Today's recommendation on the lira against the dollar

- Risk 0.50%.

- Yesterday's recommendation sell trade was activated and the deal is currently being traded

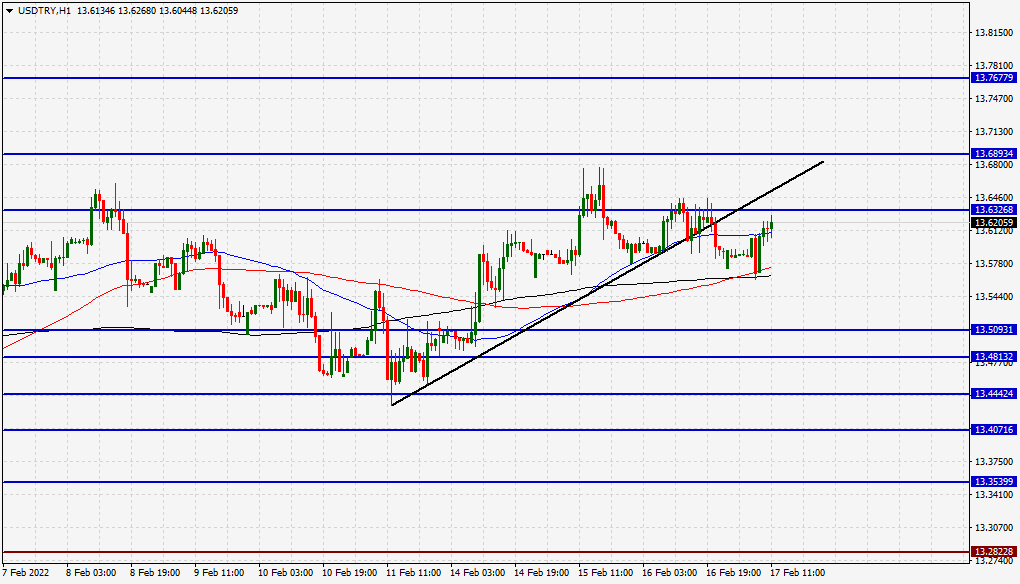

Best buy entry points

- Entering a long position with a pending order from 13.49 levels.

- Place your stop-loss point below the 13.30 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best selling entry points

- Entering a short position with a pending order from 13.69 levels.

- The best points to place the stop loss are above 13.70 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.30

The lira has stabilized during today's early trading, without major changes, as investors await the Turkish interest rate decision, which is expected to be released today. Analysts' expectations tend to fix the interest rate for the second time in a row. This is after a series of interest rate cuts carried out by the Turkish Central Bank for three consecutive months, starting in September 2021, when the Turkish Central Bank reduced the interest rate by about 5 percent to reach 14 percent. This damaged the value of the lira significantly during the last month of last year, especially with the high rate of inflation in the country. The interest rate cut was under pressure from Turkish President Recep Tayyip Erdogan, who wants to follow a new monetary policy that encourages investment and attracts capital with the aim of investing and not taking advantage of the high interest rate.

On the technical front, the price of the Turkish lira fell slightly against the dollar during today's trading, the lira is still stable above the levels of the ascending trend line on the 60-minute time frame. The Turkish lira against the dollar is also trading above the 50, 100 and 200 moving averages, respectively, on the daily time frame, the four-hour time frame, as well as the 60-minute time frame. The lira is trading above the support levels at 13.50, 13.44 and 13.35. The lira is trading below the resistance levels that are concentrated at 13.69, 13.77 and 13.84, respectively. We expect the lira to decline, targeting 13.70 levels, before resuming its rise against the dollar. Please adhere to the numbers in the recommendation with the need to maintain capital management.