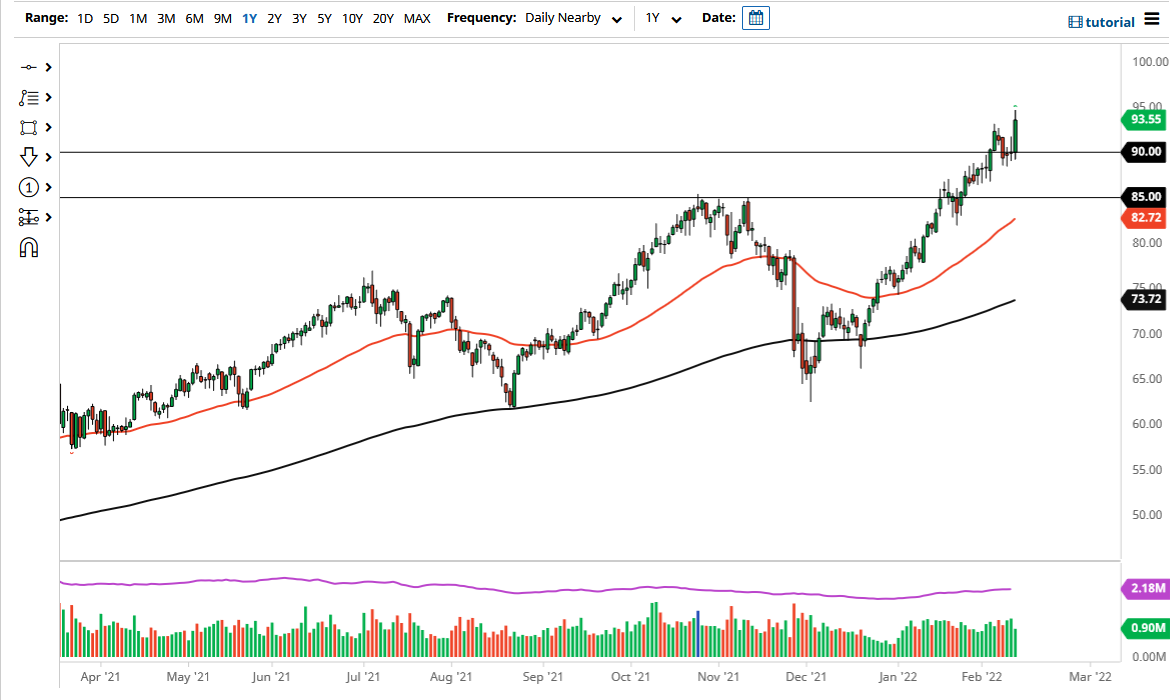

The West Texas Intermediate Crude Oil market pulled back just a bit on Friday, but then turned around as the $90 level seems to be offering support yet again. This is a market in which you continue to buy on dips, but I also would point out the fact that the volatility is going to be a major issue going forward. This is not so much due to the oil market itself, but rather the fact that the Federal Reserve is discussing tightening rather rapidly, as inflation concerns continue to be a major problem.

When I look at this chart, it is obvious that we are in an uptrend. I do not think that will change anytime soon, especially considering the fact that the market is closing at the top of the range for the session, so it does suggest that we are breaking out to the upside again. At that point, I would anticipate that we will go looking towards the $95 level, as it is the next major area above. That being said, as I was writing this article there was a blurb announced that US officials believe that Vladimir Putin has already decided to invade Ukraine, which would be a very massive fundamental issue with crude oil.

Whether or not that is true remains to be seen, so you need to be especially cautious with your position size. The $90 level should continue to offer quite a bit of support, but if we were to turn around and break down below there it could be rather negative. If we wake up to Putin not invading Ukraine, you can expect a massive correction. That being said, the fact that this was done late during the day on Friday screams that somebody is trying to manipulate the market. That may or may not be true, but at the end of the day you have to assume that it is a bit suspicious this has been released late on Friday. The size of the candlestick is rather impressive and continues to shoot straight up in the air. This could be a very dangerous thing to chase at this point in time so I closed my platform after I got a bit of profit.