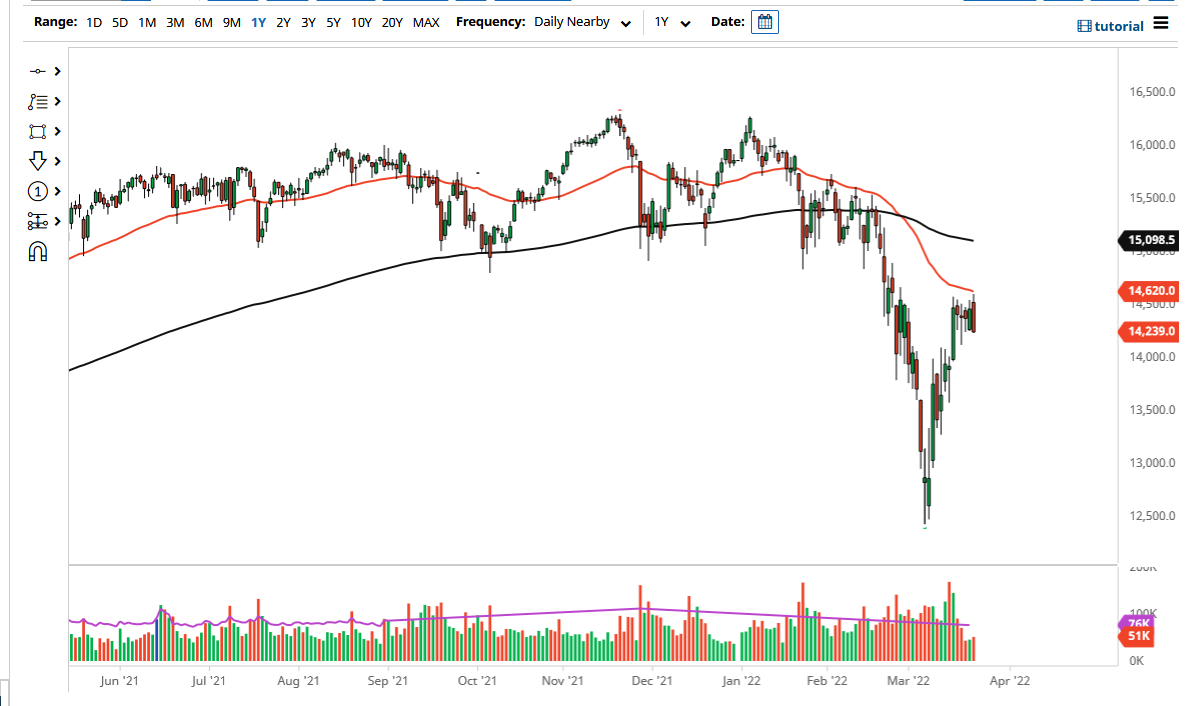

The German DAX Index initially tried to reach higher on Wednesday but pulled back from the crucial 50-day EMA. The 50-day EMA has been sloping lower, and as this was the first time we caught up with it, this was a perfect “pull back to the EMA entry.” Ultimately, this is a market that I think will try to go lower over the longer term, as the market has not only seen a lot of negativity for some time, and we have closed at the very bottom of the trading range.

If we were to break down below the €14,000 level, it is likely that we could see a much bigger move to the downside, perhaps down to the €13,000 level. I believe that ultimately this is a market that is going to be very noisy in this general vicinity, so it will be interesting to see how this plays out. The area will continue to be noisy overall, so I think you need to be cautious with your position size initially, but once we break down below the €14,000 level, I am going to start adding to the downside position.

Alternately, if we were to break above the 50-day EMA, then it is possible that we could go looking towards the €15,000 level. That is an area that would be difficult to reach, let alone break above it. The market continues to see a lot of push and pull, especially as the DAX is considered to be the “blue-chip index” of the European Union. The European Union has a whole host of problems at the moment, so it makes sense that we would see the DAX a little bit confused in the short term.

The size of the candlestick for the trading session on Wednesday is very negative-looking, and it looks as if there is a lot of confidence on the short side going into the close. Because of this, the market is likely to continue to see plenty of sellers. You will notice that the previous candlesticks had been very choppy and range-bound for a while, but it does look very likely that the market is trying to determine its overall next move.