Today's USD/TRY Signal

Risk 0.50%.

None of the buy or sell orders were activated for yesterday's recommendations

Best Buy Entry Points

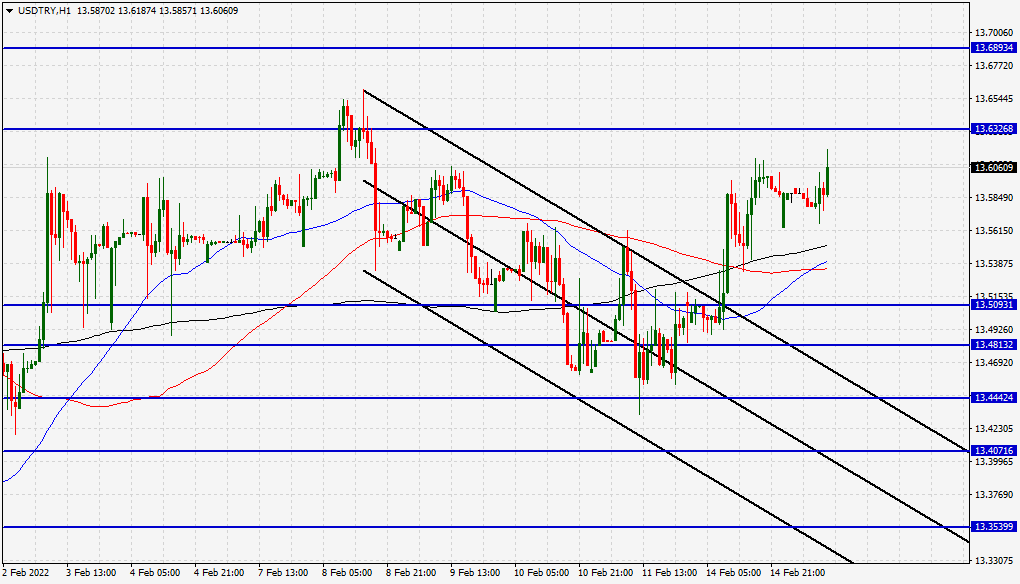

- Entering a long position with a pending order from 13.49 levels.

- Place your stop-loss point below the 13.30 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best Selling Entry Points

- Entering a short position with a pending order from 13.63 levels.

- The best points to place the stop loss are above 13.75 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.30.

The lira's trading is stable during today's early trading, as investors had followed the Turkish Finance Minister's announcement of new policies aimed at integrating the gold savings of Turkish citizens into the state's financial system. The Turkish government's estimates of the volume of gold savings in the country amounted to about 350 billion dollars. At the same time, investors followed Turkish President Recep Tayyip Erdogan's visit to Turkey, which resulted in the signing of a number of economic agreements worth several billion dollars, as Turkey aims to attract more Gulf investments to support the declining economy and help raise the price of the falling lira.

On the technical level, the price of the Turkish lira fell against the dollar during today's trading, in general, the lira is still trading within the narrow limits, which it has not left for three weeks. The lira is still stable above the 50, 100 and 200 moving averages, respectively, on the daily time frame, the four-hour time frame, and the 60-minute time frame. The lira is also trading below the resistance levels that are concentrated at 13.64, 13.77 and 13.84. On the other hand, the lira is trading the highest support levels at 13.50, 13.44 and 13.35, respectively. The lira exited outside the upper boundary of the descending channel on the 60-minute time frame. We expect the lira to decline, targeting 13.70 levels, before resuming its rise against the dollar. Please adhere to the numbers in the recommendation with the need to maintain capital management.