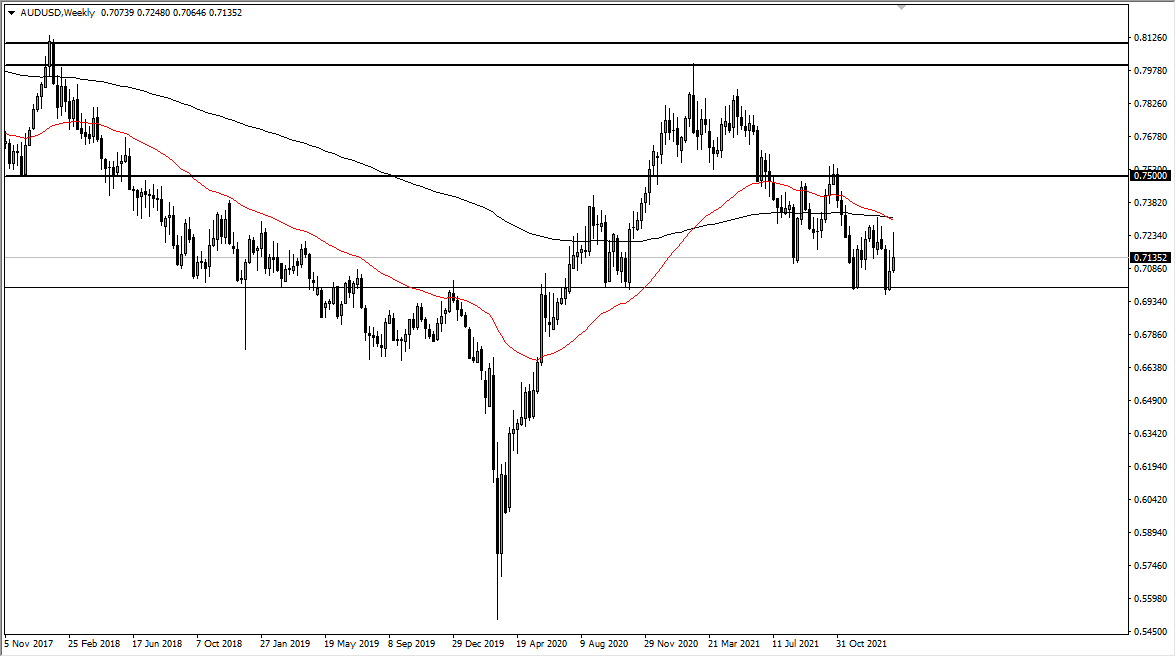

AUD/USD

The Australian dollar initially trying to rally last week, but later on we started to see a lot of selling pressure as there are concerns about whether or not the Federal Reserve is going to tighten too quickly, or if there are going to be major geopolitical issues due to the fact that Russia could invade Ukraine. Either way, it is a major “risk off” type of market right now, so it does make sense that the Aussie would be a victim.

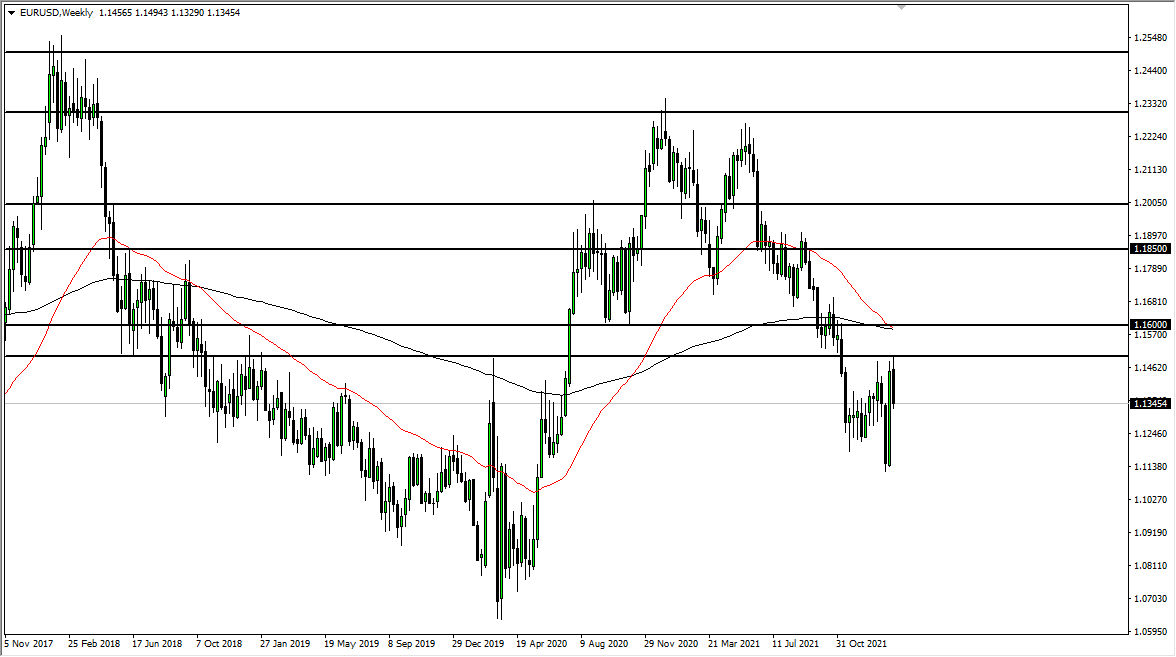

EUR/USD

The euro broke down significantly last week but still remains above the halfway point of the previous candlestick. This is a somewhat small bright spot in the bigger picture, but at this point it is very likely that we will see a lot of concerns. Ultimately, the 1.15 level above is going to continue to be an issue, which extends to the 1.16 level. Furthermore, we have a bit of a death cross getting ready to form, so it is a very negative sign. That being said, we could very well find ourselves gapping lower and continuing to grind towards 1.12 level underneath.

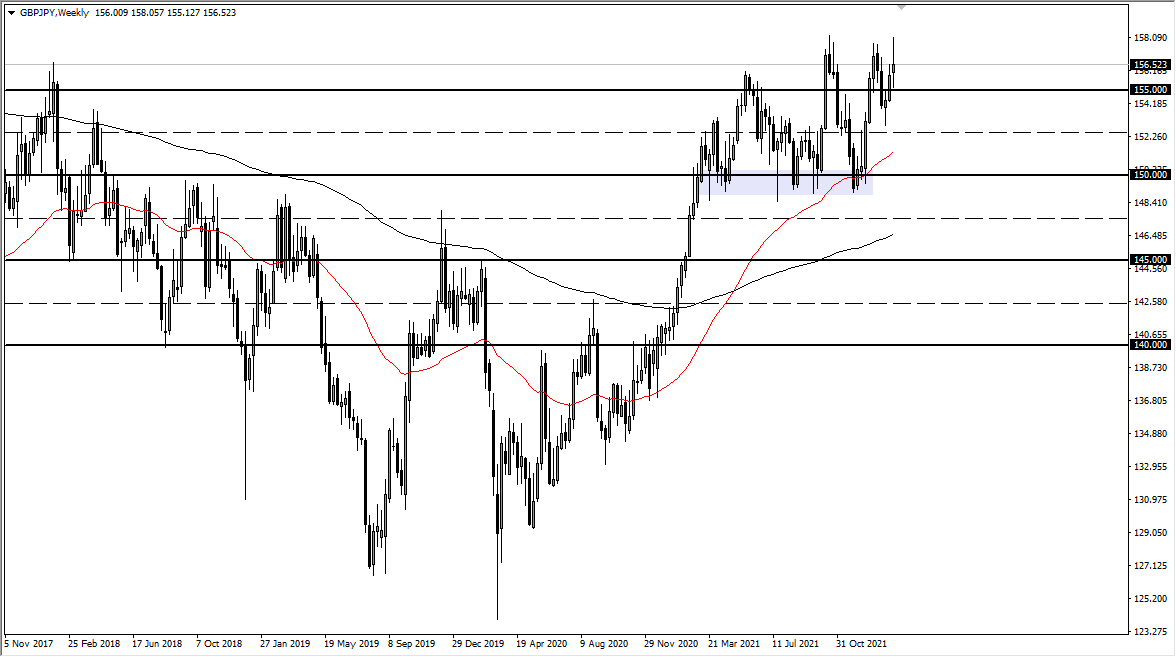

GBP/JPY

The British pound went back and forth last week, as there are a lot of concerns when it comes to risk appetite and the geopolitical situation. Keep in mind that the pair does tend to fall if there are a lot of concerns, so it is likely that we will see this pair move solely upon risk appetite at this point. It is hard to imagine a scenario where we will see a lot of bullish pressure without some type of good news. The ¥155 level underneath should be supportive, but we will have to wait and see whether or not that actually holds. If we break down below the ¥155 level, it is likely that we would see an attempt to get down to the ¥153 level.

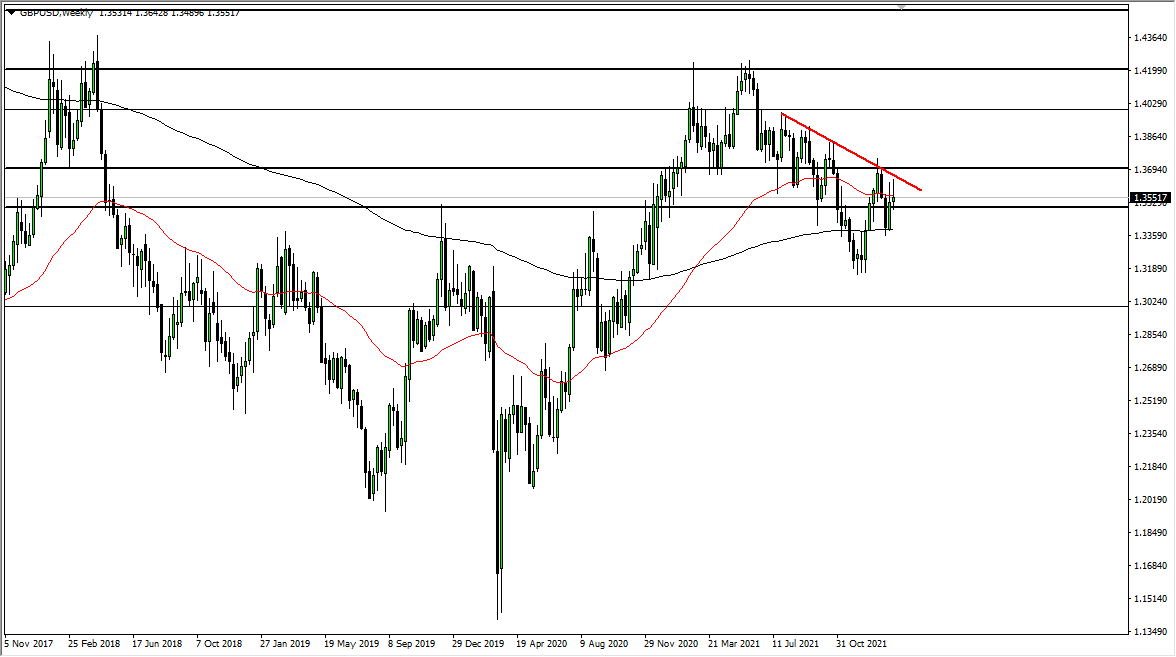

GBP/USD

The British pound initially tried to rally against the US dollar, but as you can see, we have ended up forming a bit of a shooting star. This shooting star suggests that we are in fact getting ready to try to break back down. If we get below the 1.35 handle, then I believe that the market very likely will go lower, perhaps reaching down towards the 200-week EMA. After that, it opens up the possibility of a move down to the 1.32 handle. On the other hand, if we turn around and break above the 1.37 level, then I would become bullish again.