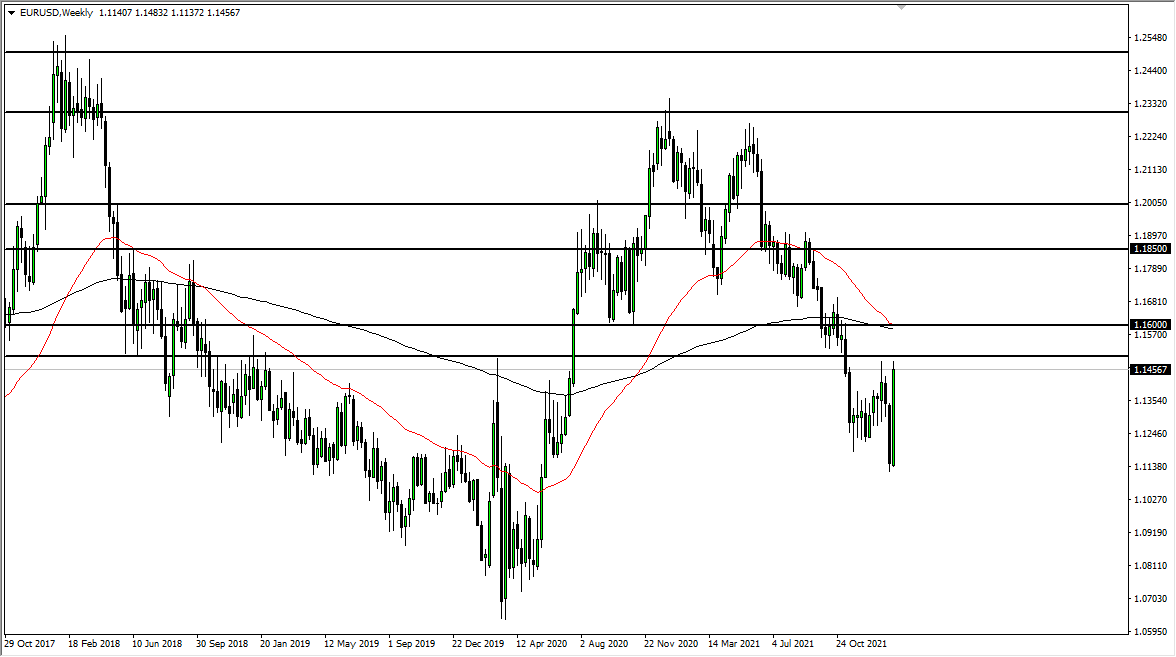

EUR/USD

The euro had an explosive week as the ECB has changed its attitude. The central bank finally admitted that there was inflation and that is something they're concerned about, signaling that they could start to tighten monetary policy later this year. Because of this, the euro shot straight up in the air to test the 1.1485 level. This was the latest swing high, and if we can break above that it would change the structure of the market. That being said, we are a little overdone in the short term, especially as interest rates continue to spike in the United States, and the Federal Reserve is going to start raising rates as soon as March. I anticipate that a short-term pullback could occur, but if we break above the 1.15 handle then it is very likely that this market will go higher.

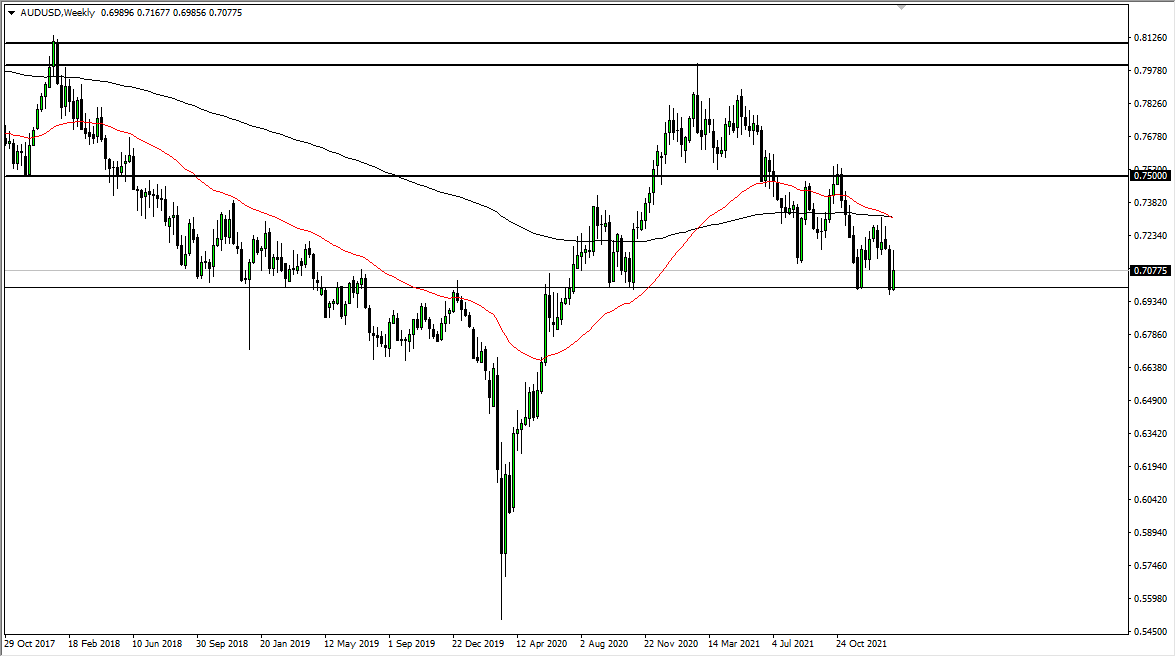

AUD/USD

The Australian dollar rallied during most of the week but fell apart on Friday as interest rates in America spiked. The 0.70 level underneath should continue to be important, and if we were to break down below there, then it is possible that we could see a major breakdown. At that point, we could go looking towards the 0.68 handle, an area that had been important in the past. On the other hand, if we can break above the top of the candlestick, then it would be a very bullish sign, perhaps opening up a move towards the 0.7250 level.

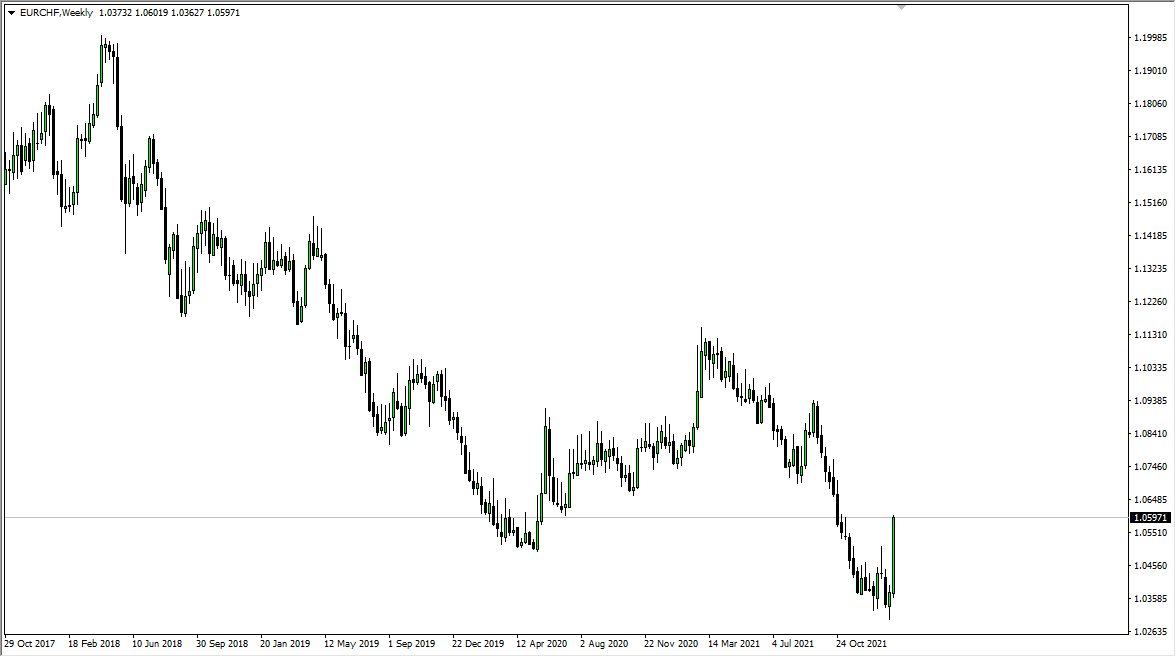

EUR/CHF

Just as we saw against the US dollar, the euro rallied quite significantly. However, the main difference is that we closed the week out at the absolute highs, and at this point it looks like this pair is going to continue to go much higher over the longer term. We are at extreme lows, so I think it does make a certain amount of sense that we will try to get back to the top of the range. That being said, I would also point out the fact that the Swiss National Bank has absolutely no issue whatsoever with the Swiss franc losing strength; in fact they probably welcome it.

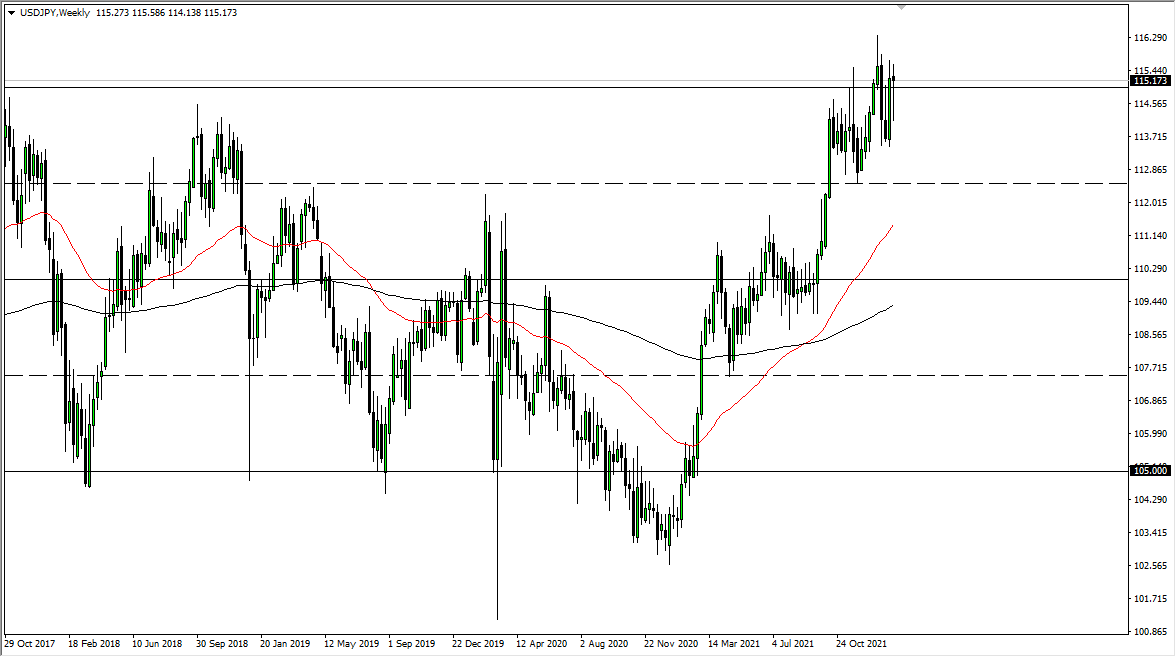

USD/JPY

The US dollar plunged against the Japanese yen initially during the week but then turned around to show signs of life again. I think at this point we are trying to break out above the recent highs, but I anticipate more choppiness over the next week or so than anything else. We have a lot of work to do, but the interest rate differential between the United States and Japan should continue to propel this market higher over the longer term.