Today's USD/TRY Signal

Risk 0.50%.

None of the buy or sell orders were activated for yesterday's recommendations.

Please be careful during today's trading due to US inflation data.

Best buy entry points

- Entering a long position with a pending order from 13.29 levels.

- Place your stop-loss point below the 13.10 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best selling entry points

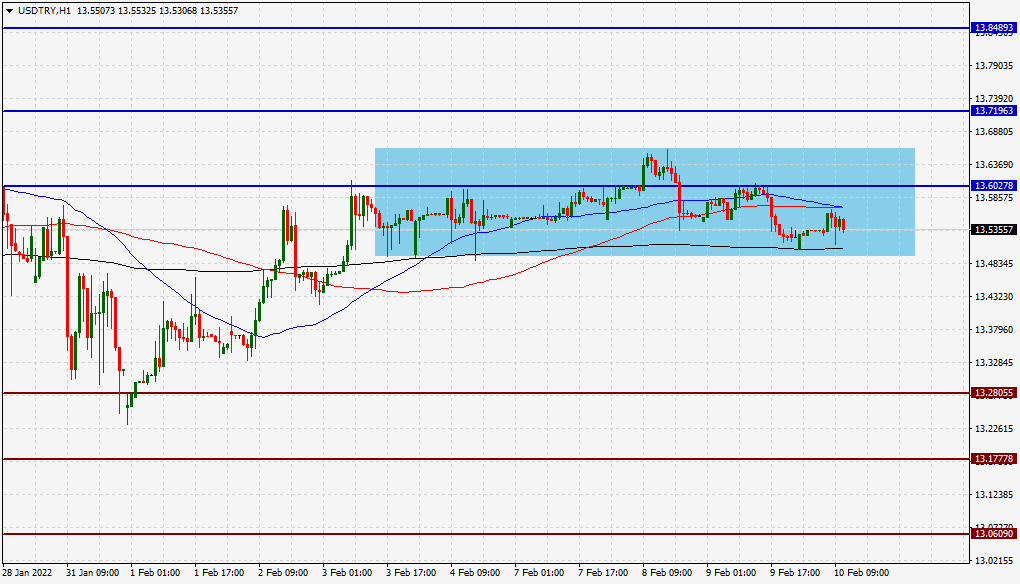

- Entering a short position with a pending order from 13.71 levels.

- The best points to place the stop loss are above 13.89 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.30

The price of the USD/TRY fluctuated during the early trading of Thursday, as investors awaited the US inflation report, which is expected to push the dollar up or down in a strong movement that will have an impact against other currencies. In the meantime, morning data was released about the volume of unemployment in Turkey, which saw a slight decline, negligible by 0.1 percent. The Turkish Statistical Office announced that the unemployment rate remained stable during the month of December, compared to November of last year. The statement also announced that the number of worlds older than 15 years has increased by about two thousand people

On the technical level, the price of the Turkish lira varied against the dollar during today's trading, as it stabilized during this week's trading with almost no changes. The lira is still trading within a limited price range. The lira is still stable above the 50, 100 and 200 moving averages, respectively, on the daily time frame, the four-hour time frame, and the 60-minute time frame. The lira is also trading below the resistance levels that are concentrated at 1371 and 13.84, respectively. On the other hand, the lira is trading the highest support levels at 13.28 and 13.06, respectively. We expect the lira to decline, especially after it approached the mentioned resistance levels, as it targets the support levels on the other side. Please adhere to the numbers in the recommendation with the need to maintain capital management.