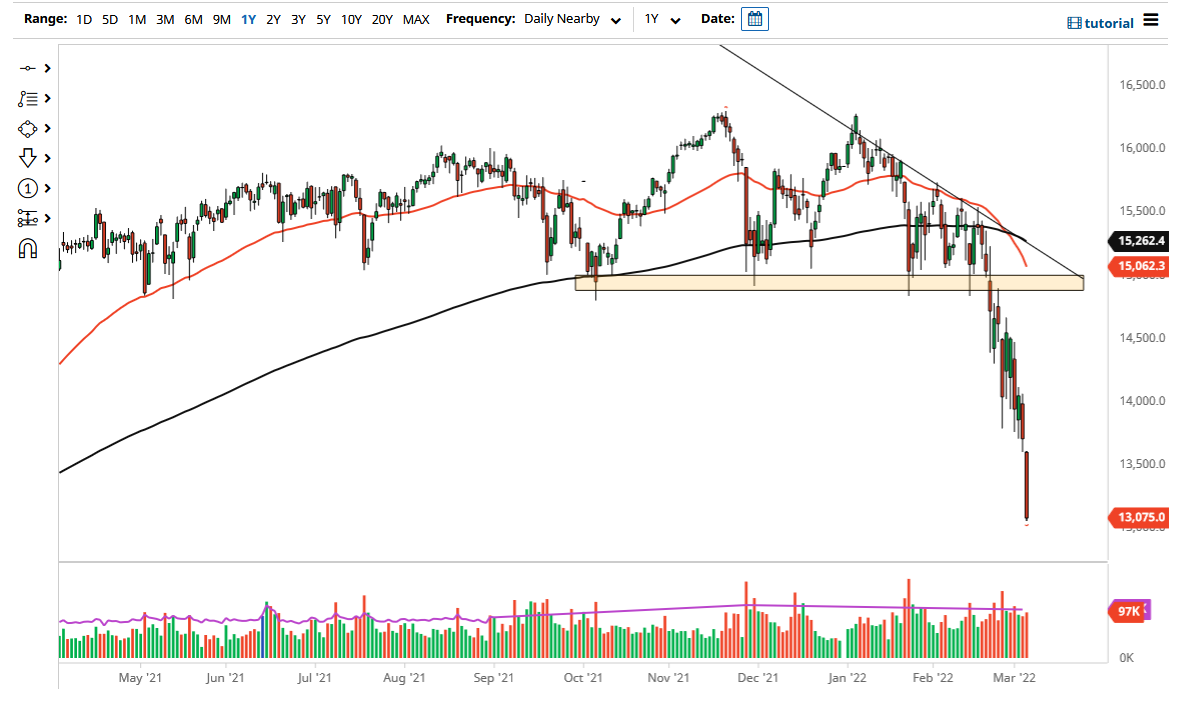

The German DAX index gapped lower to kick off the trading session on Friday, as we continue to see all things European get pummeled. The DAX is the first place that a lot of people put money to work in the European Union, as it is considered to be the “blue-chip index” for the continent. The DAX has fallen precipitously over the last several weeks, and it seems as if the “bottom fell out” during the Friday session. We not only gapped lower, but we sliced through a couple of areas that I thought could offer support.

As the DAX goes, so goes the rest of Europe. Because of this, you need to pay attention to other indices as well. For example, even if you do not wish to trade the DAX itself, it does make a certain amount of sense that we would see it as a secondary indicator. As it is plunging right now, other indices such as the IBEX, MIB, and AMX are all going to struggle. At this point, there is nothing good about investing in Europe, as this chart shows.

The size of the candlestick is also something worth paying attention to, as it is huge, and we have the market closing at the very bottom of the candlestick. The fact that we had closed that the bottom of the range for the session does suggest that we have quite a bit of confidence in this market falling, or perhaps better yet, a severe lack of confidence. With this being the case, I do think that we have further to go to the downside, but I also recognize that the €13,000 level might cause a little bit of a bounce. If we break down below the €13,000 level, then we could go looking towards the €12500 level.

If we do get a rally, it is likely that we are going to continue to see selling pressure above, especially near the gap that kicked off the Friday session. At this point, I think it is almost impossible to imagine a scenario that should be bought unless of course there is a sudden peace deal signed between the Russians and the Ukrainians. If that happens, that would obviously change a lot of things, but right now that does not look to be likely.