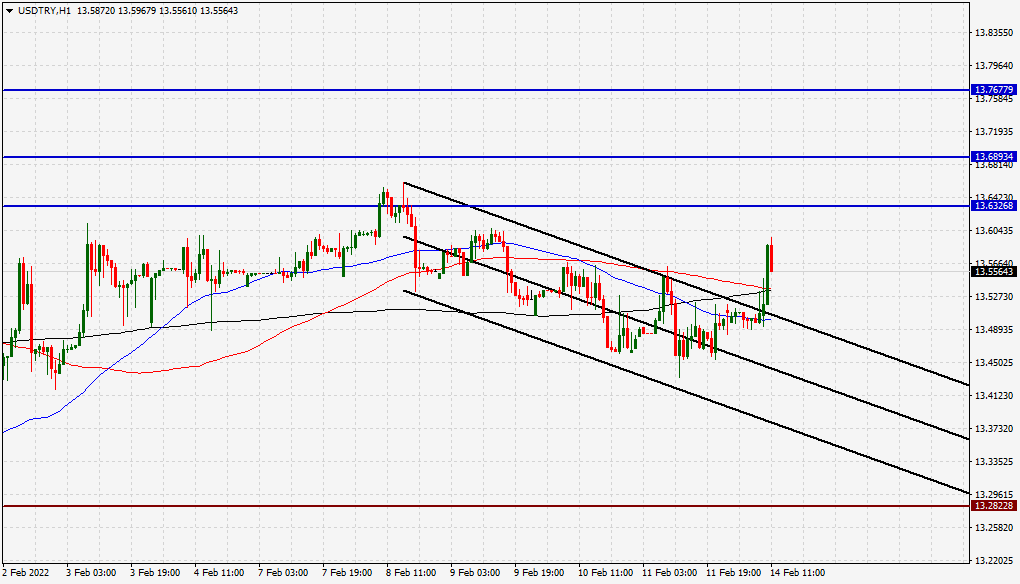

Entering a short position with a pending order from 13.63 levels.

The best points to place the stop loss are above 13.75 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.30

The Turkish lira fell during the early trading of Monday, with the opening of the markets, after the Turkish Finance Minister Nureddin Al-Nabati announced a new mechanism to benefit from the gold savings of Turkish citizens. Nabati said last Saturday, that the new mechanism will allow citizens by taking advantage of their savings securely by introducing them into the state’s economic system through a center for goldsmiths and some specific banks. The mechanism aims to introduce an estimated 350 billion dollars of gold into the state’s economy to revive the faltering lira price. Citizens will also be able to recover their gold at any time. At the same time, the Turkish president warned that the monopolists who took advantage of the government's tax cuts and increased the prices of basic commodities would be punished.

On the technical level, the price of the Turkish lira declined against the dollar during today's trading, as the lira is still stable above the moving averages 50, 100 and 200, respectively, on the time frame of the day, the four-hour time frame, as well as the 60-minute time frame. The lira is also trading below the resistance levels that are concentrated at 13.68 1371 and 13.84. On the other hand, the lira is trading the highest support levels at 13.28 and 13.06, respectively. The lira exited outside the upper boundary of the descending channel on the 60-minute time frame. We expect the lira to decline as it targets the resistance levels on the other side. Please adhere to the numbers in the recommendation with the need to maintain capital management.