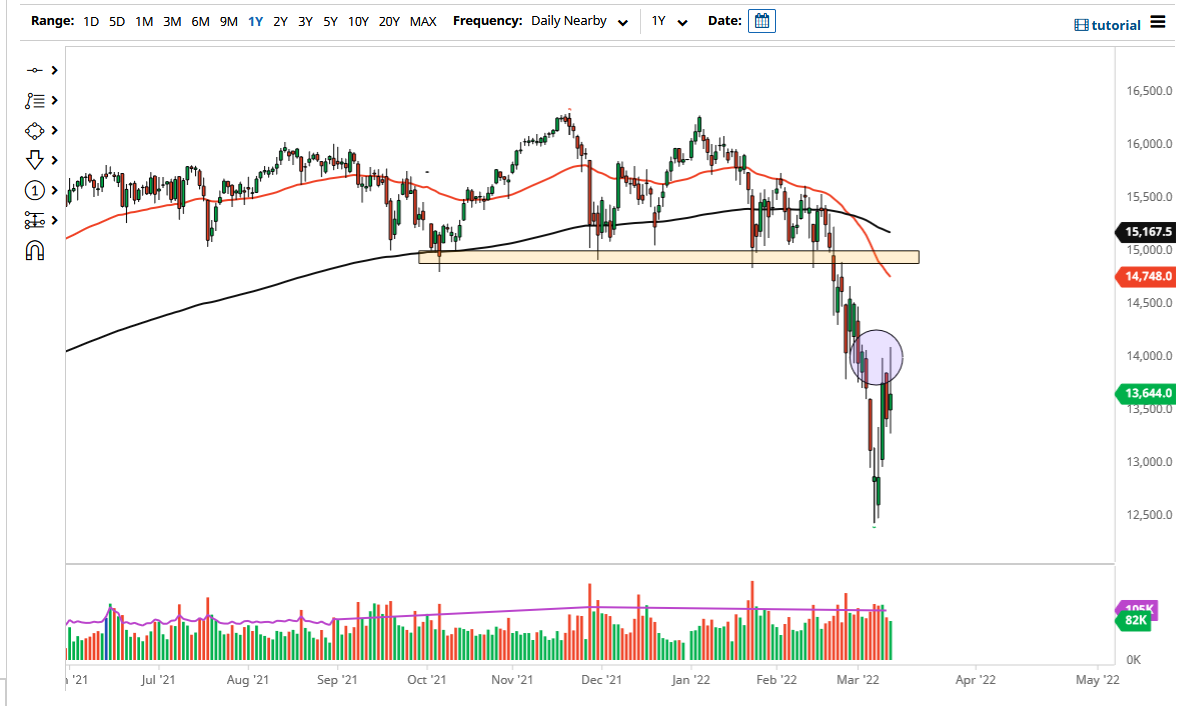

The German DAX Index initially tried to rally after gapping lower, reaching towards the €14,000 level. That is an area where we have seen a significant amount of resistance previously, so it is not a huge surprise to see that we have pulled back from there. Ultimately, this is a market that continues to be very volatile, but you would expect that considering just how much volatility we have around the world anyway.

The DAX index is going to be very sensitive to situations coming out of Ukraine and of course the unpredictability of that region. The candlestick for the end of the session ended up being a bit of a shooting star, which is a sign that we may break down again. Keep in mind that Germany is going to continue to have issues anyway, as the ECB cannot do too much in the way of tightening but has to fight inflation at the same time. Ultimately, this is a market that I think will continue to be noisy, but it looks like we are going to drop enough to retest the lows again.

The €12,500 level is an area that offered quite a bit of a bounce previously, but looking at this chart you can see that we have pulled back to test the 50% Fibonacci retracement level, so I think we have a natural area to break down. On the upside, if we were to break above the €14,000 level, then it is possible that we could go looking towards the €14,500 level, possibly even the €15,000 level after that. That is an area where we had broken down from previously, so I do think there would be a lot of interest in the market at that point in time.

The DAX is going to be sensitive to the rest of the world as well because the majority of the companies in this index are major exporters, so obviously if customers are not doing well, neither will the suppliers. Ultimately, I do think that the market will continue to see a lot of back and forth, and I think we will be better served by being very cautious with our position sizing, but most certainly looking towards the downside. In general, fading the short-term rallies continues to be the best way forward.