GBP/USD Fundamental Analysis

The situation in British economy does not look scary yet, but with all the background we can be sure that things are going to be harder, at least.

Firstly, mind inflation. In January, it reached 5.5%, growing since December. Normally, the Bank of England prefers staying away from inflation processes, letting the economy get back to balance on its own. However, in this case, the growth of prices for energy carriers and food will keep the CPI high, resulting in a decline in the economy. The CB will have to interfere to bring inflation back to 2-4% with the previous target level of 2%.

Secondly, there are supply issues. The system has not recovered from the pandemic yet when geopolitics gave new surprises. It will be hard to make economic and trade connections in such circumstances. This can have an adverse effect on investments in the real sector, industrial production orders, and the employment market.

Businesses need a clearer understanding of what is going on, and the broader the horizons, the better. The Bank of England gave some information on the meeting on 17 March. The interest rate grew to 0.75%. Inflation is indeed too high to leave in unattended. However, the position of the BoE is less aggressive than one would expect.

In the employment market, the situation is neither simple. Great Britain left the EU, hence, it is not likely to suffer from a flow of refugees. However, to hold the employment market stable, the country needs some effort. The currency market is trying to avoid risks. This makes the USD popular and puts serious pressure on other currencies, including the pound. No changes in the moods are expected anywhere soon.

GBP/USD Technical Analysis

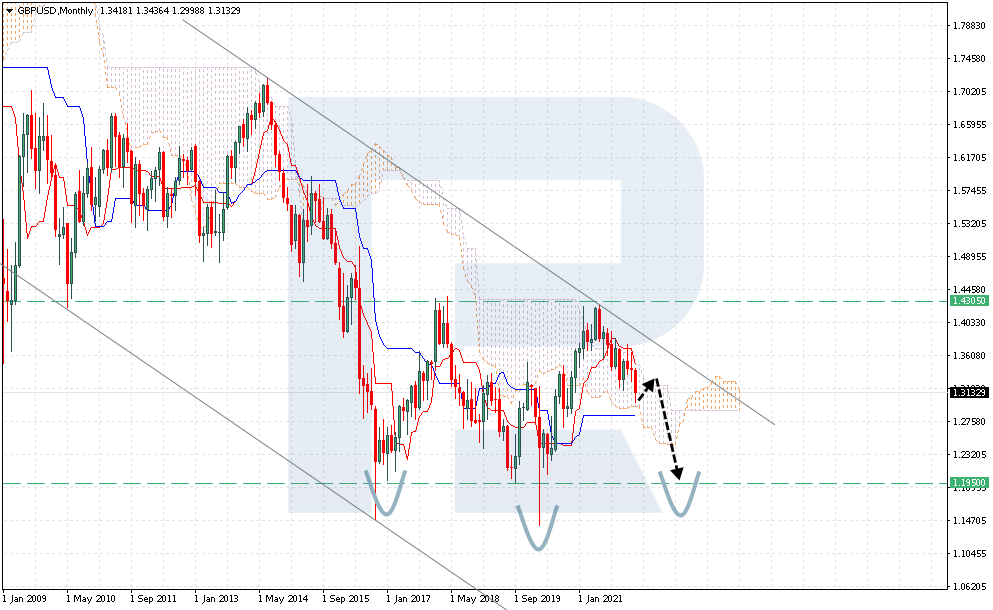

GBP/USD continues falling. On W1, a reversal inverted Head and Shoulders pattern keeps forming. The right shoulder is at 1.1950, so in the long run this will be an aim for a test. The perspective will be confirmed by a breakaway of the lower border of the Ichimoku Cloud, thus winding up the range and forming a strong descending impulse. However, the pattern can reverse the trend upwards at any moment.

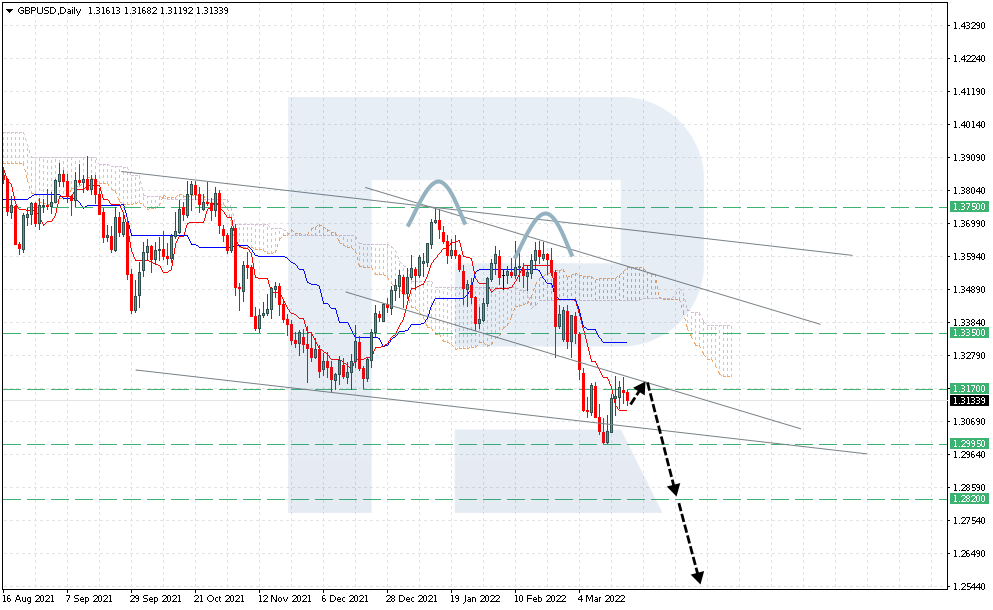

On D1, the market has almost reached the goals of the Double Top reversal pattern. The quotes are pushing off the resistance level that used to be a good support in December last year. That time, buyers managed to prevent a breakaway of 1.3170 downwards. Currently, we should expect a minor bullish correction to the broken border of the descending channel at 1.3180. From this level, the price is likely to bounce downwards and continue falling by the width of the channel. The aim of the decline is 1.2820. Now the quotes are clinging to the lower border of the long-term bearish channel, so the decline has somewhat slowed down. As soon as the bears break through 1.2995, the decline will speed up.

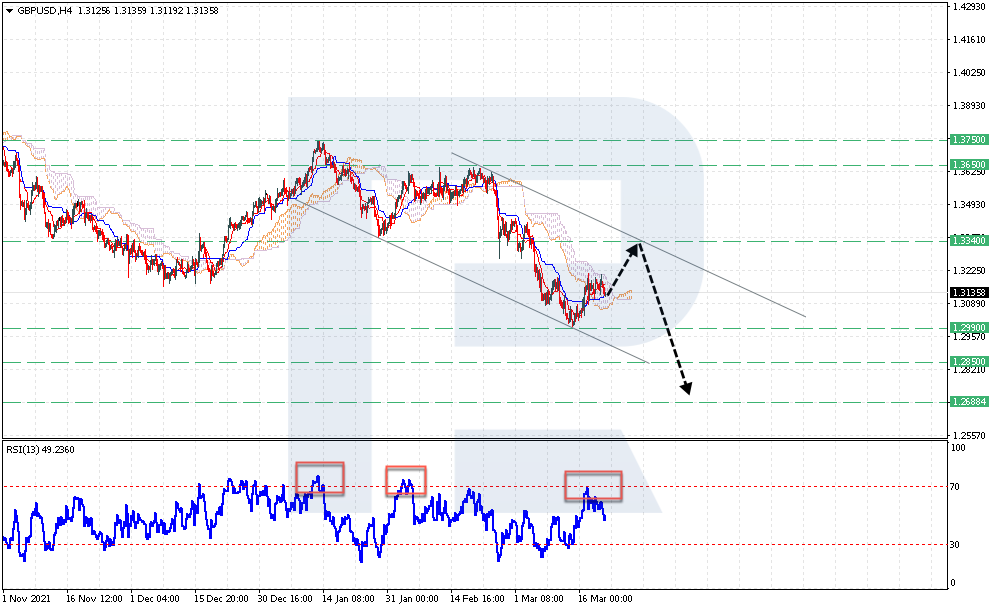

On H4, the pair is trading inside the Ichimoku Cloud, indicating a range. However, here as well the quotes pushed off the resistance level of 1.3225 several times. The RSI also confirms further falling: as soon as the pair reaches 70, the pair declines, while breakaways of 30 get ignored. This means sellers are quite strong. A deeper correction to the upper border of the descending channel at 1.3340 is not excluded.

Closing thoughts

Summing up, we should expect further falling of the pair. Now GBP/USD is pushing off the nearest resistance level, forming a reversal pattern on MN. In most cases, the quotes reach the low of the right shoulder at such instances. The general goal of the decline is 1.1950, and the nearest goals are 1.2820 and 1.2625. Only pressure from buyers and a breakaway of 1.3340 can slow down the decline and provoke the development of a lengthy bullish correction. In this case, the quotes can leave the borders of the descending channel.

Risk Warning: The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.