Today's USD/TRY Signal

Risk 0.50%.

None of the buying or selling transactions for Thursday were activated

Best buy entry points

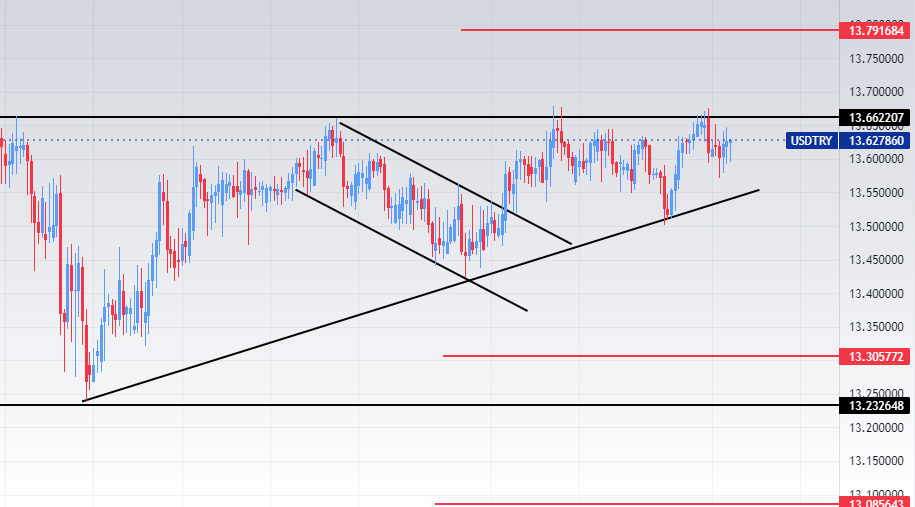

- Entering a long position with a pending order from 13.32 levels.

- Place your stop-loss point below the 13.18 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best selling entry points

- Entering a short order with a direct order from 13.66 levels.

- The best points to place the stop loss are above 13.79 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.30

The lira stabilized during today's early trading, without major changes, as investors followed the Turkish interest decision, which was announced by the Turkish Central Bank on Thursday. The bank fixed the interest rate for the second month in a row after it was carried out by the Turkish Central Bank for three consecutive months, starting in September 2021, the Turkish Central Bank reduced the interest rate by about 5 percent to reach 14 percent. In general, the average price of the USD/TRY settled at 13.50 levels.

On the technical front, the price of the USD/TRY settled on slight changes during today's trading. The lira is still stable above the levels of the ascending trend line on the 60-minute time frame. The pair is also trading above the 50, 100 and 200 moving averages, respectively, on the daily time frame, the four-hour time frame, as well as the 60-minute time frame. The lira is trading the highest support levels at 13.57, 13.23 and 13.08, respectively. On the other hand, the lira is trading below the resistance levels that are concentrated at 13.66, 13.79 and 13.84, respectively. We expect the lira to decline, targeting 13.50 levels, before resuming its rise against the dollar. Please adhere to the numbers in the recommendation with the need to maintain capital management.