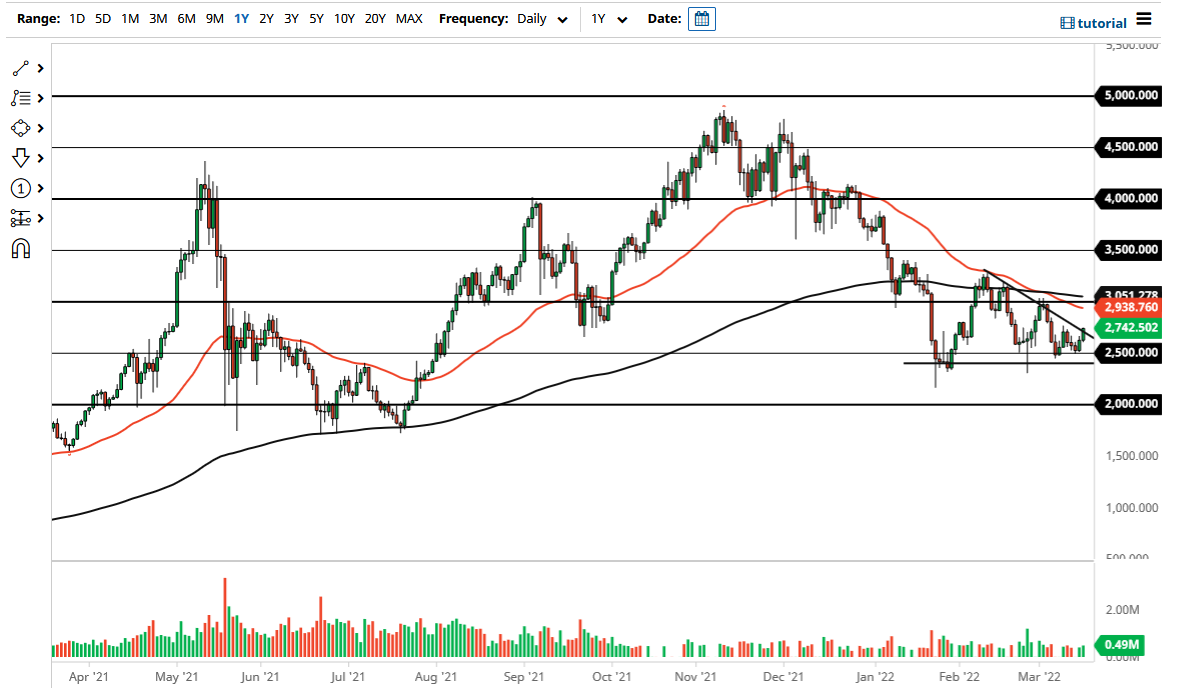

Ethereum has rallied a bit to kick off the trading session on Wednesday, but I do not see a lot of momentum, nor do I see a lot of volume in this market. That is not a good look, and therefore it is very possible that we will see Ethereum struggle going forward. For what it is worth, we are sitting on top of a rather major support level, so it is worth paying close attention to it.

The major support level is at the $2500 level, extending down to the $2400 level. If we break down below the $2400 level, then it is likely that we go looking towards the $2000 level. The $2000 level is an area that will attract a lot of attention due to the large, round, psychological importance of that figure. That being said, I do believe that the market is likely to at least attempt to get back down there again because we continue to make “lower highs. In fact, we are currently sitting in the midst of a descending triangle, which of course is a very negative shape.

If we were to break higher, I do not know how excited I would get about going long until we get above the 50 Day EMA, and it would also have to coincide with Bitcoin rallying. I almost always use Bitcoin as a secondary indicator, because it is by far the biggest coin in the crypto markets. If the poster child for crypto is not rallying, it is difficult for other markets to do so, although admittedly Ethereum has the best chance of doing so against that backdrop.

I believe at this point in time we continue to see a lot of volatility, and quite frankly I think we need to see a large amount of time go by before we build up enough confidence. However, an impulsive candlestick to the upside of course is something that you have to pay close attention to, as it would show a complete change in attitude suddenly. That of course is something that will more than likely catch the market off guard. On the downside, if we break down below the $2000 level, the market would clearly be ready to dump much lower at this point in time. At this point, the only thing you can count on is volatility.