Today’s AUD/USD Signals

Risk 0.75%

Trades may only be entered prior to 5pm Tokyo time Friday.

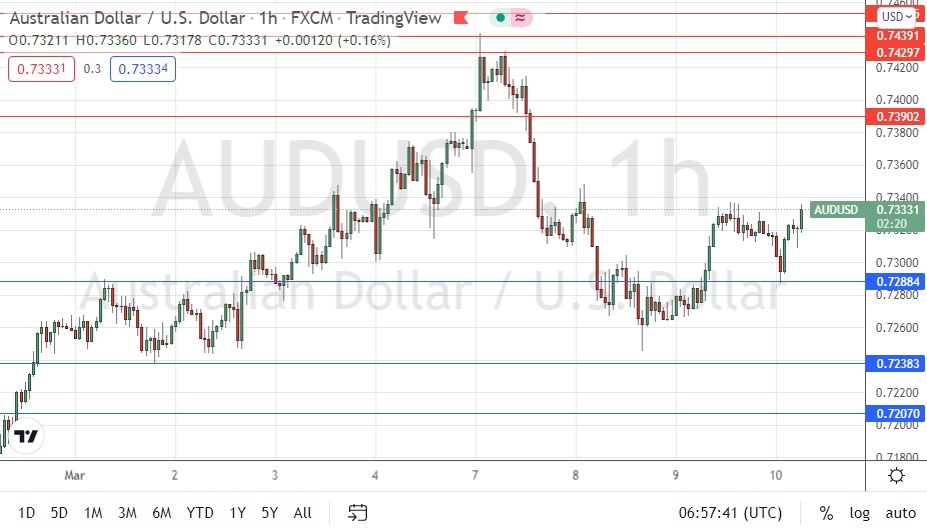

- Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7390.

- Place the stop loss 1 pip above the local swing high.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

Long Trade Idea

- Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7288.

- Place the stop loss 1 pip below the local swing low.

- Move the stop loss to break even once the trade is 20 pips in profit.

- Remove 50% of the position as profit when the price reaches 20 pips in profit and leave the remainder of the position to ride.

The best method to identify a classic “price action reversal” is for an hourly candle to close, such as a pin bar, a doji, an outside or even just an engulfing candle with a higher close. You can exploit these levels or zones by watching the price action that occurs at the given levels.

AUD/USD Analysis

In my previous analysis on 23rd February, I wrote that if the price retraced to 0.7207 and bounced there, it would make a good long trade to 0.7250, but if the price hit 0.7250 first and stalled there, a short trade could be taken successfully. This was an indifferent call as the price blew though both levels over the day.

This currency pair has not been at the forefront of the Forex market, which since the Russian invasion of Ukraine has been focused on European currencies and safe havens. However, the Australian Dollar continues to act as a risk barometer and the price here has followed risk sentiment, which seems to be improving as it becomes clearer that Ukraine may be able to hold off Russia which could result in some kind of peace deal – this seems to be becoming a more probable outcome and peace talks are underway, although it is far from clear they will succeed. This news is boosting the Australian Dollar at the expense of the US Dollar.

Technically, we see new support at 0.7288 which has acted to push up the price, and there are no key resistance levels ahead until 0.7390 which means the price has considerable room to rise. However, bulls should be careful near the half number at 0.7350 which may be inflective and act as minor resistance.

I am prepared to take a long trade from a bullish bounce at 0.7288 today.

Concerning the USD, there will be a release of CPI data at 1:30pm London time. There is nothing of high importance due regarding the AUD.