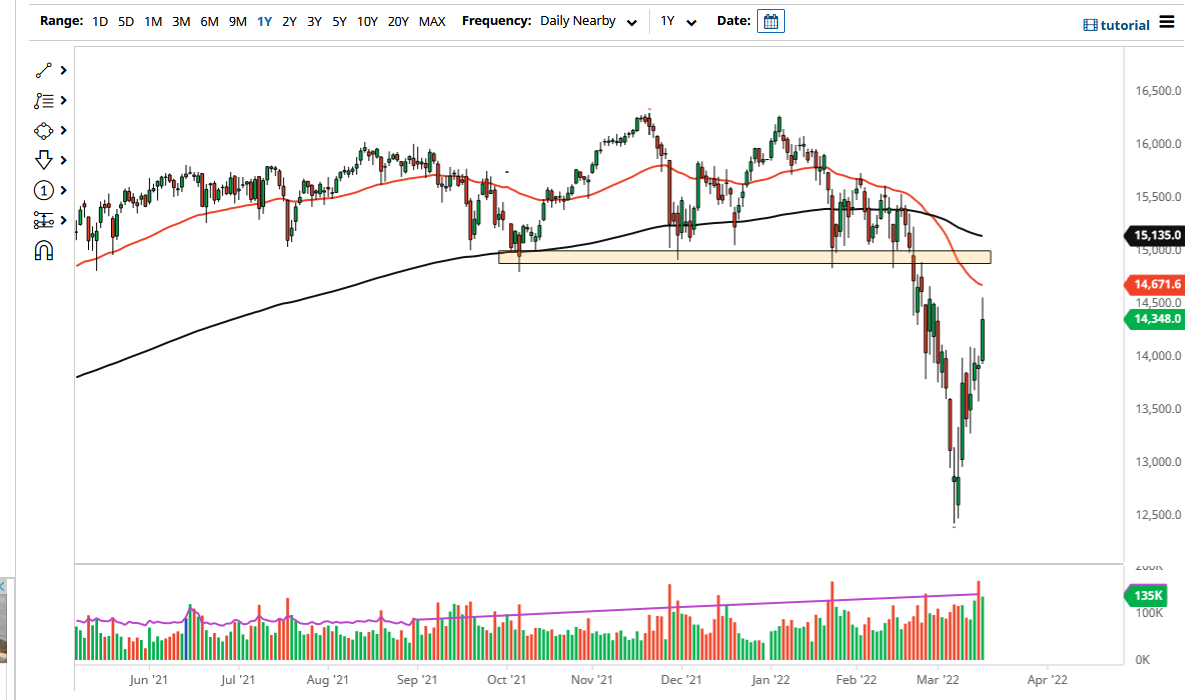

The DAX had an explosive positive move during the trading session on Wednesday to reach towards the €14,500 level. This is an area that will attract a certain amount of attention, but at the end of the day, I do not think it is necessarily a sign that the market is going to shoot straight up in the air. It has been a very impressive bounce, but it must be noted that we are still recovering from a massive selloff. In other words, this could be a “bear market bounce”, which can be quite vicious.

I believe at this point if we break back down below the €14,000 level, the DAX will continue to reach down towards the lows. We may have sold off too quickly, and therefore we needed this bounce to bring back some type of equilibrium. Because of this, I believe it is worth noting that towards the end of the day we did start to sell off again, so this could be people jumping back into the short side of trading.

As far as buying is concerned, I would need to see this market clear the €15,000 level on a daily close, and perhaps even reach above the 200 Day EMA which is above there. If that were to happen, then obviously the DAX would continue to go higher, but with the situation in Ukraine dragging on, it is difficult to imagine a situation where the DAX simply takes off as it is the first place money goes looking to win in the European Union.

The ZEW announcement came out of Germany yesterday at a reading of -39, although it was expected to be +5. This shows you just how bad business confidence is right now in Germany, and that certainly could continue to weigh upon market confidence and therefore price. Given enough time, I think those questions need to be answered as well. The business confidence being so poor in Germany will have a negative effect on the stock market as well, and of course the global market slowing down means that we will have less exports coming out of Germany also. Remember, the DAX is highly levered to exports as most of the major companies are international conglomerates that sell their products all over the world. This has been a nice bounce, but I think we probably see more selling.