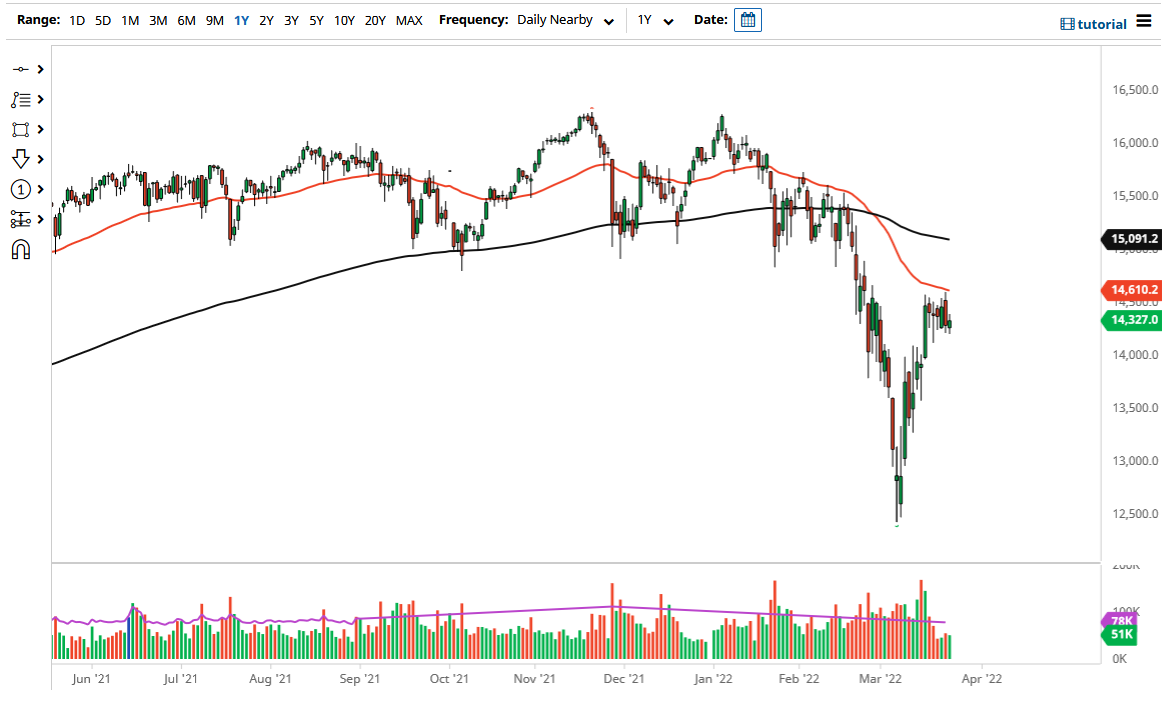

The German index has rallied slightly during the trading session on Thursday as the market is testing the €14,300 level. This is an area that has been supported over the last couple of weeks, so if we were to break down below that level, it is likely that the market goes look towards the €14,000 handle. That of course is a large, round, psychologically significant figure, and there will be a certain amount of attention paid to that region. If we were to break down below there, things could get ugly rather quickly.

It is worth noting that the 50 Day EMA has offered a significant amount of resistance, and it is an area that a lot of people pay attention to. This indicator is widely accepted as a trendsetting indicator, so it does make sense that we have pulled back from after this “V-shaped bottom.” That being said, the market struggles to hang onto these rallies most of the time, at least for a bigger move.

If we were to break out above the 50 Day EMA, then it opens up the possibility of a move to the €15,000 level. The €15,000 level is a large, round, psychologically significant figure that will attract a lot of headlines, and of course, it is an area that has offered support previously. This area will have quite a bit of “market memory” going forward, but if it were to be broken, all vestiges of negativity would be wiped out.

More likely than not, we will probably have to pull back in order to establish a much more stable bottom if nothing else, so keep that in mind. The DAX will more likely than not suffer at the hands of other markets, as risk appetite has been similar everywhere. If we see risk evaporate in other indices, the DAX will be sold off as well.

This consolidation area will break one way or the other eventually, and depending on in which direction, you have your signal. Wait for a daily close outside of this little rectangle to give you a heads up as to where we go, and then trade accordingly. The noisy behavior in the short term is simply the market trying to determine whether or not we are going to go higher or possibly lower.