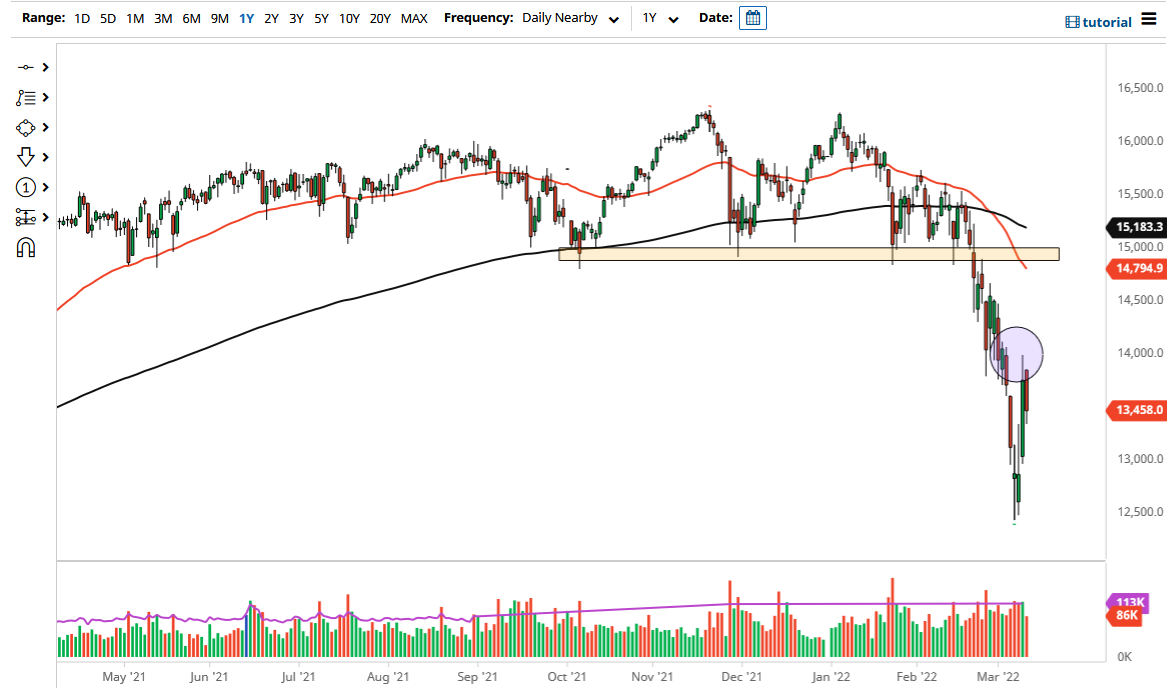

The German index fell after initially gapping higher on Thursday, as we continue to see negativity and stocks worldwide. Quite frankly, the massive rally that we had seen over the last couple of days could have been thought of more as a “dead cat bounce” than anything else. After all, this is a market that had fallen quite rapidly. Keep in mind that the market had been oversold, so this bounce made sense. Now that we have seen it happen and of course the DAX fail at €14,000, it does suggest that we have further to go to the downside.

Looking at this chart, if we could break above the €14,000 level, we could go looking higher, perhaps towards the €14,500 level, but I think we have put a new top into the market for the time being. If we break down below the lows of the trading session on Thursday, I expect that the market goes looking towards the €13,000 level initially, followed by the lows near the €12,500 level. Even mind that the ECB is now starting to talk about inflation, which could mean tightening monetary policy. This is toxic for stocks, especially export stocks, because it could signal that German products could become more expensive.

Regardless, when you look at stock markets around the world, they are all doing the same thing, which is falling. I think given enough time, the DAX will continue the overall negativity, and I believe that Thursday was just a simple continuation of what we have been seeing for so long now. You should also keep in mind that a lot of headlines out there are very negative for stocks, not the least of which is the war in Ukraine. Remember, this is on the doorstep of Europe, and is causing major tension between Russia and the EU. Germany is heavily reliant on Russian energy, and as a result we will more than likely see a lot of concerns when it comes to the German economy.

Recently inflation numbers in Germany have hit some of the highest numbers since just after World War II, to give you an idea as to how manufacturing inflation is really starting to pick up. With that being said, I think that this is a market that is to be shorted on signs of exhaustion after short-term rallies.