Today's USD/TRY Signal

- Risk 0.50%.

- None of the buying and selling transactions for Thursday were activated

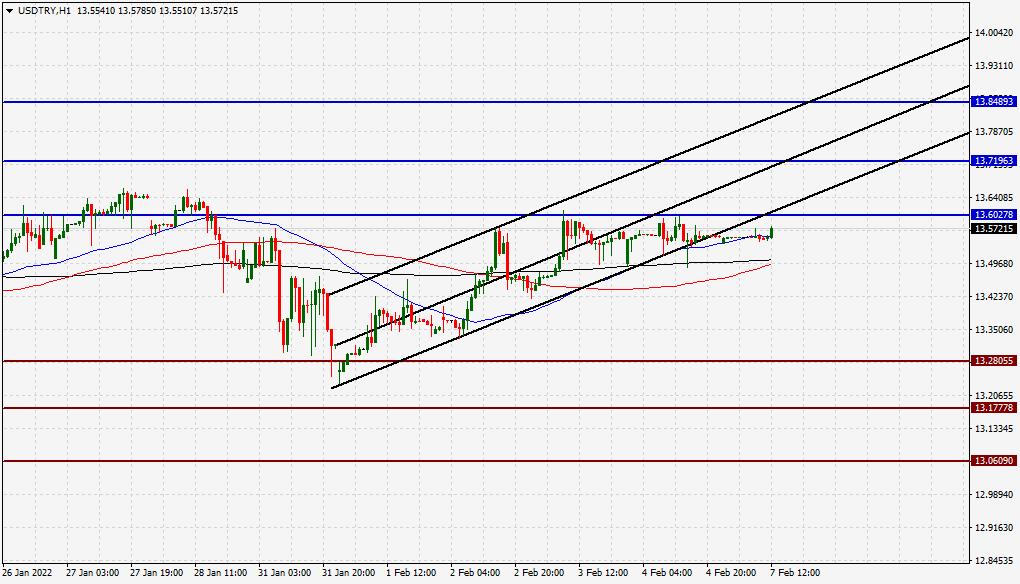

Best Buy Entry Points

- Entering a long position with a pending order from 13.29 levels.

- Place your stop-loss point below the 13.10 support levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the strong resistance levels at 13.79.

Best Selling Entry Points

- Entering a short position with a pending order from 13.71 levels.

- The best points to place the stop loss are above 13.89 levels.

- Move the stop loss to the entry area and continue to profit as the price moves by 50 pips.

- Close half of the contracts with a profit equal to 75 pips and leave the rest of the contracts until the support levels 13.30

The Turkish lira was flat against the US dollar, which rose against most of the major emerging market currencies. The lira witnessed a demand from local depositors and owners of savings, as an official announced the rise in what is known as (lira protected accounts). This is the system announced by Turkish President Recep Tayyip Erdogan during the middle of last December as one of the means to support the declining Turkish lira at the time. According to official statements, the protected lira accounts rose to about 290 billion liras until the end of last week, compared to 209 billion liras during the preceding week.

On the technical front, the price of the Turkish lira varied against the dollar during today's early trading, almost unmoving. The lira maintained a limited trading range. The lira is still trading below the resistance levels that are concentrated at 13.60, 1371 and 13.84. On the other hand, the highest support levels are trading at 13.28 and 13.06. The lira is trading outside the lower boundary of the ascending channel on the 60-minute time frame. The pair also rose to trade around the 50, 100 and 200 moving averages, on the four-hour time frame, as well as the 60-minute time frame. We expect the price of the lira to rise, especially if it reaches the mentioned resistance levels, as it targets the mentioned support levels. Please adhere to the numbers in the recommendation with the need to maintain capital management.