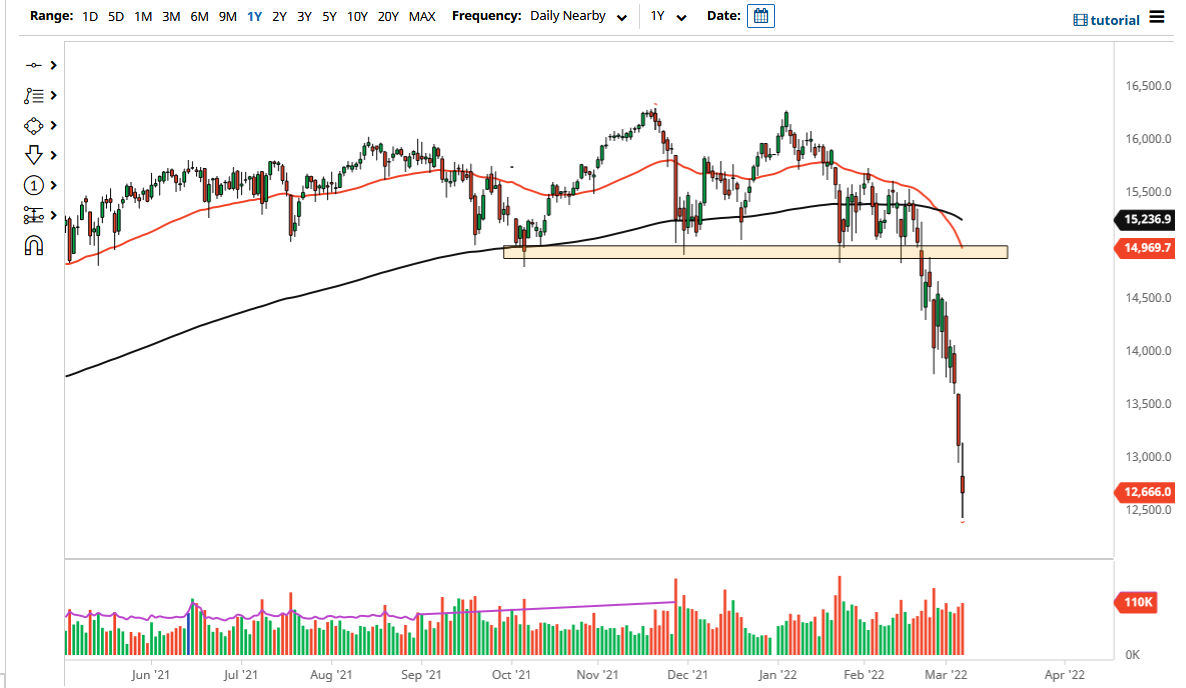

The DAX gapped lower to kick off the week on Monday, showing signs of extreme selling pressure. That being said, the market is likely to continue to find plenty of sellers as the DAX is highly sensitive to the issues surrounding the European Union. The most obvious one of course is going to be the war between Russia and Ukraine, but there are also other things out there causing problems as well.

Inflation in Germany is starting to rip higher for production, which is going to be passed on to the consumer. Because of this, the DAX is starting to show just how troubled the markets are going to be going forward as we have plunged into something similar to a full-out crash. The market did turn around to fill the gap, so that suggests that there are still plenty of sellers underneath willing to get involved. Furthermore, the 12,500 level has offered significant support, so that will be worth watching later. I think at this point the market is starting to show signs of exhaustion to the downsid,e but given enough time I think rallies will continue to get sold into.

The overall attitude of the DAX will continue to be negative as long as there are concerns about the war on the doorstep of Europe and of course the economy worldwide. If we do continue to see a slowdown, the DAX is full of exporting companies that will be hurt not only at home but also abroad. In other words, there is no real reason to think that this market is about to rally other than a potential relief rally. That relief rally should offer a nice selling opportunity on signs of exhaustion, so the best way to look at this market is one in which you will sell relief rallies. Remember, markets cannot go in one direction forever, be it up or down. The market is most certainly oversold at this point, so although we should have no surprise about the direction, we also need to be very cautious about trying to chase the trade all the way down here. Do not worry, there will be plenty of opportunities going forward. I would look for the ECB to get involved sooner rather than later, but so far they have not made any moves.