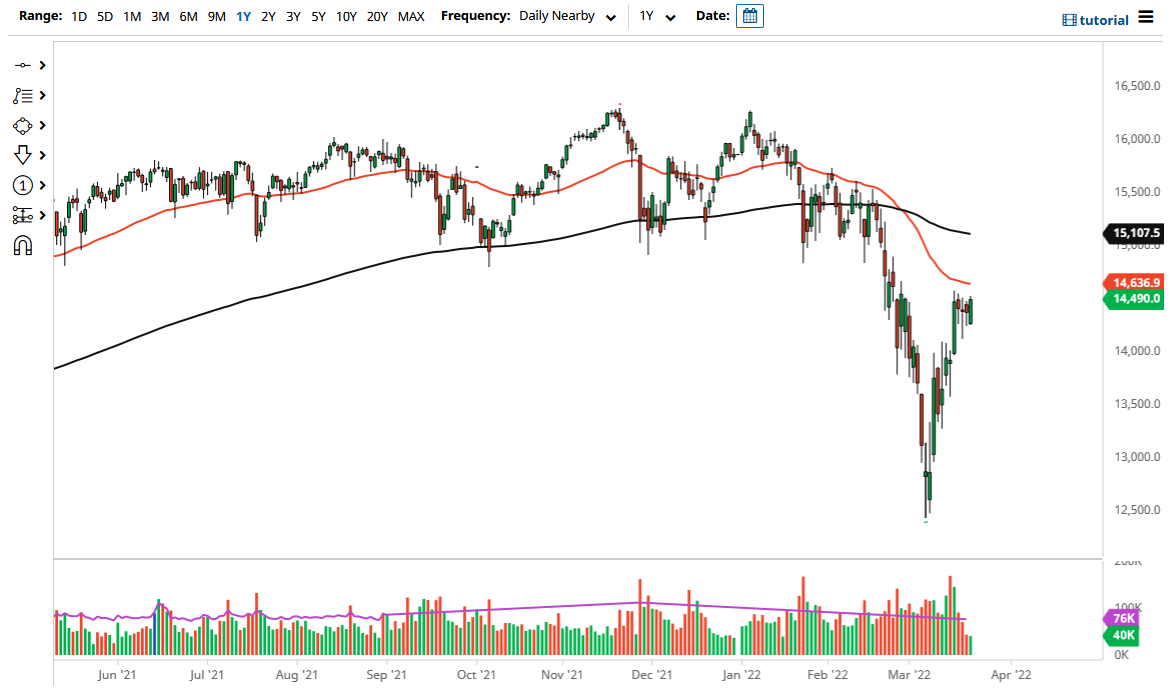

The DAX gapped lower to kick off the trading session on Tuesday but then turned around to show quite a bit of strength. By doing so, the market has reached towards the €14,500 level, an area that has been resistant previously. However, this bullish engulfing candlestick is a positive sign so I will look at the 50-day EMA above as a potential signal.

If we were to break above the 50-day EMA, then it is likely that the market could go higher, perhaps reaching towards the €15,000 level. That would still not wipe out all of the losses that we had seen previously, but it would be a very strong indication of the market not falling apart. This is a market that I think will continue to be very noisy, but I think at this point the DAX will more than likely continue to see a certain amount of attraction, simply due to the fact that the DAX is the first place that people put money to work, and Germany is without a doubt the biggest economy in the European Union.

If we were to turn around and break down below the hammer from the Friday session, that could open up fresh selling in the DAX, probably accompanied by selling and other major stock indices around the world. While interest rates have been rising, some traders are starting to bet on the idea that central banks will not be able to raise interest rates for very long, and therefore will offer a certain amount of liquidity to the markets, which is what they have been moving on for the last 13 years for the most part.

I do think we will continue to see a lot of noisy behavior, so you need to be cautious about your position size, which will keep a certain amount of traders away from the market. Volatility generally is not good for the markets, and that is something that we have in spades at the moment. Because of this, I think you need to be very cautious but use the 50-day EMA as an entry to the upside, while the hammer from the Friday session would be a signal to start selling. In the short term, it looks like we are going to see more back-and-forth on short-term charts.