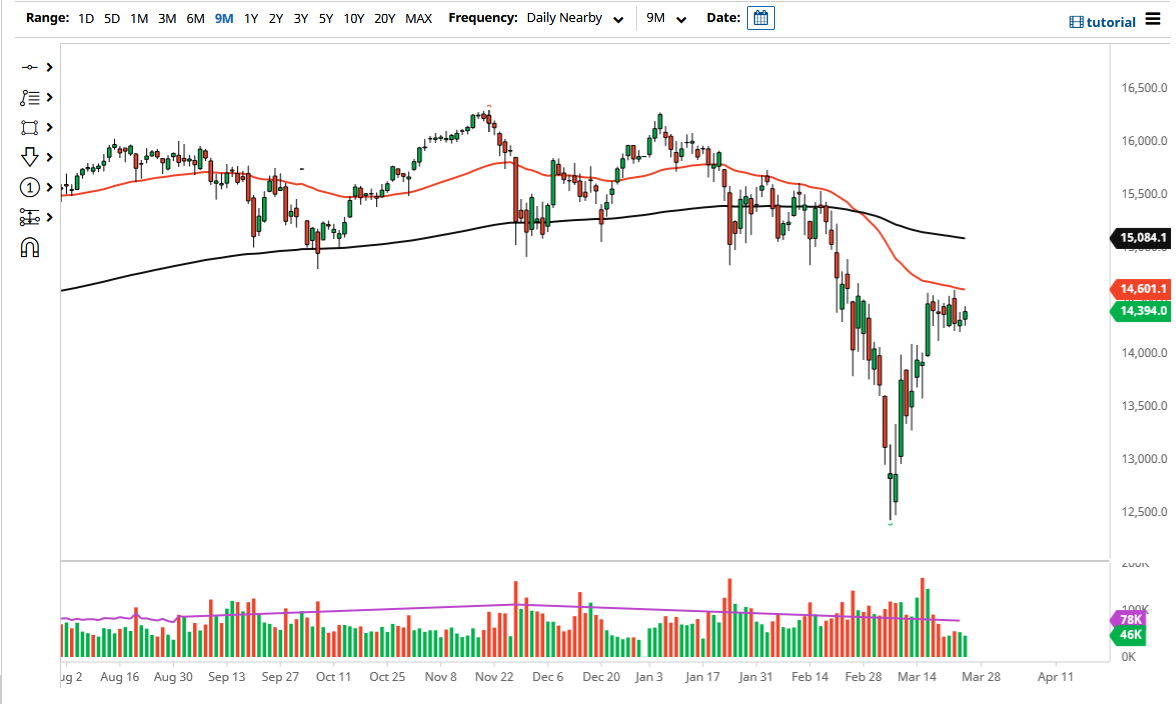

The German DAX Index rallied on Friday to reach the €14,400 level. The market is currently in a consolidating area, as we are sitting between the highs and lows of the last week or so. This is an area of decision for the German index, which has been very noisy overall. The 50-day EMA sitting just above offers resistance, and I would pay special attention to that indicator.

If we were to break above the 50-day EMA, then it is possible that the market could go looking towards the 200-day EMA. At that point, the market is likely to continue seeing more resistance, as it has been widely followed. Ultimately, the DAX is going to be the heart of Europe when it comes to stocks, so you need to pay close attention to the way it behaves. The market breaking down below the bottom of the consolidation of the last week or so could open up selling, and it would probably be preceded by some of the peripheral markets in Europe such as the IBEX, or maybe the MIB.

On a breakdown, this market could drop as low as €13,000, and this will almost certainly be due to not only “risk-off” behavior, but also some type of negative catalyst. Recently, stock markets have had very bullish, but whether or not they can sustain the type of momentum we have seen is a completely different question. I think at this point we are trying to build up enough inertia for the next big move, and it simply going to be a matter of waiting to see in which direction that move happens. I do believe that we are getting closer to that point in time, and all we need at this moment is going to be a catalyst.

There are a lot of risks out there, so I still think that the downside is a very real threat, and it is worth noting that other major indices such as the S&P 500 struggled a bit during the day, as they seem to be running out of momentum. Because of this, it may be a situation where the market is whispering that it is about to make its move. This will almost undoubtedly be a nice setup once we break out of this little rectangle.